Well, that was disappointing!

Well, that was disappointing!

As noted by Dave Fry: "Stocks barely moved overall as Bernanke said little to motivate traders in any direction. It still must amaze viewers to listen to the most powerful man (along with his merry fellow governors) take over the money of the United States with only a bunch of useful idiots in congress to monitor their activities. Stunning!"

Bernanke could not possibly have been more doveish in his statement to Congress (see yesterday's post) and he speaks to the more intelligent Senate Banking Committee today, where Elizabeth Warren gets a crack at him for the first (and probably last) time.

It will not be covered as closely as yesterday's clown college in the House and nothing new is likely to be said so we turn our focus back to earnings, and we'll see if they can provide the fuel we need to take this market rocket (up 30% since November) out of orbit and out into space – where we can continue to expand forever more.

Unfortunately, we had a few misses yesterday, with MAT, NTRS, NVS and PJC missing in the morning and ALB, CNS, CYS, EPB, GHL, JAKK and KMP missing in the evening. 21 companies did beat though adn IBM, SNDK and XLNX actually raised guidance but, of the 3, only SNDK actually had revenue growth – it's just that the expectations are so low for most companies – they are stepping right over the low bars.

Unfortunately, we had a few misses yesterday, with MAT, NTRS, NVS and PJC missing in the morning and ALB, CNS, CYS, EPB, GHL, JAKK and KMP missing in the evening. 21 companies did beat though adn IBM, SNDK and XLNX actually raised guidance but, of the 3, only SNDK actually had revenue growth – it's just that the expectations are so low for most companies – they are stepping right over the low bars.

This morning is still messy with misses from FCS, IIIN, ERIC, PM, POOL, DGX, SAP, SCHL and SHW so far and TSM gave negative guidance – also a big concern. Even the beats have problems with NOK, for example beating by earning ZERO (expectations for a 0.02 loss) but sales were off 24.5% from last year, where they lost 0.08 – they saved the money by laying off 12,200 people – Yay Capitalism!!!

Still, that's Finaland's problem, not ours. In the US, we only fired 334,000 people last week and that's 24,000 less people than lost their jobs last week but, as people who are paying attention well know – this is the result of many, many people switching from full-time to part-time jobs (still a job, just a crappy one) and, in fact, we added 91,000 people to continuing claims (long-term unemployed), way up from 24,000 last week.

PLEASE, do not confuse us with facts – the headline number says unemployment is down and that's all that fits in a tweet and you know we don't have time to click on the details…

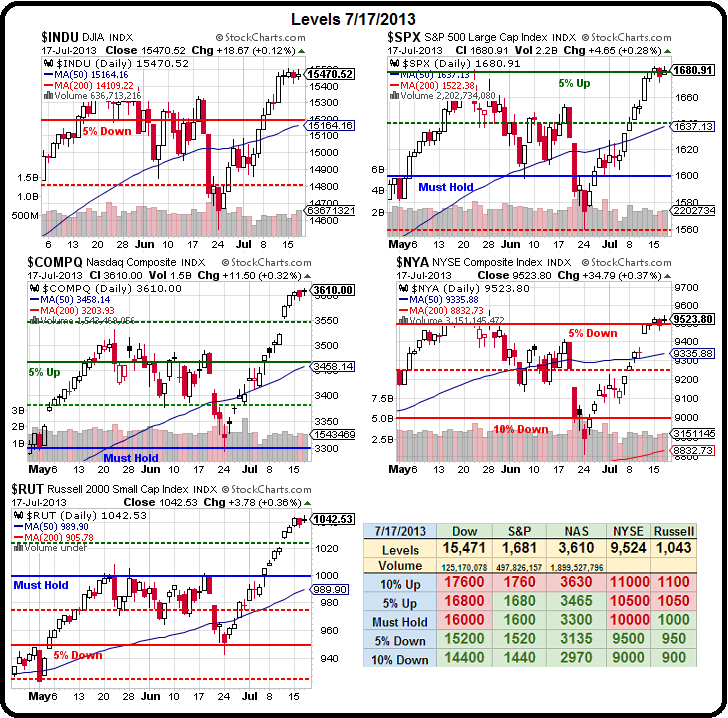

The fact is we are up 5% in 4 weeks and up 30% since November (7 months) so 5% per month is about our average gain in this non-inflationary environment – what can possibly go wrong? Well, several things spring to mind but we're already bearish over the weekend, no matter what nonsense options expirations day (tomorrow) brings and I'm trying to find ways to go with the flow if we have to flip bullish next week (see our 5 bull market plays from Monday morning's post as a good start).

The fact is we are up 5% in 4 weeks and up 30% since November (7 months) so 5% per month is about our average gain in this non-inflationary environment – what can possibly go wrong? Well, several things spring to mind but we're already bearish over the weekend, no matter what nonsense options expirations day (tomorrow) brings and I'm trying to find ways to go with the flow if we have to flip bullish next week (see our 5 bull market plays from Monday morning's post as a good start).

Like that great news on Monday that we were making progress with China on a Technology pact and the Nasdaq rallied 50 points! Unfortunately, those talks have now collapsed and negotiatations have been suspended as China made a list of outrageous demands that were simply deal-breakers:

“The United States is extremely disappointed that it became necessary to suspend negotiations,” U.S. Trade Representative Michael Froman said yesterday in a statement on the Information Technology Agreement. “A diverse group of members participating in the negotiations determined that China’s current position makes progress impossible at this stage.”

But hey, the Nasdaq still has those 50 points so, party on markets! IBM is up $4.50 (2.5%) pre-market and that will give the Dow a 35-point pump while INTC is down 3% but, since that's only a $24 stock and 3% is .75, it's only going to cost the Dow 6 points – as that index is ridiculously price-weighted.

But hey, the Nasdaq still has those 50 points so, party on markets! IBM is up $4.50 (2.5%) pre-market and that will give the Dow a 35-point pump while INTC is down 3% but, since that's only a $24 stock and 3% is .75, it's only going to cost the Dow 6 points – as that index is ridiculously price-weighted.

AAPL is being ramped up today (we're long, so fine with us) to offset incredibly disappointing guidance from Ebay (down 6% pre-market), who warned of "headwinds" in the second half of the year.

Chicgago's bonds are being cut to just over B (A3) as growing pension liabilities (boomers retiring) have offset all efforts to control costs. Detroit has already passed the point of no returns on pensions and is about to file the World's largest municipal bankruptcy as Detriot's plan, to pay 75% of the money back to secured bondholders while paying pension funds 10 cents on the Dollar and leaving a 20,000 citizens (3%) without retirement benefits is having trouble getting passed despite Republican Governor, Rick Snyder appointing emergency manager, Kevin Orr, to ram this deal through so his campaign contributers can get their money back.

$9Bn of the $11Bn of Detroit's unsecurted debt is in the form of health and other benefits for retirees and their pensions. People who are already reitred would get 10% of what they are currently getting but the bondholders are demanding that 10% as well, to make themselves whole.

$9Bn of the $11Bn of Detroit's unsecurted debt is in the form of health and other benefits for retirees and their pensions. People who are already reitred would get 10% of what they are currently getting but the bondholders are demanding that 10% as well, to make themselves whole.

People familiar with the matter say bondholders could tie the city up for months if not years in court with delay tactics in a bid to secure more favorable terms. And future borrowing at reasonable rates could be difficult for Detroit.

Detroit is one of many US cities teetering towards bankruptcy so forgive me if I'm going to stay bearish for a few more days…