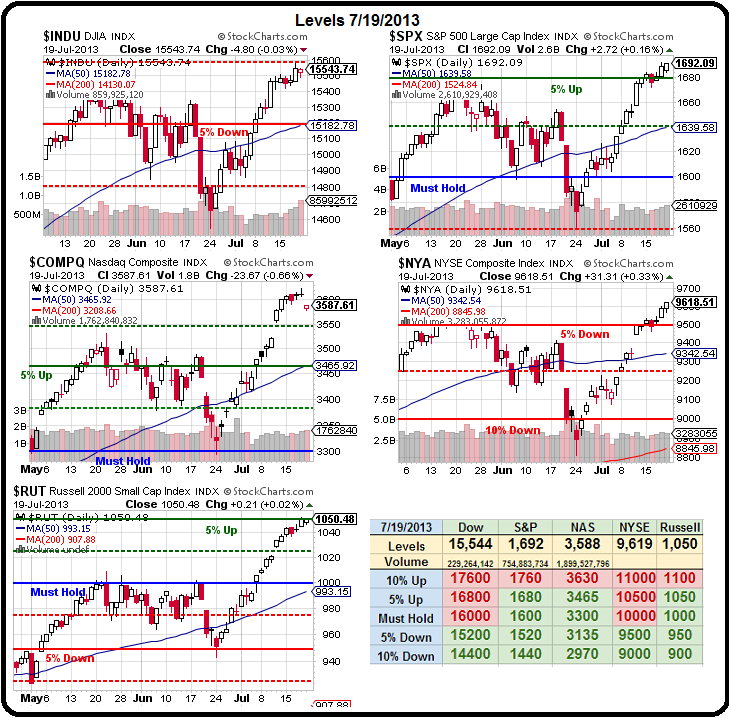

One of these things is not like the other:

One of these things is not like the other:

That's right, it's the Nasdaq, which fell hard and fast on Friday and, as I said to our Members over the weekend: "Will the Nasdaq correct or IS the Nasdaq correct?" Based on the possibility the rally would continue and the Nasdaq would right itself (nothing matters until AAPL earnings tomorrow, anyway), we picked up the weekly QQQ $74.50/75 spread for .30 on Friday afternoon – a spread that gains 66% in 7 days if the Qs hold $74.50 (any positive move for the week).

This is a very simple trade idea – if the Nasdaq goes up – we're good. If the other indexes go down – we stop out – not at all complicated.

Also not complicated is our short position on oil. If they (the crooks at the NYMEX) want to keep pretending they want to buy 1,000 barrels of oil for $108.50 each then we are very happy to promise to sell it to them for that price. This is a very easy promise to keep as we can roll our obligation (just like they do) and we can buy December barrels for just $102.68, an almost $6,000 per contract spread in our favor.

|

Click for

Chart |

Current Session | Prior Day | Opt's | ||||||||

| Open | High | Low | Last | Time | Set | Chg | Vol | Set | Op Int | ||

| Aug'13 | 108.34 | 108.67 | 108.14 | 108.44 |

05:18 Jul 22 |

– |

0.39 | 959 | 108.05 | 28536 | Call Put |

| Sep'13 | 108.07 | 108.46 | 107.88 | 108.22 |

05:18 Jul 22 |

– |

0.35 | 12034 | 107.87 | 387732 | Call Put |

| Oct'13 | 106.15 | 106.67 | 106.11 | 106.45 |

05:18 Jul 22 |

– |

0.33 | 2172 | 106.12 | 131990 | Call Put |

| Nov'13 | 104.61 | 104.92 | 104.41 | 104.74 |

05:18 Jul 22 |

– |

0.39 | 1114 | 104.35 | 83002 | Call Put |

| Dec'13 | 103.03 | 103.26 | 102.80 | 103.10 |

05:18 Jul 22 |

– |

0.42 | 2002 | 102.68 | 204514 | Call Put |

Back on July 4th, I pointed out that prices were being driven up over $100 a barrel by NYMEX Economic Terrorists faking the orders for over 250,000,000 barrels (250K contracts) for August delivery. As you can see from the above chart, they have already cancelled all but 28,536 contracts (90%) and will cancel most of those today, the last day of trading, in order to create an artificial shortage of US oil next month by simply cancelling all the contracts that were ready for delivery.

According to the EIA, imports of crude oil to the United States are down 1.2M barrels PER DAY – which means the criminal cartel of traders that control the NYMEX are choking off the US supply of imported oil by 36M barrels per month or 432M barrels a year – an amount equal to over 1/2 of our Strategic Petroleum Reserves. They do this in a criminal conspiratcy to create an artificial shortage that drives up the prices we pay for heating oil, gasoline, diesel fuel, jet fuel, oil used to make products like plastic and, of course, to grow the crops we need to live.

According to the EIA, imports of crude oil to the United States are down 1.2M barrels PER DAY – which means the criminal cartel of traders that control the NYMEX are choking off the US supply of imported oil by 36M barrels per month or 432M barrels a year – an amount equal to over 1/2 of our Strategic Petroleum Reserves. They do this in a criminal conspiratcy to create an artificial shortage that drives up the prices we pay for heating oil, gasoline, diesel fuel, jet fuel, oil used to make products like plastic and, of course, to grow the crops we need to live.

WAKE UP PEOPLE!!! If you don't get angry about being robbed like this and WRITE TO YOUR CONGRESSMEN, these oil bastards will just rape you, and rape you and rape you again! They are stealing your disposable income, they are stealing the disposable income of your customers, they are the primary cause of inflation and they are sending a large portion of that money overseas, where it often funds terrorists who kill Americans.

Now these criminals are faking demand for 387,732,000 barrels of oil in September. Those contracts are rock-solid, the people who sold the contracts are absolutely obligated to deliver the oil to Cushing, OK the following month. Oddly enough – THERE ARE ONLY 367,000,000 COMMERCIAL BARRELS OF OIL IN THE ENTIRE UNITED STATES – delivering that many barrels of oil in a month would double our supply and send prices rapidly falling. So, do you know what these criminals are going to do? They are going to cancel 95% of them all over again to maintain the appearence of a shortage and gouge you at the pump.

Does your Congressman care? Write to them and find out. Our Members have already written to a few Congresspeople and gotten a few good responses but it's VERY, VERY, IMPORTANT that you do it this TODAY, as a Senat Subcommittee covenes TOMORROW to explore whether financial firms such as Goldman Sachs Group Inc. and Morgan Stanley (MS)should continue to be allowed to store metal, operate mines and ship oil. At a time when JPMorgan faces a potential fine for alleged manipulation of U.S. energy prices, the panel will discuss possible conflicts of interest in the business model, said its chairman, U.S. Senator Sherrod Brown, an Ohio Democrat.

5 years ago, the previous administration sold you down the river and gave control of commodity pricing to the people who stand to profit from its increase. Now the Senate prepares to declide whether they will allow them to do it for another 5 years. Are you just going to sit back and let this happen?

5 years ago, the previous administration sold you down the river and gave control of commodity pricing to the people who stand to profit from its increase. Now the Senate prepares to declide whether they will allow them to do it for another 5 years. Are you just going to sit back and let this happen?

“When Wall Street banks control the supply of both commodities and financial products, there’s a potential for anti-competitive behavior and manipulation,” Brown said in an e-mailed statement. Goldman Sachs, Morgan Stanley and JPMorgan are the biggest Wall Street players in physical commodities.

The 10 largest banks generated about $6 billion in revenue from commodities, including dealings in physical materials as well as related financial products, according to a Feb. 15 report from analytics company Coalition. Goldman Sachs ranked No. 1, followed by JPMorgan. That's probably the saddest part about this – in order to skim $6Bn in profits from commodity trading – they manipulate the price of oil and petroleum products 20% higher, costing US consumers $125Bn a year – just so these bastards can make 5% of it!

The 10 largest banks generated about $6 billion in revenue from commodities, including dealings in physical materials as well as related financial products, according to a Feb. 15 report from analytics company Coalition. Goldman Sachs ranked No. 1, followed by JPMorgan. That's probably the saddest part about this – in order to skim $6Bn in profits from commodity trading – they manipulate the price of oil and petroleum products 20% higher, costing US consumers $125Bn a year – just so these bastards can make 5% of it!

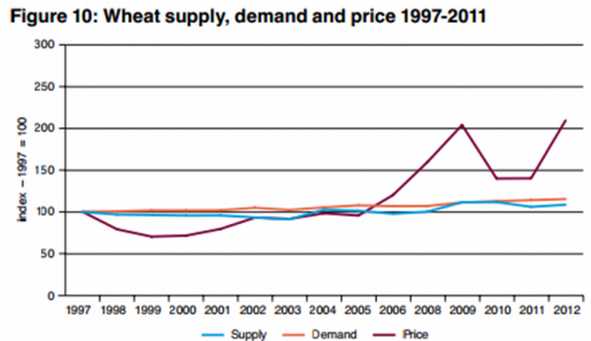

It's not just oil, of course:

“While nearly a billion people go hungry, Goldman Sachs bankers are feeding their own bonuses by betting on the price of food. Financial speculation is fuelling food price spikes and Goldman Sachs is the No 1 culprit.”

~Christine Haigh, World Development Movement

As with oil, gold, silver, agriculture… Price has become disconnected from supply and demand and is now merely a means of enriching the Banks and their Traders and has nothing at all to do with setting free-market prices. Quite the opposite, in fact – they now control the markets with an iron fist and create artificial shortages to justify price hikes and I AM NOT MAKING THIS UP – JP Morgan is being fined $500M right now to settle a case in which they are accused of manipulating the energy markets in California and Michigan alone.

Do you think they JUST manipulated it in those states? Do you think it was JUST JPM? On Tuesday, the Federal Energy Regulatory Commission ordered Barclays to pay a $470 million penalty for suspected manipulation of energy markets in California and other Western states by some of its traders. The bank is fighting the charges.

Do you think they JUST manipulated it in those states? Do you think it was JUST JPM? On Tuesday, the Federal Energy Regulatory Commission ordered Barclays to pay a $470 million penalty for suspected manipulation of energy markets in California and other Western states by some of its traders. The bank is fighting the charges.

For God's sake, PLEASE take 5 minutes and write you Congressman, especially Senators, and let them know you want this stopped. In the very least, send them a copy or a link to this article and say "What are you doing about this?" We got some interesting responses so far – especially from Rand Paul, who is going to repeal Obamacare to help us!

If you keep electing people, who let their campaign contributors rob you at the gas station, on the plane, at the grocery store, at the restaurant – every day and make it the focus of their political life to make sure the United States of America continues to have the worst, most expensive (by a mile) health care system in the entire free World, which also robs you and your customers of their disposable incomes and funnels all of our country's economic growth into the hands of the privileged few – then you are getting EXACTLY the sort of Government you deserve!

We are those privileged few, of course. While I was writing this, oil fell from $108.50 to $107.75 for a $750 PER CONTRACT contract gain betting against the NYMEX crooks. We'll play this debacle all day long and enjoy the ride but what about the rest of our countrymen? Senators care when they get letter from OUR zip codes – let's put our positions to good use for a change.

Thanks,

– Phil