World Acceptance: What Happens if Credit Insurance disappears?

Courtesy of Citron Reports

Courtesy of Citron Reports

World Acceptance's (NASDAQ:WRLD) utter dependence on predatory loan practices has just been exposed top-to-bottom by Pro Publica, whose award-winning journalism is well above the usual stock market noise.

Citron adds the investment-related perspective that this company draws over half its profitability from dubious "credit insurance", a loan add-on that is clearly deceptive to consumers. The CFPB has already cracked down on two major credit card issuers.

Citron believes World Acceptance is very vulnerable. Kudos to Pro Publica.

Excerpt:

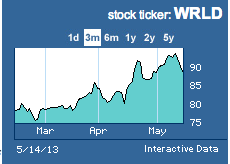

No other Citron story has generated as much reader interest over time as World Acceptance Corp. (NASDAQ:WRLD) Citron initially examined WRLD in May 2009, documenting how the company systematically abuses the economically disadvantaged with its egregious and downright sleazy lending tactics. The stock was $20, and the economy was on the ropes.

Citron thought the US government would inevitably intervene to protect consumers. Obviously, consumer protection has been slower than we expected. Today WRLD’s book of sub-sub-sub-prime consumer loans has swollen to $1.1 billion, the stock perched at $90, and its day of reckoning may have just arrived….

|

For the full story on World Acceptance, Click Here.

|