Courtesy of Lee Adler of the Wall Street Examiner

Retail sales grew modestly and on trend in April. There was no evidence of either a slowing economy or one that is overheating and about to cause conventional inflation measures to move higher. At the same time, as usual, economists got the outlook wrong, underestimating the growth rate.

According to the Commerce Department’s Advance Retail Sales Report, retail sales rose by 0.1% in April (month to month) and were up 3.7% annually, which was an acceleration from the annual rate of +2.8% in March. These are seasonally adjusted estimates which will be revised several times before they are finalized. Neither figure is adjusted for inflation. The median forecast of economists in mainstream media surveys was for sales to be down -0.3% to -0.6% month to month. The economists’ consensus was too low (what else is new?), with the problem being partly with the seasonal adjustment, and partly just the fact that economic forecasting is quackery. These big forecasting misses happen almost every month lately.

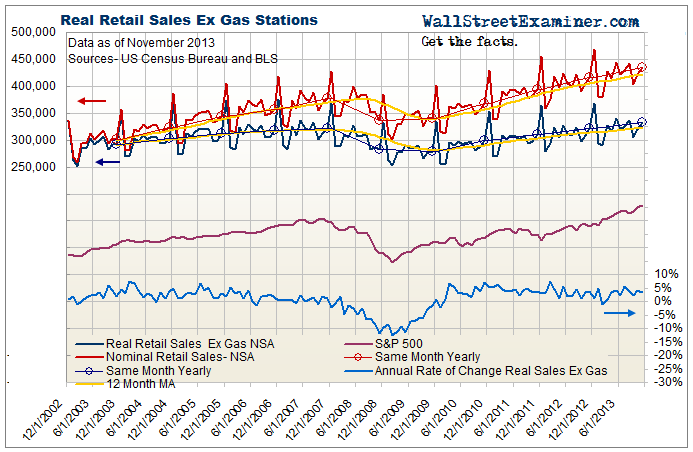

Note: When analyzing retail sales, I’m interested in the actual volume of sales, not the inflation skewed dollar total. To get to the kernel of the matter, I look at the real, not seasonally finagled retail sales, adjusted for top line CPI inflation (not core which normally understates the actual). Then I back out gasoline sales, which are a substantial portion of total retail sales. Gasoline sales distort total retail sales higher when gas prices are rising, when they actually act like a tax on disposable income and reduce non-gasoline sales. On the other hand, when gas prices fall, the top line total retail sales figure will understate any gains in the volume of sales. Gasoline sales typically account for around 12% of total retail sales. By subtracting gas sales and adjusting for inflation, the resulting number represents the actual volume of retail sales.

This analysis uses not seasonally adjusted (NSA) data due to the inaccuracy and potentially misleading nature of seasonally adjusted data.

The year to year change in real retail sales, ex gasoline sales and adjusted for inflation in April was a gain of 4.7%, which was a big improvement over the 1.4% year to year gain in March. Excluding an anomalous, weather related decline in February, year to year gains have ranged from +0.9% to +5.5% over the past 12 months.

On a month to month basis April is always a down month. This year, the monthly drop was 2.7%. That was better than April 2012 at -5.7%, and similar to the -2.4% drop in 2011. The average change for the 10 year period from 2003 to 2012 was a decrease of -2.4%. This year was consistent with the 10 year average for the month.

Rising gas prices are a de facto tax on consumers that can cause reduced consumption of other goods and services since demand for gasoline is relatively inelastic. A rise in gas prices cuts consumers’ ability to spend more on other things. Conversely, a fall in gas prices is like a tax cut that puts a little cash back in consumers’ pockets. Gasoline prices fell about 14 cents a gallon through April according to the US Energy Information Administration. So theoretically this factor should have boosted retail sales ex gas.

Consumers were hit with increased Federal payroll and income taxes in January. That was supposed to depress retail sales, but if it has, it has not shown up in the data. Falling gas prices may have offset the impact. Gains in withholding tax collections greater than the increase in tax rates suggest that the increase in the number of jobs is helping to sustain slow growth in retail spending.

The Fed’s QE3 and 4 and the Bank of Japan’s new QE campaign continue to risk stimulating rising gasoline prices, but so far, the central banks have been skillful at jawboning speculators away from crude oil and other commodities purchases. The Fed has been threatening an early end to QE in speeches and FOMC meeting minutes since January. Then last weekend, ventriloquist Ben Bernanke spoke through his dummy in a piece in the WSJ, again threatening the winding down of QE. Eventually if it does not act on these threats, the “boy who cried wolf” syndrome will set in. Traders would then drive oil prices higher. That would crimp retail sales and defeat one of the Fed’s supposed purposes for QE. But we don’t know when “eventually” will be. For now, the band plays on.

The real rate of growth in the retail sales ex gas was between 3% and 7% in 2011, falling to 1% to 5.5% in 2012, and is still in that range this year, excluding the anomalous February reading. US population is growing at slightly less than 1%. A retail sales real growth rate of several times that is remarkable. The wealthy and tourists are helping to boost sales. However, the growth rate has trended down even as the Fed has engaged in more money printing. QE simply is not working to boost employment or consumer demand.

Does any of this matter for stock prices? This indicator had a long lead time versus the 2007 stock market top. Stocks only turned down when the Fed stopped growing its balance sheet in mid 2007.

The real driver of the market is the Fed, and the Fed has only pulled the punchbowl in the past when it saw reason to be worried about conventional inflation. The issue is probably how long it will take the forces of conventional inflation to force the Fed to end the money printing. The modest growth rate of retail sales isn’t likely to move them in that direction, notwithstanding the mindless gibberish spewed by the Wall Steet Journal over the weekend.

Get regular updates the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, in the Fed Report in the Professional Edition, Money Liquidity, and Real Estate Package. Click this link to try WSE's Professional Edition risk free for 30 days!

Copyright © 2012 The Wall Street Examiner. All Rights Reserved. The above may be reposted with attribution and a prominent link to the Wall Street Examiner.