Courtesy of Lee Adler of the Wall Street Examiner

Rising corporate profit margins have been a key driver of rising stock prices according to a report in Business Insider that summarizes a research piece from BAML. The report claims that margins have grown mostly due to low interest rates and low taxes and that this margin growth will end. However, the report contends that currently fat margins will not revert back to historical norms as the bears claim. If margins are stable, profit growth should be as well. Therefore they expect stock prices to rise 5-7% annually.

News Flash! Corporate profits don’t drive stock prices and stock prices don’t discount the future.

Stock prices have already risen 17% this year, and they might rise another 17%. That might be followed by a decline of 40% next year. The idea that prices will rise along a nice soft 5-7% curve because profit growth will be around that rate is just silly.

People think stock prices are driven by expectations of corporate profits because Wall Street has been repeating that thought so often for so long.

Sure, prices of individual stocks do adjust to profit surprises, so it appears that profits are the driver. In those individual, instantaneous reactions, they are, for a few seconds as the news disseminates. People recognized their failure to understand the business, see that it’s better than they thought (or worse as the case may be), and they pile on. They’re not discounting the future. They’re reacting. They are expressing surprise or shock in a purely emotional response to unexpected change. Profit surprises, and the reactions of investors to them, are evidence that the market doesn’t discount the future, or that for those who attempt it, they’re not doing it very well.

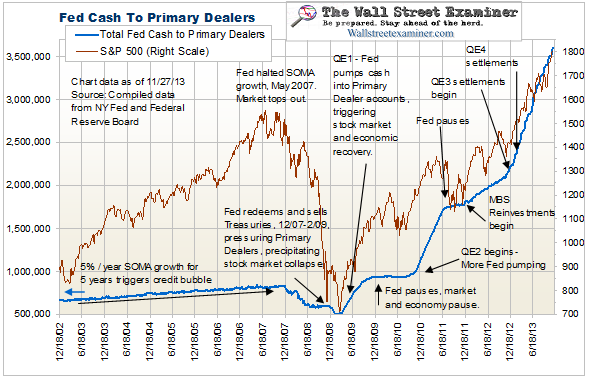

In the aggregate, price levels are driven by the amount of liquidity in the system. When central banks pump excess liquidity into the markets day in and day out as the Fed has been doing since November, stock prices rise faster than profits. In fact, profits may not be rising very much at all but stock prices continue to rise. People interpret that as margin expansion, and as stocks “discounting the future” which is just more nonsense. Stock price indexes measure liquidity, nothing more, nothing less.

When central banks pull the plug on the money printing, stock prices will come back down, hard, regardless of what profits do.

Of course falling profits run with falling stock prices, because when central banks do get tight, or at least stop subsidizing the market, the economy simultaneously contracts. Profits and stock prices have the same driver. That’s why they often correlate. But there’s absolutely no causality between profit levels and aggregate equity prices. Any focus on drilling down to profit margins is a waste of time. It won’t give you any useful information about the likely direction of stock prices.

Profits (and margins) expand when money is easy and rates are low, which is what the BAML report showed. Stock prices rise at the same time because the central bank is pumping money into the accounts of the market’s wholesale distributors. They buy inventory, sometimes repackage it, mark it up, and sell it.

But when this cycle ends and the Fed ends its massive market subsidy, both processes will run in reverse. Profit margins will get squeezed and stock prices will fall. They’ll both occur over the same time periods, and people will continue to be misled into thinking that profits are driving stock prices and that stock prices are discounting the future. Neither is true.

Get regular updates the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, in the Fed Report in the Professional Edition, Money Liquidity, and Real Estate Package. Click this link to try WSE's Professional Edition risk free for 30 days!

Copyright © 2012 The Wall Street Examiner. All Rights Reserved. The above may be reposted with attribution and a prominent link to the Wall Street Examiner.