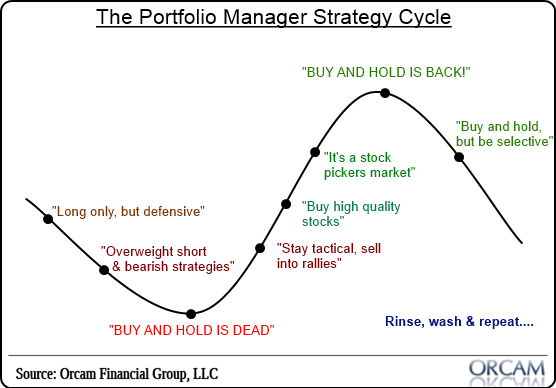

The best time for the buy-and-hold strategy is when people are swearing off it. The worst time is when it's back in vogue….

PragCap’s Strategy Cycle Chart

Courtesy of Joshua M Brown, The Reformed Broker

I love this so much I had to nick it from my friend Cullen's site. You're not completely immune to this kind of behavior nor am I, keep it real.

The key is to recognize this happening and to be bigger than it, above it:

- In 2009 buy and hold died.

- Almost everyone became a trader at the trough of the crisis.

- Then it was “buy the dips, sell the rips”.

- Then it was all about high quality dividend names.

- Then it was a “stock pickers market”.

- Now buy and hold is all you hear about from anyone.

- “Stocks for the long run!”

- Then long only via defensive names will be the only game in town.

- Then buy and hold will die.

- Then short strategies dominate.

- Then tactical approaches win, hedge funds are your only savior, etc, etc.

Source:

The Portfolio Manager Strategy Cycle (PragCap)

Cullen: "Although the financial crisis might feel like it was a lifetime ago, the cycle of various strategic approaches to this market is fresh on my mind. We all know the cycle of emotions. You tend to feel euphoric at the peak, panicked at the trough and generally confused all the way inbetween. Don’t worry – portfolio managers are no better. They just express their emotions in varying degrees of active portfolio management with fancier sounding ways to express the rollercoaster ride they’re on."