The woods are lovely, dark and deep.

But I have promises to keep,And miles to go before I sleep – Frost

Poetry, that's what we got from the Fed's Bill Dudley and James Bullard yesterday, as they both hinted that – not only is the Fed likely to continue QE for "an extended period of time" – but they may EXPAND IT FURTHER if the economy doesn't turn around in the near future.

That's right, the economy sucks and the Fed knows it, even if "investors" don't. Of course, we're in that bad news is good news thing as the bad news keeps the free money flowing from the Fed and, as I say over and over again – a rising tide of money lifts all Financial Ships BUT, that has nothing at all to do with the underlying Fundamentals of the Global Economy, which continue to sink into the abyss.

Of course (and here's where the above chart becomes useful, the same could have been said in 1921 and 1933 and 1974 and 1987 but not in 1942, when we had that really big war to create so much demand we had to ration stuff! Despite my current caution, once inflation does kick in I have no doubt we will hit 2,100 on the S&P (see yesterday's post) – just not quite yet.

Of course (and here's where the above chart becomes useful, the same could have been said in 1921 and 1933 and 1974 and 1987 but not in 1942, when we had that really big war to create so much demand we had to ration stuff! Despite my current caution, once inflation does kick in I have no doubt we will hit 2,100 on the S&P (see yesterday's post) – just not quite yet.

What we have at the moment is a frenzy of anticipation that things will get better but it's always "next quarter" or "after the summer" or "next year" while we ignore the NOW that doesn't look so hot.

That's putting us into a pretty extremely overbought position on the NYSE Summation Index (from Dave Fry) and, as you can see from the last 3 years of our rally – this usually doesn't last very long without a pullback. So, forgive me for being cautions just because we did, in fact, drop 10% from the Oct '12 high and 15% from the March '12 high and 13% from the Nov '11 high and 20% from the June '11 high.

We did not, however, pull back in Oct 2010 or Feb of this year but both times we did have a lengthy consolidation while the overbought conditions worked themselves off. Of course that led up to the big 20% drop in mid 2011 and here we are in mid 2013 – also without having let off any steam but maybe this time is different… maybe…

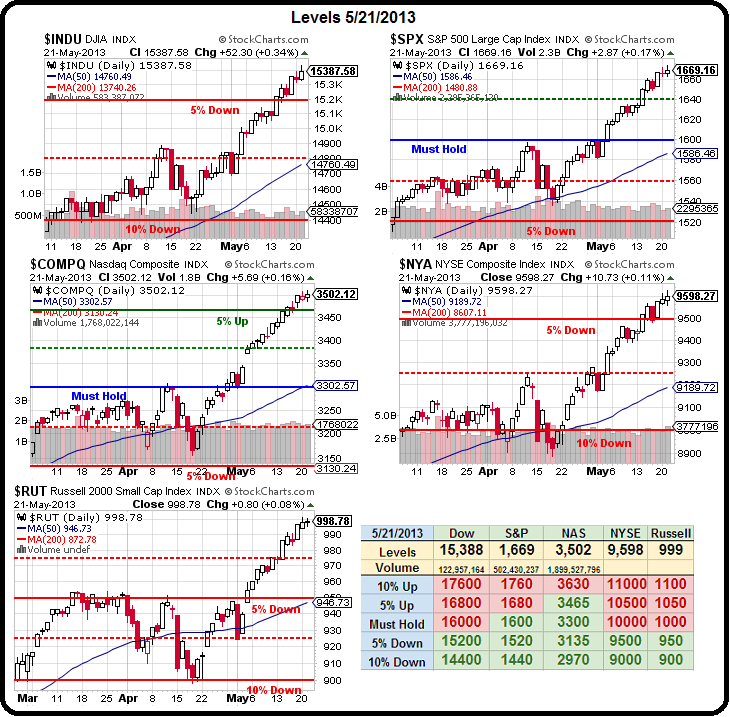

Nonetheless, we are being greedy and waiting to see that 1,000 lin on the Russell hold for at least two consecutive days to confirm the next-level breakout that is predicted by our Big Chart. Once we get there, we can afford to be gung-ho enthusiastic about the Dow and the NYSE catching up and we discussed bullish Dow bets yesterday so – moving on.

Nonetheless, we are being greedy and waiting to see that 1,000 lin on the Russell hold for at least two consecutive days to confirm the next-level breakout that is predicted by our Big Chart. Once we get there, we can afford to be gung-ho enthusiastic about the Dow and the NYSE catching up and we discussed bullish Dow bets yesterday so – moving on.

This morning, I sent out an early morning Alert to our Members at 3:15 with ideas for short plays on Oil Futures (/CL) at $95.89, Natural Gas Futures (/NG) at $4.225, Russell Futures (/TF) at 997.5 and Nikkei Futures (/NKD) at 15,700.

The Nikkei quickly stopped us out with a small loss ($5 per point, per contract) and did so again as we crossed 15,800 later in the morning but Oil gave us a lovely dip to a stop out at $95.55 for a $340 per contract gain and the Russell dropped to just below 996 but then back up for no play but Nat Gas was and still is our hero, with a huge (for them) 0.0425 drop to $4.18 and now stopped out at $4.185 fro a LOVELY gain of $100 per penny per contract so $400 there as well.

One day we'll catch a real dip, but not today apparently – as we're getting the usual re-pump in the Futures as the Dollar pulls back from the 84 line. It's happy, happy, joy, joy for investors today as Uncle Ben gives a talk at 10am on the "Economic Outlook" but Dudley and Bullard already told us it's not very good so it's really an issue of how much MORE FREE MONEY Uncle Ben can promise us to see if we can still goose the goosed markets by merely hinting at stuff.

One day we'll catch a real dip, but not today apparently – as we're getting the usual re-pump in the Futures as the Dollar pulls back from the 84 line. It's happy, happy, joy, joy for investors today as Uncle Ben gives a talk at 10am on the "Economic Outlook" but Dudley and Bullard already told us it's not very good so it's really an issue of how much MORE FREE MONEY Uncle Ben can promise us to see if we can still goose the goosed markets by merely hinting at stuff.

If Bernanke fails to please, there's always the FOMC Minutes at 2pm and those can be interpreted whichever way the MSM wants it to be and, judging by the slew of upgrades coming from their advertisers this week – I'd say those minutes are going to be spun fantastically. Even this morning, FRBNY's Dudley is now weighing in and saying it will be 3-4 months before the Fed will have a sense of how the economy is responding to fiscal drag and can decide whether to reduce OR EXPAND asset purchases.

So the stars are all aligned for Russell 1,000 and, if we don't get it – we should be VERY concerned.

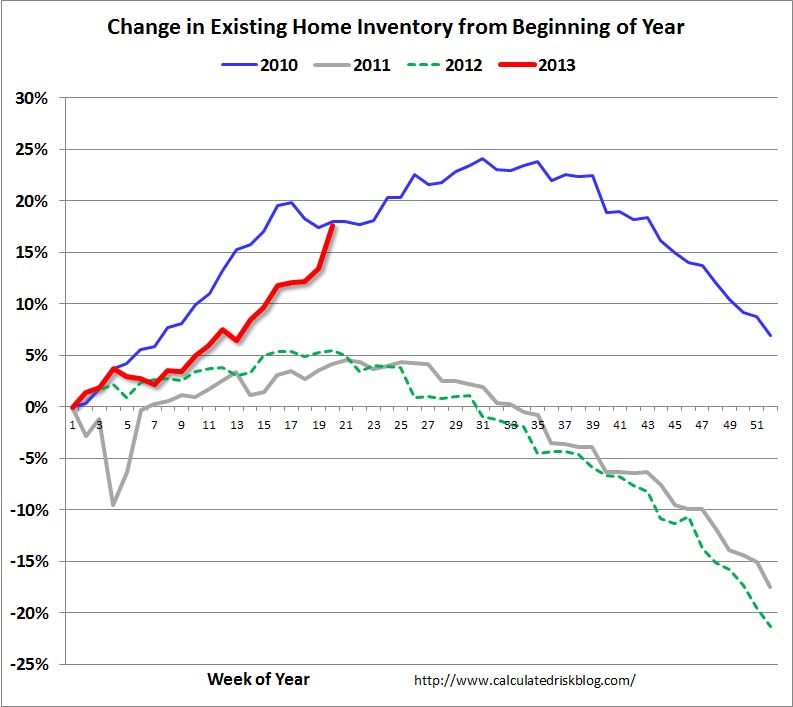

We should also be concerned about this alarming rise in Housing Inventories that looks a lot more like what one sees in a downturn vs. what we would expect to see in a recovery. MBA Mortgage Applications are confirming the negative trend this morning with a 9.8% weekly drop – accelerating from the 7.3% drop last week and no, that is not normal at all for this time of year.

We should also be concerned about this alarming rise in Housing Inventories that looks a lot more like what one sees in a downturn vs. what we would expect to see in a recovery. MBA Mortgage Applications are confirming the negative trend this morning with a 9.8% weekly drop – accelerating from the 7.3% drop last week and no, that is not normal at all for this time of year.

In fact, we peaked out last year at 110 in the index on May 25th and here we are, on May 22nd a year later and the the Home Loan Index just fell from 82.50 to 74.50. Wow, that' really, really sucks, doesn't it? No wonder the Fed is freaking out. They should be freaking out. Investors sure aren't freaking out (the VIX is still at 13.37) so someone has to – these are crisis numbers!

We get Home Prices tomorrow as well as new Home Sales so that will add some color to the report but, if they are not going the other way, then Durable Goods on Friday are likely to disappoint and how will the poor Russell hold 1,000 with all this horrible stuff going on? Does the Fed have enough fairy dust to lift the market with the weight of Housing dragging us down? Tune in tomorrow and we'll see!

Internationally, we used to follow the Swiss Franc but it got boring as they had the Franc pegged against the Euro at 1.20 Euros to the Franc so the Swiss could maintain their export market, as well as not freak out their bank depositors when they came to visit their money. Well, that was last summer and this is now and now the Swiss have lost control and the Euro has fallen 5% against the Franc to 1.26 per Franc and the SNB is now the second major World Bank (Japan beat them by a month) to threaten to go negative on their rates.

Internationally, we used to follow the Swiss Franc but it got boring as they had the Franc pegged against the Euro at 1.20 Euros to the Franc so the Swiss could maintain their export market, as well as not freak out their bank depositors when they came to visit their money. Well, that was last summer and this is now and now the Swiss have lost control and the Euro has fallen 5% against the Franc to 1.26 per Franc and the SNB is now the second major World Bank (Japan beat them by a month) to threaten to go negative on their rates.

That's right folks – you have to pay them for them to hold their money and they will then lend it out to their Banksters for zero (already there since last year) or, perhaps, they will turn around and PAY their banksters to borrow money from the Central Bank! The SNB has accumulated foreign currency reserves equal to about three quarters of annual economic output due to its interventions to maintain its ceiling on the Franc. It also holds 1,040 tonnes of gold, most of which is stored domestically.

I'm sorry to mention these things in the middle of a market rally. Far be it for me to rain on Uncle Ben's parade today as he clearly has all of his little Governors playing the same tune this week but, holy crap…

That's all I can say – holy crap. Holy crap.

Good luck!