Courtesy of Lee Adler of the Wall Street Examiner

New orders for manufactured durable goods in April increased $7.2 billion or 3.3 percent to $222.6 billion, the U.S. Census Bureau announced today. This increase, up two of the last three months, followed a 5.9 percent March decrease. Excluding transportation, new orders increased 1.3 percent. Excluding defense, new orders increased 2.1 percent. Transportation equipment, also up two of the last three months, led the increase, $5.1 billion or 8.1 percent to $67.6 billion. This was led by nondefense aircraft and parts, which increased $1.9 billion.

from Census Bureau

The consensus forecast was for an increase of 1.6% according to the widely followed survey by Briefing.com. As usual, they weren’t close. The old seasonal adjustment bugaboo reared its ugly head. That and the fact that most economists are quacks practicing the dark arts of economics fraudquackery means that they almost never guess the number.

The media frames it as the economy beating forecasts. In reality the economy does not “beat” or “miss.” The economy is what it is. All the guesswork about what the numbers will be and the attention the media gives that, are just silliness. But that’s the game and many traders play it, trying to guess whether the number will “beat” or “miss,” and on top of that, trying to guess how the market will react to that. It’s a bit of a fool’s errand.

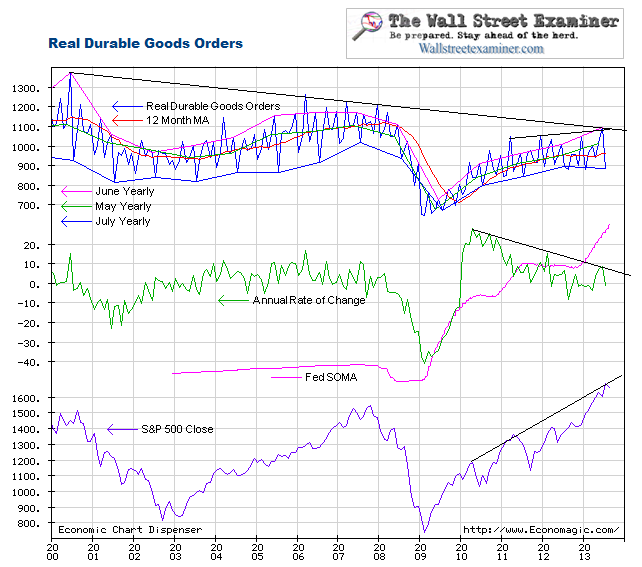

April Real Durable Goods Orders, adjusted for inflation and not seasonally manipulated, rose 3.2% year over year. That compares with a 3.5% year to year decrease in March. In spite of the uptick, the annual rate of change remains in the declining trend in which it has been since early 2010. This deceleration has been consistent whether the Fed was pumping QE full bore or was in a pause. After the initial rebound in 2010, the Fed’s money printing has had no discernible impact. This isn’t new. It’s part of a downtrend in US manufacturing that has persisted since 1999.

Note: In adjusting for inflation, this measure attempts to represents actual unit volume of orders. Also, the use of actual, versus seasonally adjusted (SA) data allows an accurate view of the trend. With SA data, this may not be the case, since SA data can overstate or understate the real underlying change by attempting to fit the data to a standardized curve. There are no such issues when using the actual data (see Why Seasonal Adjustment Sucks).

New orders volume remains well below the 2004 through 2007 levels. Those years were when the housing bubble was in full swing, but current levels of orders are even below 1998 through 2000 and 2001 through 2003 when the US was in recession after the internet/telecom/tech bubble collapsed. The economy may be growing in other areas, but the pace of activity by this measure is still no better than the worst level of 2002. This data has consistently shown since 2011 that manufacturing in the US is not recovering. The US is producing less stuff today than it did 5 years ago, or 15 years ago.

To see how this data performed on a short term basis, since it’s actual NSA data, it’s necessary to compare it to April in previous years. April is always a down month. The month to month change for this month over the prior 10 years averaged -12.7%. The current month had a drop of only 6%. That was better than average, and better than the past two years, but it came on the heels of the worst March performance of the previous 10 years. The improvement in April was a rebound from that.

The trend of US manufacturing still looks dead in the water. With all the confusion emanating from the Fed and the forked tongue of Bernanke, don’t expect a coherent response from the Fed. Keynesian econoquacks and the Fed itself are blaming the tax increases that went into effect in January for economic growth that’s less than what they want, just as I predicted. But that based on the real time data on withholding taxes that is simply wrong. Withholding has risen by substantially more than is attributable to the rate increases. The decline in US manufacturing is part of a secular trend that shows no real sign of reversing.

The stock market has been following the growth of the Fed’s balance sheet, just as Bernanke has ordered. But he’s had less success at getting US manufacturing on its feet. It has stalled out in spite of massive Fed money creation and a stock market bubble.

The stock market has shown that it can go on its merry way higher for several years with little or no growth in manufacturing. Durable goods manufacturing makes up only 5-6% of the US economy. So it’s a good idea not to get hung up on durable goods orders as a stock market indicator. The market is always its own best indicator, but if you are looking for economic data that correlates well with stock prices, look at the Fed’s balance sheet and Industrial Production.

Read Bullshit Walks – Claims On Trend As QE Gooses Overbought Market, Not Jobs

Get regular updates the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, in the Fed Report in the Professional Edition, Money Liquidity, and Real Estate Package. Click this link to try WSE's Professional Edition risk free for 30 days!

Copyright © 2012 The Wall Street Examiner. All Rights Reserved. The above may be reposted with attribution and a prominent link to the Wall Street Examiner.