36 companies missed yesterday.

36 companies missed yesterday.

Granted there were about 120 companies reporting but 36 MISSED (30%) – that's NOT GOOD! What it's certainly not is what you expect to be seeing when the stock market is at an all-time high. Misses mean expectations were too high and companies (part of the indexes) are not doing as well as you thought and, therefore (and this is the logic people seem to have trouble with) the market is OVER-PRICED!

I know, it's a real logical stretch to connect those dots isn't it? It sure seems to be for our mainstream media (see yesterday's post), who remain in cheerleader mode. Another telling indicator is on the right of that earnings chart (link above) where you can see guidance and there we have 9 companies offering positive guidance and 13 lowering their guidance – 9 of the companies lowering guidance were ones that had earnings beats (CAJ, DHX, MSI, TUP, WLP, MLNX, MKSI, TER and VAR).

SQNM, who make diagnostic equipment, had 8 buys on them with 5 of them strong buys and the stock is down 33% on an earnings miss. CROX had 3 strong buys, 4 buys and a hold after running up from $12 in November to $17.50 (45%) and they missed by 23%, which is how much their stock dropped overnight ($13). It's not the company's fault that expectations were way too high and, in fact, they are now on our buy list if they drop any further (see early morning Member Chat).

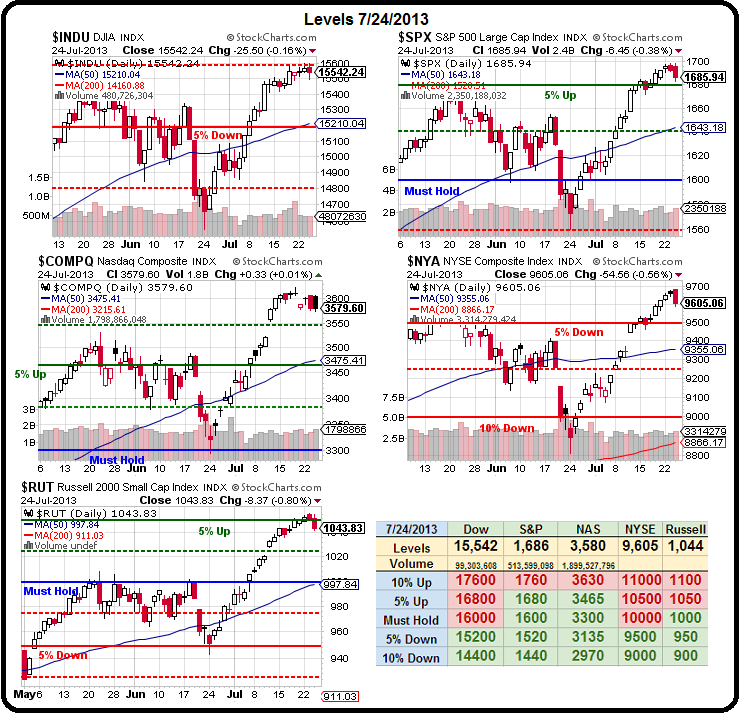

As you can see from our Big Chart and Dave Fry's S&P charts, we haven't done too much technical damage so far but we have broken the parabola I warned you about and, if we make a candle today that is below the body of yesterday's candle – things can turn technically ugly very fast!

As you can see from our Big Chart and Dave Fry's S&P charts, we haven't done too much technical damage so far but we have broken the parabola I warned you about and, if we make a candle today that is below the body of yesterday's candle – things can turn technically ugly very fast!

Ideally, we pull back no lower than 1,600 and prove that out as support and then we can consolidate for a proper break-out to 1,700 and above but, as I said last week – it's generally safer to bet your index WON'T break out of a range the first one or two times they try.

We still can't get no satisfaction on our Big Chart at our "Must Hold" levels of Dow 16,000 and NYSE 10,000. Those are the levels we need in order to allow the other indexes to make a run at their own 10% lines.

We still can't get no satisfaction on our Big Chart at our "Must Hold" levels of Dow 16,000 and NYSE 10,000. Those are the levels we need in order to allow the other indexes to make a run at their own 10% lines.

I often tell our Members to imagine that the indexes are like a bunch of tug boats pulling a barge – they can go off in different directions but only so far before the rope pulls them back and, unless they all pull together in the same direction – the barge isn't going anywhere.

The same analogy holds true for sectors within the indexes and stocks within the sectors – you need a near-perfect alignment to get over these key resistance levels and, when 30% of your stocks are going in the wrong direction – it's simply not good enough to make new all-time highs and hold them. As I warned in Monday's post, seeing even ONE index showing weakness at these levels can often be an indicator of a broader problem as I asked about the Nasdaq sell-off on Friday: "Will the Nasdaq correct or IS the Nasdaq correct?" Since then, AAPL has held up the Nasdaq while the other indexes have had a bit of a correction – we still don't know which way this will play out, but we took some quick profits on our short-term short index plays into yesterday's drop.

Also, as I often complain, it's a completely false prosperity for the top 10% of this country as the Fed hands out free money to the top 1% and some of it trickles down to their toadies.

Also, as I often complain, it's a completely false prosperity for the top 10% of this country as the Fed hands out free money to the top 1% and some of it trickles down to their toadies.

This can be great for stocks the way a shot of adreneline can make a coma patient jump up in the bed – it doesn't cure the coma, but it makes you THINK they're getting better. While it's a good show – repeat it too many times and you kill the patient.

These constant injections of free money from the Fed, aside from ultimately leading to inflation, tend to cause what Hayek calls "malinvestment", referring to investments of firms being badly allocated due to an artificially low cost of credit and an unsustainable increase in money supply. It's growth, but it's not helpful growth.

This problem has not escaped the Fed, who are making more noises about removing the stimulus before the economy explodes (in a bad way), nor has it escaped the notice of our President, who made a great speach on behalf of the bottom 90% yesterday that can be summarized simply as: "1, 2, 3, 4 – I declare a CLASS WAR!"

This problem has not escaped the Fed, who are making more noises about removing the stimulus before the economy explodes (in a bad way), nor has it escaped the notice of our President, who made a great speach on behalf of the bottom 90% yesterday that can be summarized simply as: "1, 2, 3, 4 – I declare a CLASS WAR!"

While declaring that the economy stood in a better place now than when he took office, Obama also conceded that the status quo was not good enough. The current state of income inequality, he stressed, "isn’t just morally wrong; it’s bad economics," which has always been the point I try to get across to our readers. America, he added, had to make new investments such as "rebuilding our manufacturing base, educating our workforce, [and] upgrading our transportation and information networks."

The fundamentally American idea that hard work leads to success, he said, has been undermined by an inattention to education and decades of government policies that favored only the rich. While income of the top 1 percent nearly quadrupled from 1979 to 2007, there has been almost no change in the typical family’s income.

Obama did not deliver a laundry list of new proposals. Most of what he advocated has been on his list for years: a major investment in rebuilding roads and power grids and school buildings; high-quality preschool for every 4-year-old; a reduction in college costs (which is a huge barrier between lower-income students and professional success) and better incentives for retirement savings.

These ideas were good when he first proposed them as part of the American Jobs Act, and they remain essential ingredients of long-term economic growth. They are not “stale” and “tired,” as Republicans charged; they are familiar only because they remain unfulfilled. The hard-right that controls the Republican Party never really cared about the content of his proposals, anyway. It reflexively opposes whatever he supports.

These ideas were good when he first proposed them as part of the American Jobs Act, and they remain essential ingredients of long-term economic growth. They are not “stale” and “tired,” as Republicans charged; they are familiar only because they remain unfulfilled. The hard-right that controls the Republican Party never really cared about the content of his proposals, anyway. It reflexively opposes whatever he supports.

The government must pass a budget by the end of September. Lawmakers must also figure out what to do with the spending cuts caused by sequestration or risk having them become even larger in the next fiscal year. Negotiations on the latter are virtually non-existent, while both sides remain far apart on the former. As The NY Times reported on Wednesday, congressional Republicans are crafting spending bills that would gut the president's top priorities.

There's a battle brewing for the soul of our country and the kids (stocks) don't like it when the parents (President and Congress) are fighting – another reason to be cautious in the months ahead.