Courtesy of Lee Adler of the Wall Street Examiner

Average hourly earnings rose by 1.2% on a yearly basis in April, down from 1.9% in March and 2.1 % in February. That’s starting to sound like a change of trend. The rate of increase had fluctuated from 1% to 2.9% since 2010, averaging around 2%.

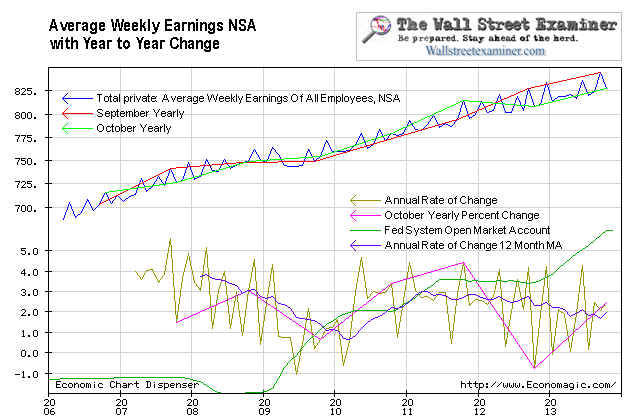

But the news gets worse. Average weekly earnings were absolutely flat year to year in April after gaining 1.8% in March and 2.1% in February. In April 2012, the annual rate of gain had hit 4.1%. The 12 month moving average has dropped from around 3% in 2011 to around 1.8% now. This month’s drop is part of a persistent weakening trend.

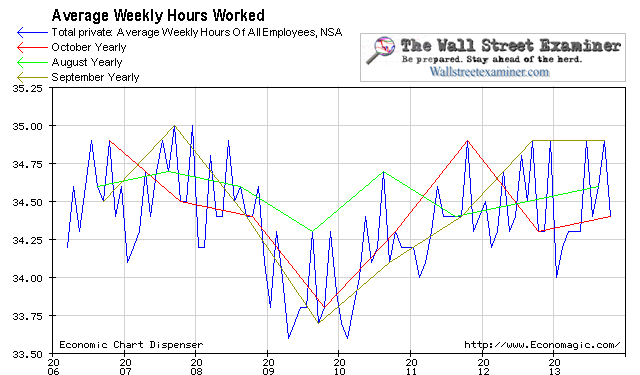

QE isn’t boosting the number of full time jobs and it’s not boosting compensation. What about hours worked? Average hours worked came in at 34.3 in April, down from 34.7 a year ago. While hourly pay growth weakens, total average weekly pay weakens even more because employers are cutting worker hours and shifting more workers from full-time to part time.

Why isn’t all the new money which the Fed is pumping into the system causing job growth or wage growth? Many of the unemployed do not possess the skills that are in demand in the market. Or they are overskilled. All of the growth is in near-minimum wage, low skilled service work. The call of, ”Welcome to Burger King may I have your order please,” echoes throughout the land.

Economic pundits and FOMC policy makers must realize that the 10 million fake jobs spawned by the bubble are not coming back, which is why the Fed is trying to spawn new bubbles, hoping for the bubble jobs they create.

The 7.5% unemployment rate is probably “normal.” The bubble unemployment rate of 5.5% was abnormal. If the goal is to continue QE until the unemployment rate hits a target of 6.5%, then the policy is simply a matter of fomenting the next bubble to generate millions of fake jobs. The problem with that is that as bubbles grow and the economy overheats, inflation will eventually force the Fed to stop printing, and all the new fake jobs will once again disappear.

While we have asset inflation, that’s fine with the Fed. Consumer price inflation hasn’t shown up in the conventional measures that the Fed watches, but then neither have the good jobs, so in spite of the fact that there’s no evidence that it increases jobs or wages, the money printing will go on.

Read also:

Full Time Jobs Number Increases… To Levels Reached in Year 2002

Payrolls Gain But QE Has No Impact On Growth Rate

Downtrend In Claims, Uptrend in Withholding, Suggest Blowout Jobs Number As Stocks Bubble

Get regular updates the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, in the Fed Report in the Professional Edition, Money Liquidity, and Real Estate Package. Click this link to try WSE's Professional Edition risk free for 30 days!

Copyright © 2012 The Wall Street Examiner. All Rights Reserved. The above may be reposted with attribution and a prominent link to the Wall Street Examiner.