Plosser, Rosengren, Fisher, Raskin & Williams.

Plosser, Rosengren, Fisher, Raskin & Williams.

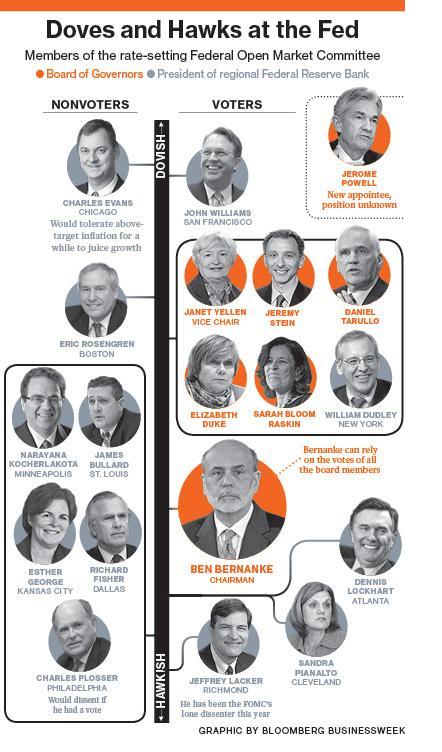

All are scheduled to bat today in the Stock Market's Home Run Derby. As I noted on Monday (we like to be prepared at PSW), it's hawk, dove, hawk, dove, dove and Plosser already had his swings this morning, calling for a "wind down" of the Fed's Balance Sheet (which is updated after the markets close today). While inflation may be tame for the time being, Plosser says an acceleration in the velocity of money could change the calculus quickly and leave monetary policy struggling to keep pace. That is, of course, exactly what I said on Sunday morning at our Atlantic City Investor Conference, just a few weeks ago.

While I don't remember Plosser in the audience, I have to compliment the guy on his incisive views, if not his conclusions. Unlike Plosser, I don't think the runaway inflation is undesirable – more like it's inevitable as we not only NEED to inflate our way out of debt but we need to inflate our homeowners into a reasonable retirement and, in order to do that, we need China-like housing inflation of over 100% in 5 years in order to give 110M US homeowners some spending money.

The average American has $40,000 saved for retirement and that is NOT net of debts. 41% of our Labor Force (57M workers) are now 55 or older and, technically, 10 years or less from retirement. If we assume an even spread, then close to 6M people a year are turning 65 and begin qualifying for Social Security and, CLEARLY, they are NOT being replaced at a rate of 500,000 a month by younger workers.

This should not be news to anyone – we've been hearing about "boomers" since they were born in the 50s but now the bulk of the boom, people born between 1954 and 1964 are moving into retirement and the chart below, from the last census report, shows you how dramatic this wave is (and the circled group from this chart is already 49 to 69):

These trends aren't hard to play from a market standpoint. Back in my 2010 Market Outlook (12/27/09) we discussed this exact trend as the easiest macro to bet on for the decade and we discussed IHI at $53 (now $80 – up 51%), ISRG at $300 (now $500, up 66%), MDT at $44 (now $50, up 13%), TMO at $48 (now $86 – up 100%), BSX at $9 (still $9), STJ at $37 (now $46 – up 24%) and SYK at $50 (now $70, up 40%).

We also liked GE, who make a lot of medical devices at $15 (now $23, up 53%) as well as MRK at $36 (now $46 – up 27%) and PFE at $18 (now $30 – up 66%). CELG at $55 (now $129, now $74 – up 134%) and AMGN at $56 (now $107 – up 91%) were my favorite Biotechs and UHS at $30 (now $69 – up 130%) and THC at $21 (now $47 – up 123%) were my favorite hospitals.

Keep in mind the S&P rose 48% during this time so that's the performance benchmark but, on the whole, they were an outperforming set of picks. I also liked the trend of MORE FREE MONEY being handed out to the top 1% and that led me to pick XLF at $14.40 (now $19.80 – up 37% – see Dave Fry chart) and the more aggressive UYG at $56 (now $98 – up 75%), OWW and CCL didn't go anywhere but UAL went from $12 to $34 (up 183%) and MAR rose from $26 to $43 (up 65%) and saved my travel picks.

Keep in mind the S&P rose 48% during this time so that's the performance benchmark but, on the whole, they were an outperforming set of picks. I also liked the trend of MORE FREE MONEY being handed out to the top 1% and that led me to pick XLF at $14.40 (now $19.80 – up 37% – see Dave Fry chart) and the more aggressive UYG at $56 (now $98 – up 75%), OWW and CCL didn't go anywhere but UAL went from $12 to $34 (up 183%) and MAR rose from $26 to $43 (up 65%) and saved my travel picks.

Our tech plays did not fare as well, nor did TBT, which we abandoned that year as it simply never works and turned out to be a bad ETF – so lesson learned there. The tech plays didn't follow the demographic macro – another lesson to learn for long-term investing but, if this is going to be a real and sustainable rally, stocks like INTC, GLW, WFR and SPWR may still come back and head for new highs. Oddly enough, my main fear came to pass but, as we now know, the issues were washed away in a flood of free money. At the time, I said:

My main concern for the US and the global economy is that rising rates and other credit risks, reflected in various CDS rates, will begin to bring down some of the marginal global economies like Spain, Greece and anything ending in "stan" or "ia."

As long as we can keep the peasants from revolting we can keep partying like it’s 1999 but I do have reservations (obviously) and we will continue to exercise a degree of caution in our investing but history has taught us that the rich can indeed get richer and we have plenty of good places to focus our bullish attention as we begin this century’s second decade.

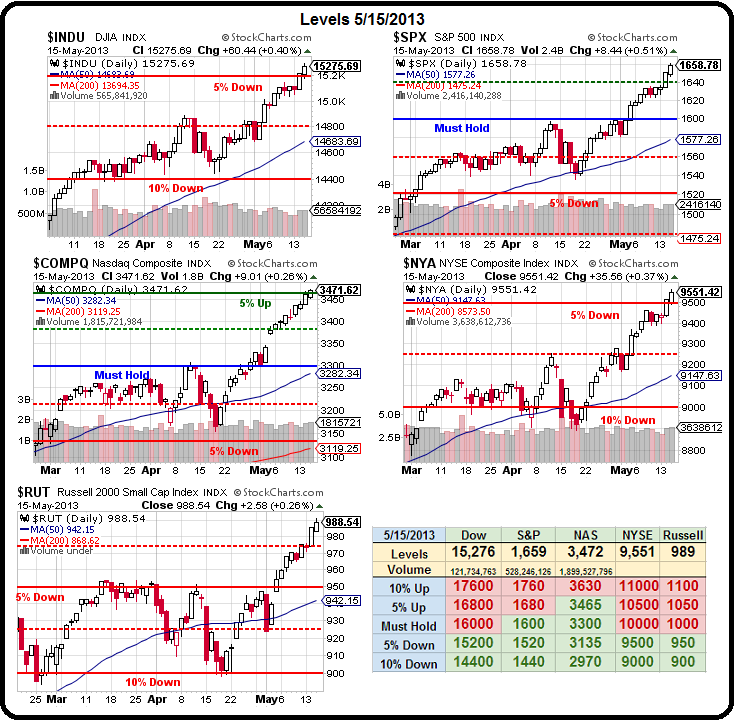

I'm reviewing this myself and you should re-read the original post as well as 2011, where our outlook was for inflation and 2012, where we decided to go on vacation for the year and put all our money into BAC (up over 100% from that pick), because – here we are, heading into June and I have not made a 2013 outlook. We went very bullish back in November, when we had our Las Vegas Conference and then we had the Fiscal Cliff "crisis" but, after that, we were off to the races as the free money flooded in. Recently I've begun to "feel" that the rally is getting ugly and overbought but I'm having trouble proving it so I made a call this week to begin moving to cash or at least cautiously hedging the tops.

I'm reviewing this myself and you should re-read the original post as well as 2011, where our outlook was for inflation and 2012, where we decided to go on vacation for the year and put all our money into BAC (up over 100% from that pick), because – here we are, heading into June and I have not made a 2013 outlook. We went very bullish back in November, when we had our Las Vegas Conference and then we had the Fiscal Cliff "crisis" but, after that, we were off to the races as the free money flooded in. Recently I've begun to "feel" that the rally is getting ugly and overbought but I'm having trouble proving it so I made a call this week to begin moving to cash or at least cautiously hedging the tops.

I'll be continuing to soul search this weekend and, as promised, we'll have another round of Inflation Fighters as well as 500% Plays for our Members – just in case I'm wrong and we keep heading higher. I wish I had a more solid take on things but, at the moment – it's a very tricky environment where we have to balance out deteriorating fundamentals (WMT disappointed, as we expected) with insane amounts of money printing by the Fed and the BOJ. If the ECB cranks up the presses next week – nothing else will matter but, if they don't – I'm very worried that things will start to.

Let me know what you think.