Courtesy of ZeroHedge. View original post here.

Submitted by Tyler Durden.

Succinctly summarizing the positive and negative news, data, and market events of the week…

Positives

- Moar revenue! Senate passes online tax bill

- GDP? We've got that. BEA changes calculation to include 'promises' to fund pensions

- No time for macro tourists: S&P ignores plunge in Macro data, soars to new highs

- Twitteresque: BofA & JPM have zero (as in none) trading losses in Q1

- Paging Hans Mikkelsen: High Yield debt yields below 5%, or where the US 10yr was in 2007!

- Weekly initial claims drop to 324k, lowest since 2008

- Central Planning 1, South Korea 0 … South Korea cuts rates to stop hot money flows, despite inflation headwinds

- USDJPY breaches 100 — yay!

- US 30yr Demand stronger than expected, pricing at a 2.98% yield

Negatives

- Nope, no rotation: Hans Mikkelsen's credit short gets "Crushed"

- Buying SPY instead? Home renovation spending plummets

- March consumer credit misses, as revolving loans actually decline for the first time in 2013

- Trickle-Down, down, down… Q1 Annual wage growth declines .1% YoY

- Wednesday's 10yr US auction was rather weak

- And for our next bucket of cold water, the dow in Gold terms…

- Don't look now, but there may be a run on physical gold taking place

- Wholesale sales drop most since 2009

- JGB Volatility gets out of control again

Additional

- As a reminder, here is the S&P with and without QE (click this link for article)

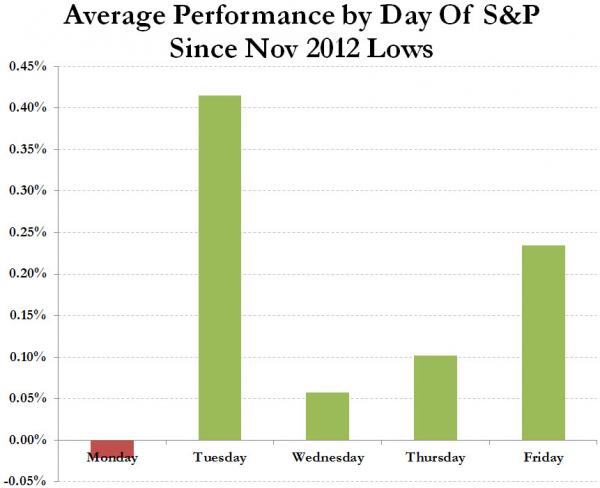

- How about the S&P with and without Tuesdays?

(h/t @ZH_Crown)