Reminder: Craigzooka is available to chat with Members regarding his virtual portfolio performance, comments are found below each post.

Welcome to the first update on the IRA Portfolio. The plan, from here on out, is to do a recap of the portfolio every options expiration. In this recap we will do a review of all the activity in the portfolio for the last month and talk about our plans for the next expiration. We had a decent amount of activity over the last month, so lets get to it!

ABX – Barrick Gold Corporation

- On 5/21/2013 in, member chat, we said, “ABX has gotten to cheap and the premiums to juicy to ignore any longer. So our first position in the NEW IRA portfolio will be ABX. We are scaling into a $10,000 position so for the first round we will sell a put spread and hope we have a chance to buy the shares even cheaper. The 19-14 put spread in JUN is trading for $.80 and the 19-14 in JUL is trading for $1.09. I don’t think the extra $.29 is worth missing the opportunity to potentially sell JUN for $.80 and then JUL for another $.80. So our first trade will be selling 1x the 19-14 put spread in JUN for a $80 credit.”

- Our first trade went spectacularly and on 6/6/2013 the short 19 PUT was trading at $13. There was no reason to be greedy and risk the $67 profit to make $13 more so we bought back our short 19 PUT for $13 and booked our first winner ( member chat link ).

- When we first initiated the trade we were ready and willing to buy more if it got cheaper. By 6/21/2013 ABX had gotten way cheaper so we initiated another position. We sold the 16/11 PUT Spread for a credit of $101. ( member chat link )

HPQ – Hewlett-Packard Company

- On 5/21/2013, in member chat, we said, “Adding an opening position in HPQ as well. Selling the 21-16 Put spread in JUN for a credit of $104. Once again, we really hope they crash and we will get to pick them up cheaper, but we might as well sell some premium while we wait for that to happen.”

- Two days later HPQ popped after earnings and we were able to close out our short 21 PUT for only $10 and book another winner. (member chat link)

CLF – Cliffs Natural Resources Inc

- On 5/21/2013 we added a position in CLF by selling the JUL 20/15 Put Spread for a credit of $100. ( member chat link )

- Since then CLF had declined to $16. If it is still this low at JUL expiration we will be excited to close out our put spread, buy 100 shares, and begin selling more premium.

AAPL – Apple Inc

- On 5/24/2013 we added a position in APPL by selling the JUL430/380 PUT Spread for a credit of $99. ( member chat link )

- This PUT Spread was in the mini options so we are only risking being assigned 10 shares of APPL instead of 100. When we put the trade on our plan was to buy more if they go lower. Given that they are trading at 400 now, we might just get our chance.

BTU – Peabody Energy Corporation

- On 5/28/2013 we were still incredibly under invested so we decided to initiate a position in BTU by selling the JUL 20/15 PUT Spread for a credit of $86.( member chat link )

- BTU is now trading Below 15 so it looks like we will get a chance to buy some more shares this expiration.

X – United States Steel Corporation

- On 6/6/2013 there was a nice spike in the VIX so we decided to initiate a position in X by selling the JUL 17/12 PUT Spread for a credit of $80. ( member chat link )

- With X trading above 17 this trade is still on track and we are just waiting to collect our profits.

SLW – Silver Wheaton Corporation

- On 6/21/2013 we were in the middle of a huge slide in silver so we decided to initiate a position in SLW by selling the AUG 19/14 PUT Spread for a credit of $92. ( member chat link )

- SLW is trading above 19 so this trade is still on track.

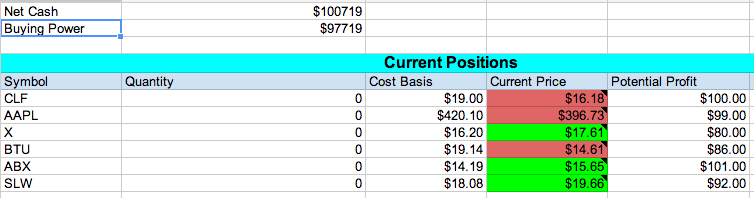

To summarize, here is the status of the portfolio as of 6/28/2013