I love good bounce, don't you?

I love good bounce, don't you?

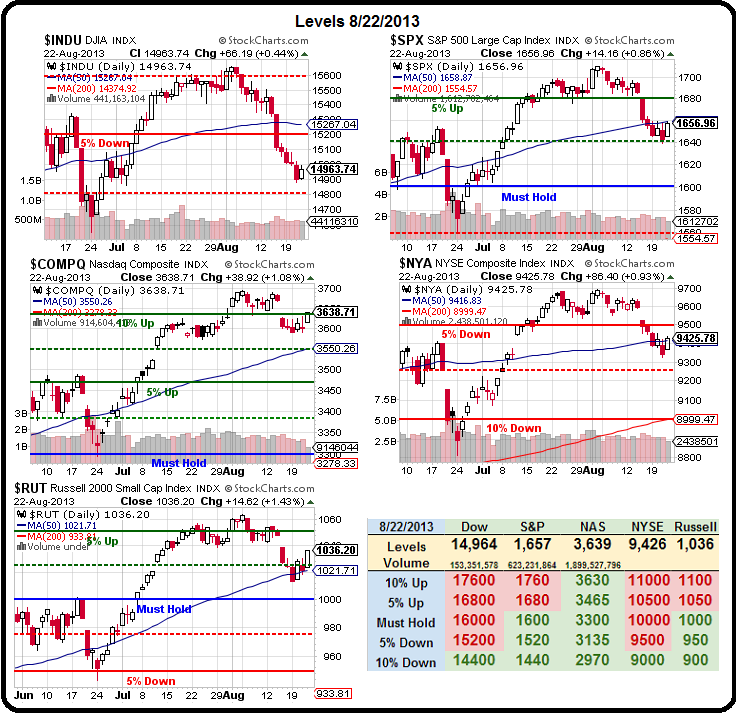

But just how good have our index bounces really been so far. While we had a pretty exciting session on Friday the voulum on a 0.34% up day on the SPY (see Dave Fry's chart) was only 1/2 what it was on the 0.64% drop on Wednesday. As Dave notes: "They don't put volume on your brokerage statement, but…." As to our bounce lines – not too impressive:

- Dow 14,960 (weak) and 15,120 (strong)

- S&P 1,658 and 1,671

- Nas 3,620 and 3,640

- NYSE 9,420 and 9,500

- Rut 1,020 and 1,030

The NYSE is barely over the line so we keep that black until it proves it and, so far, we only have weak bounces taken from the Nas (right on the strong bounce line) and the always-leading Russell, which makes a fantastic short in the Futures (/TF) below the 1,040 line (with very tight stops above). We were looking to at least make our strong bounce lines by Friday

The NYSE is barely over the line so we keep that black until it proves it and, so far, we only have weak bounces taken from the Nas (right on the strong bounce line) and the always-leading Russell, which makes a fantastic short in the Futures (/TF) below the 1,040 line (with very tight stops above). We were looking to at least make our strong bounce lines by Friday

The Dow couldn't even put a good day together on Friday and finished off it's third down week in a row failing to take back the 200 dma at 15,100 while the S&P tested theirs at 1,635 with AAPL and MSFT giving the S&P and Nasdaq most of their lift as well as TLSA, which flew up to the $160 level, putting the short-sellers into a bunker mentality.

Durable Goods this morning is likely to put the longs into a bunker as they should be trending much lower – based on the indications we've gotten from earnings reports this quarter. It's just part of some very negative news-flow I've been warning you about and our weekend reading did not do anything to make us more bullish, unfortunately.

8:30 Update: Durable Goods were TERRIBLE at -7.3% for July. Even worse, they are down 6.7% ex-defense, so it's a "real" number with Transportation falling 19.4% within the index, so down 0.6% taking out that other volatile number. Computers and Electronic Devices fell 3.2%.

8:30 Update: Durable Goods were TERRIBLE at -7.3% for July. Even worse, they are down 6.7% ex-defense, so it's a "real" number with Transportation falling 19.4% within the index, so down 0.6% taking out that other volatile number. Computers and Electronic Devices fell 3.2%.

It's easy to over-analyze a report like this – the bottom line is that it's much weaker (100%) than leading Economorons predicted and it's not updated on the chart yet but imagine that line at the end now turning down to the -7.3% line, back to the lowof the past 3 years and making for a VERY CLEAR DOWNTREND since June 2010 – DESPITE ALL THE STIMULUS!!!

Of course the markets see this as bullish because they'll get MORE FREE MONEY but, as I asked last week – how many times will you buy based on the same premise. Look at this chart – IT'S NOT WORKING!!!

Of course the markets see this as bullish because they'll get MORE FREE MONEY but, as I asked last week – how many times will you buy based on the same premise. Look at this chart – IT'S NOT WORKING!!!

Sure stimulus works, the same way a big shot of adreneline can make a coma patient spike up for a minute or two but, once that wears out – back to flatline. The real economy isn't going anywhere until wages go up – and we're not there yet.

Even the WSJ is starting to realize "Stagnant Wages are Crimping Economic Growth" saying:

Four years into the economic recovery, U.S. workers' pay still isn't even keeping up with inflation. The average hourly pay for a nongovernment, non-supervisory worker, adjusted for price increases, declined to $8.77 last month from $8.85 at the end of the recession in June 2009, Labor Department data show.

Stagnant wages erode the spending power of consumers. That means it is harder for them to make purchases ranging from refrigerators to restaurant meals that account for most of the nation's economic growth.

Well, DUH! But it's a revelation to the Conservative Capitalists that read the WSJ and are under the impression that wages are the way poor people try to rob them of their profits.

Even though rising home prices and stock values are making some people optimistic, many workers can't push for higher pay—crimping their spending and potentially the recovery. "Workers feel like they have absolutely no bargaining power," said Robert Mellman, an economist at JPM. Besides not feeling confident enough to demand higher wages, employees also are wary of going out and looking for better jobs. Only 1.6% of employed Americans quit their jobs in June, below the roughly 2%-2.2% prerecession level. People tend to quit jobs more readily when they are confident they will find a new one that's equal or better.

Falling incomes are colliding with rising housing rents as speculators (more Capitalists!) have run into the housing market, taking advantage of near-zero rate finanicing to snap up the available housing inventory causing places like Minnesota, where they did a study, to notice "since 2000, rents have risen about 6% state-wide but renter incomes have dropped about 17%."

Falling incomes are colliding with rising housing rents as speculators (more Capitalists!) have run into the housing market, taking advantage of near-zero rate finanicing to snap up the available housing inventory causing places like Minnesota, where they did a study, to notice "since 2000, rents have risen about 6% state-wide but renter incomes have dropped about 17%."

This is sick stuff people! We're forcing the bottom 80% of this country into an Economic Torture Chamber and the top 1% just keeps tightening the screws to make sure that THEY can show that Q/Q growth that allows them to remain in the top 1%.

God knows it's terrifying to lose that position and be forced to join the ranks of the riff-raff!

For any tribe or pack of animals to survive, the leaders make due with less in times of hardship. That's not what's happening here. Corporate Profits are at record highs while wages are at record lows – this will not end well. Mark my words...