Actually, I'm all talked out.

Actually, I'm all talked out.

I wrote a very long Macro outlook this weekend so I don't have a lot to add this morning. We've been expecting a pullback and, so far, a pullback has not come. As you can see from Doug Short's chart on the right, the S&P has pulled off a spectacular recovery – getting to 109.2% of it's pre-crash levels in just 5 years, which is better than the Dow did 20 years after the 1929 collapse (despite FDR Stimulus and the Great War) and almost 70% better than the Nikkei has done in the past 23 years.

Adjusted for inflation, the S&P is still DOWN 19.6% from it's 2000 highs so the goal is 2,160 – for those of you who like an even playing field. That would be a very happy 35% over our "Must Hold" line of 1,600 on our Big Chart and that's just a tad shy of that big 38.2% that constitutes a Fibonacci Sequence but (and this is interesting) 23.6% below 2,160 is, TA DA, 1,650.

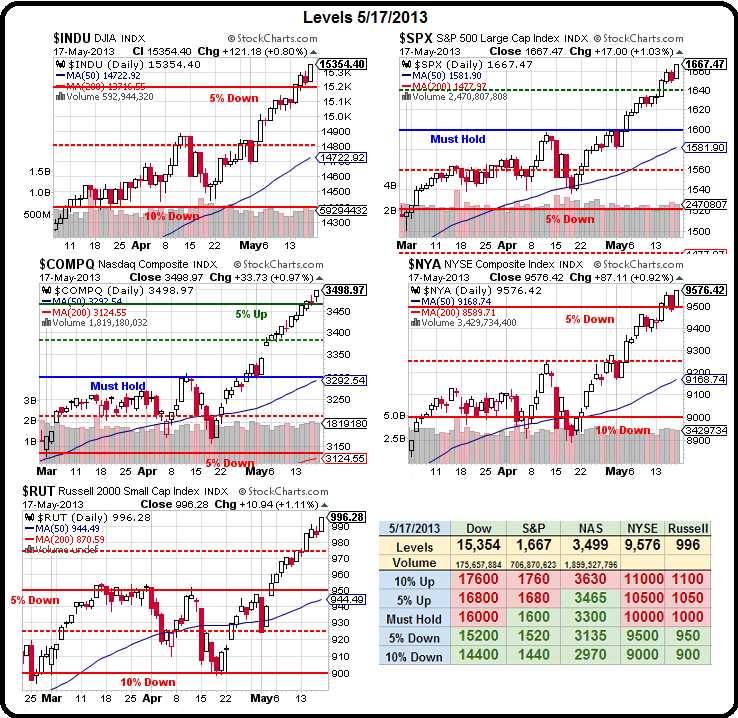

So here we are at 1,667 and we have our 5% rule telling us that the next significant resistance is 1,680 and Fibonacci has been telling us since 1250 (AD) that we should be looking for 1,650 – not bad for a dead mathematician! If we hold 1,650 and we get over 1,680, then we HAVE to be bullish. IFF the Russell hits 1,000 – we HAVE to be more bullish.

So here we are at 1,667 and we have our 5% rule telling us that the next significant resistance is 1,680 and Fibonacci has been telling us since 1250 (AD) that we should be looking for 1,650 – not bad for a dead mathematician! If we hold 1,650 and we get over 1,680, then we HAVE to be bullish. IFF the Russell hits 1,000 – we HAVE to be more bullish.

I put up some bullish plays in our weekend post – one is even being added to our new Short-Term Portfolio (CLF) but our first two plays (from Friday's post) were bearish (USO and GME) – as we're still expecting that pullback and those levels have NOT been crossed yet.

I already sent out an Alert to our Members this morning to look at short s on Oil (/CL) at $96 and the Nikkei (/NKD) at 15,400 as we're expecting a poor Chicago Fed report at 8:30 and, of course, the oil contracts are winding down in two days and they still have 50K contracts to get rid of with 331,000 already stuffed into July (331M barrels of fake orders). That puts the odds nicely in favor of shorting oil as nothing blew up over the weekend to support $96 a barrel.

It certainly won't be a surprise to us to see a nice pullback this week. Frankly, what's been surprising is the lack of it for the last 3 weeks. We keep waiting for reality to hit the fan but it never quite seems to get there but there's lots of ways to make fantastic money in an up market and I laid our 5 new trade ideas in the weekend post so I do truly believe we a ready for anything over the next couple of weeks.

Goldman Sachs took my advice this weekend and is taking the money and running away from the Industrial and Commercial Bank of China, offering up their last $1.1Bn worth of shares this morning. At $240Bn, the market cap of ICBC is about the same as JPM and BCS combined so PERHAPS a little toppy here…

Goldman Sachs took my advice this weekend and is taking the money and running away from the Industrial and Commercial Bank of China, offering up their last $1.1Bn worth of shares this morning. At $240Bn, the market cap of ICBC is about the same as JPM and BCS combined so PERHAPS a little toppy here…

As you can see from the chart on the right, ICBC is China's biggest lender, with 14.45% of the market and, of course, we've been tracking articles indicating rising wages in China are eating into Corporate Profits and bad loans are on the rise and then there's civil unrest and bird flu. But still, GS wants OUT of China's biggest bank? That's a little concerning, to say the least.

Also concerning (or it would be in a real market) is the fact that, if Scotland were an independent state, it's banking sector would have assets totalling 1,250% of their GDP. Now, here's the funny part, Scotland has a referendum on the ballot to become an independent state in 2014! Even Cyprus is laughing at this one as their bank assets were "only" 700% of the GDP. Scotland's Finance Secretary called the report "a feeble attempt to undermine confidence" in an independent Scotland. I wish I were making this stuff up, but it's really happening, folks. Unfortunately, as Warren Buffet sort of says, it's only when the tide goes out that you see who's naked under their kilt.

Speaking of Scotty, the new Star Trek movie "only" made $84.1M (US) this weekend for Paramount (VIA) but I know why as $13.5M for IMAX was for just 336 theaters and you could not get a ticket to the IMAX (I tried) and who the hell wants to see that movie on a regular screen. Even my Mom is waiting to go see it in IMAX. Still, it was more than double the $35.2M taken in by Iron Man 3 this weekend ($337M total) and that's still in IMAX as well, which is why seats are so scarce for Star Trek.

Speaking of Scotty, the new Star Trek movie "only" made $84.1M (US) this weekend for Paramount (VIA) but I know why as $13.5M for IMAX was for just 336 theaters and you could not get a ticket to the IMAX (I tried) and who the hell wants to see that movie on a regular screen. Even my Mom is waiting to go see it in IMAX. Still, it was more than double the $35.2M taken in by Iron Man 3 this weekend ($337M total) and that's still in IMAX as well, which is why seats are so scarce for Star Trek.

IMAX is a great long-term stock and they go up and down depending on box offices but mostly up and they were in our last Income Portfolio but not the new one for some reason. Hopefully we'll get a little pullback over the summer (we usually do) and we'll have a chance to reload ahead of the new Star Wars cycle (also JJ Abrams)

As we expected, the Chicago Fed Report came in at -0.53 vs -0.23 expected so a 130% miss by Economorons. The National Activity Index is not like the regional NY Fed or Philly Fed reports but a weighted average of 85 monthly National Indicators with negative numbers indicating below trend growth. The 85 economic indicators that are included in the CFNAI are drawn from four broad categories of data: production and income; employment, unemployment, and hours; personal consumption and housing; and sales, orders, and inventories.

March was already down 0.23 and is unrevised in this report so we're accelerating to the downside by 130% in 30 days. At this rate, we'll be at -1,000 in a few months! Don't you just love extrapolation? 8)

Still, let's be careful out there!