Wow, what a ride!

Wow, what a ride!

After making "just" 20% on our Nikkei trade idea over the weekend, we got more aggressive yesterday and went with the /NKD futures just after the close as I said to Our Members at 4:09:

Nikkei at 13,185 is a bull play over 13,200 as long as the Yen is over the 96 line but very dangerous stuff (/NKD).

The Nikkei is a great way to lock in bearish gains overnight as it tends to have spectacular recoveries, as you can see from a $1,500 per contract gain in just over 12 hours (much sooner if you were up all night playing the lines). Futures play is VERY dangerous but it's also a very useful tool we like to teach as, in situations like yesterday – it's a fantastic way to make sure you don't get blown out of your main positions by overnight changes.

We took the money and ran on oil at $94 (our goal #1 with $92.50 our next downside target) and now it's back to $95.50 pre-market ($33.90 on USO, see Dave Fry's chart), where we're now waiting for inventories at 10:30 to hopefully give us another leg down. In this case, we found a nice SCO (ultra-short oil) hedge to get into on yesterday's pump into the close. Later we'll add USO puts if we get a nice run-up as we're expecting a build in inventories to disappoint oil bulls.

We took the money and ran on oil at $94 (our goal #1 with $92.50 our next downside target) and now it's back to $95.50 pre-market ($33.90 on USO, see Dave Fry's chart), where we're now waiting for inventories at 10:30 to hopefully give us another leg down. In this case, we found a nice SCO (ultra-short oil) hedge to get into on yesterday's pump into the close. Later we'll add USO puts if we get a nice run-up as we're expecting a build in inventories to disappoint oil bulls.

Our key index this morning is the NYSE, as it finished just below its 50 dma line of 9,275 at 9,255 so that needs to stay over today if we're to stay bullish on this, so far, weak bounce (see yesterday's post covering all bounce lines). The Futures are up a bit but, with Dow at 15,200 and the Nikkei at 13,500 this morning – I expressed my doubts in an early morning Alert to Members (also tweeted!) that we'd go any higher from here.

Not enough to turn bearish pre-market but I just don't get that bullish vibe from the overnight moves vs. the news-flow I'm seeing which, frankly, sucks. Most of that sucking can be easily summed up in this one chart that shows the US Macro Surprise Index ( a compilation of upside or downside data points vs. expectations) is back to January lows as we head into earnings and the 10-Year Yield is spiking higher but the S&P is just obliviously marching on near it's highs.

Something's gotta give so, either we start getting a bunch of upside economic surprises (and earnings reports for Q2 are just starting to come in) or maybe, just maybe, the S&P is still due for a bit of a correction to 1,575 (5%) or maybe even 1,500 (10%) while we wait for the fundamental data to catch up to market expectations (if indeed that's even possible).

You can see that massive 10-year move since mid April is being mirrored on the 30-Year Mortgage Rates, that have jumped 22% to 4.16% in less than a month. Fortunately, we already have our "5 Inflation Fighters Set to Fly," which I just so happened to post on April 20th, right at the beginning of that wave (part two was Members Only the next day).

You can see that massive 10-year move since mid April is being mirrored on the 30-Year Mortgage Rates, that have jumped 22% to 4.16% in less than a month. Fortunately, we already have our "5 Inflation Fighters Set to Fly," which I just so happened to post on April 20th, right at the beginning of that wave (part two was Members Only the next day).

We get our PPI data tomorrow at 8:30 and next Tuesday is CPI along with Housing Starts and Building Permits but Wednesday we get the MBA Mortgage Index at 7am as of June 15th and it's not likely to be pretty with that relentless rise in rates.

Also on Wednesday next week we have another FOMC Rate decision, the day before we see Existing Home Sales, the Philly Fed and Leading Economic Indicators – all the macros we need to confirm or deny the trend in the above chart. So lots of excitement ahead and, as with the BOJ and the ECB and the BOE – all of whom failed to deliver MORE FREE MONEY last week – hope springs eternal that Bernanke will shower the people he loves with love (or money) to show them the way that he feels about the economy.

As noted by many analysts, and even Fed Hawks recently is the fact that, at this point, the Fed is essentially "pushing on a string" with QE – meaning the policy is getting less and less effective as the money supply grows and grows because we're not actually doing a thing to improve the VELOCITY of money and, no matter what amount of money you multiply by zero – you still end up with zero.

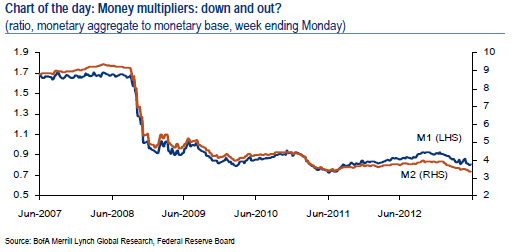

This BAC chart indicates the decline of the "Money Multipliers" over the past 9 months (and longer term, of course) and you can see that QE3 gave us only the briefest of bumps before collapsing back to mid 2011 lows and yes, that was right before the S&P spectacularly collapsed from 1,350 in late July to 1,125 by the middle of August (16.66%). We made our call to get the Hell out of the rally a bit early then too (June 30th), but it all worked out in the end. It's fun to review the old daily articles as we headed into that catastrophic failure and note how similar my commentary was at the time on very similar concerns to the ones we have now. Now the Financial Times shares my concern on the velocity of money (which we discussed in detail at our Atlantic City Conference in April), saying:

The channel through which money creation is expected to stimulate the economy is credit creation. However, not only has the money multiplier process broken down, but the linkages from money growth to credit growth are at best very limited, as Chart 2 reveals. Since the end of the Volcker disinflation, the correlation between year-on-year growth of M2 and credit (measured here as loans and leases by banks) is just 0.13%. Bank lending arguable is soft now relative to historical trends because both loan supply and demand are restrained — albeit gradually improving. High lending standards and regulatory uncertainty hold back supply, while slow growth, deleveraging and depressed collateral values keep demand low.

Though it's tanked the markets before, expect Bernanke to plead with Congress to DO SOMETHING next week, because the ability of the Fed to stimulate the economy is waning because the Lenders aren't lending and the Job Creators aren't creating jobs and those are the people the Fed is putting the American people in debt for as he continues to hand the top 1% $85Bn per month to play with.

Though it's tanked the markets before, expect Bernanke to plead with Congress to DO SOMETHING next week, because the ability of the Fed to stimulate the economy is waning because the Lenders aren't lending and the Job Creators aren't creating jobs and those are the people the Fed is putting the American people in debt for as he continues to hand the top 1% $85Bn per month to play with.

You can print infinite amounts of money but the practice of then giving that money to Banksters and the top 1% who use it only to create more wealth for themselves and don't "trickle down" to the bottom 90% gives you infinity times zero and your economy still sucks. Only when money makes it to the bottom 80% through job growth (300,000 – 400,000 a month, not 175,000, which barely keeps up with population growth), building and wage inflation can you have an expanding economy. Finally the FT gets it – let's hope some of our "leaders" begin to as well.

Same watch levels as yesterday – same skepticism as yesterday but a find opportunity to short oil today at 10:30 if the net inventory report shows a build of 2M barrels or more – stay tuned for the fun!