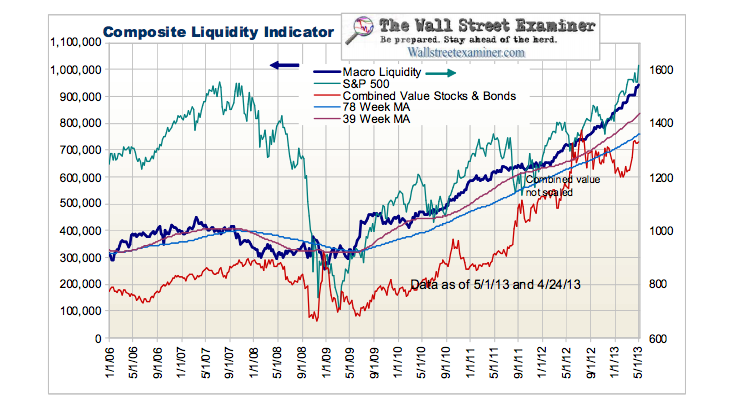

No Sign of End To Market Liquidity Tsunami

Courtesy of Lee Adler of the Wall Street Examiner

Excerpt from Lee's Professional Edition (subscription required)

The composite liquidity indicator rose last week, mostly from the Fed’s weekly Treasury purchases. April is the month of the strongest liquidity flows of the year from the massive paydowns of Treasury debt but Treasury paydowns will again add to Fed cash injections to boost liquidity in May. A tidal wave of tax receipts has pushed back the date where the Treasury becomes a net borrower again to July. Meanwhile, the river of cash will continue to flow into the markets until the Fed ends QE. The BoJ’s massive new QE program has also added to US market liquidity.

The biggest surges of cash come after the Fed settles its MBS purchases around mid month. This month those flows will take place from May 13 to May 21. That will coincide with $23 billion in net Treasury paydowns May 9-15, and a TBAC projected $23 billion paydown on May 23. That’s enough for the stock market meltup to continue or even accelerate. Might some of the benefit of all that cash will shift back to Treasuries? Here on Wednesday May 8, at least, the answer was yes.

The uptrend in liquidity will go on until the Fed ends this round of QE. News flow will cause stock and bond prices to continue to fluctuate around the liquidity trend. Buyers will get fatigue from time to time, but the trend should remain mostly steadily upward. No doubt there will be more efforts to manipulate commodity prices, particularly gold and silver, but now that the Fed sees that it may have been too successful in scaring speculators away from commodities, it’s likely to tailor its words moretoward spurring inflation. Fed policy is nothing if not ironic.

Get regular updates the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, in the Fed Report in the Professional Edition, Money Liquidity, and Real Estate Package. Click this link to try WSE's Professional Edition risk free for 30 days!

Copyright © 2012 The Wall Street Examiner. All Rights Reserved. The above may be reposted with attribution and a prominent link to the Wall Street Examiner.