Jobs or no jobs?

Jobs or no jobs?

That is the question that will be answered at 8:30 this morning. But whether 'tis nobler in the market to suffer the poverty and indignation of the low-paying jobs the economy has been throwing off this year or to take more alms from the DOE – that is indeed the question…

As I noted in our Member Chat this morning, the quality of jobs we've created has sucked and that is what spooked the market to a 5% drop on last month's report, which only showed 162,000 jobs created and hourly wages were dropping and hours worked were dropping – there's nothing to celebtrate there – even if you do think it means the Fed will keep handing out Free Money for another quarter.

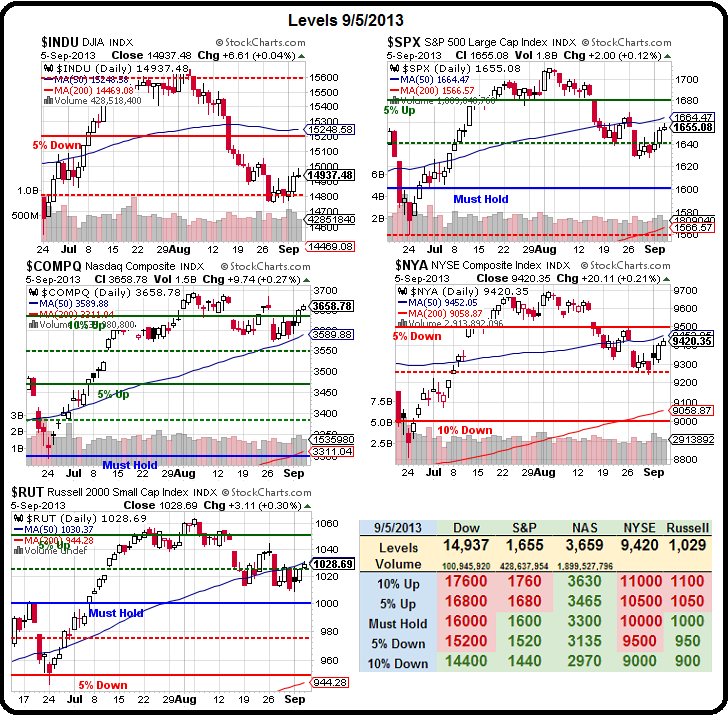

Our Futures are bouncing around ahead of the data but more or less flat and we're still waiting to see those strong bounces before we even consider picking up bullish plays at these nose-bleed levels:

Our Futures are bouncing around ahead of the data but more or less flat and we're still waiting to see those strong bounces before we even consider picking up bullish plays at these nose-bleed levels:

- Dow 15,600 (ignore spike) to 14,800 is 800 points so 160 bounce (20%) is 14,960 weak and 15,140 strong.

- S&P 1,710 (where it was rejected) to 1,630 (ignoring spike) is 80 points so 16 bounces to 1,646 weak and 1,662 strong

- Nasda 3,700 (where it was rejected) to 3,600 (non-spike low) is 100 points so 20 bounces to 3,620 weak and 3,640 strong

- NYSE 9,700 (where it was rejected) to 9,300 (non-spike low) is 400 points so 80 bounces to 9,380 weak and 9,460 strong

- Russell 1,060 (non-spike top) to 1,010 is 50 points so 10 bounces to 1,020 weak and 1,030 strong

As you can see from Dave Fry's TLT chart, we just failed that critical 103 level, which corresponds with 3% rates on the 10-year and look at that gap to fill down to 92 – 10%! Syrai and the G20 and Jobs have distracted us this week but next week – all eyes will be on rates because another 10% move like we had last quarter will be the nail in the coffin of the housing recovery and will put a lot of additional pressure on consumers.

As you can see from Dave Fry's TLT chart, we just failed that critical 103 level, which corresponds with 3% rates on the 10-year and look at that gap to fill down to 92 – 10%! Syrai and the G20 and Jobs have distracted us this week but next week – all eyes will be on rates because another 10% move like we had last quarter will be the nail in the coffin of the housing recovery and will put a lot of additional pressure on consumers.

8:30 Update: 169,000 jobs were added and that's in-line but July was revised DOWN by a whopping 58,000 jobs to just 104,000. Amazingly, the market is interpreting this as a positive (as it keeps the Fed on the table) and we're up about half a point now but this is nothing to get excioted about and I'm going to like shorting the Dow Futures at the 15,000 line (/YM) with tight stops as this is just silly.

We also had a pop on Aug 4th (last NFP day), from 15,550 to 15,650 so let's not get too excited about a futures pop to 15,000 on essentially the same number (July was reported at 162,000 at the time) – especially when it could be off by 30%!

We also had a pop on Aug 4th (last NFP day), from 15,550 to 15,650 so let's not get too excited about a futures pop to 15,000 on essentially the same number (July was reported at 162,000 at the time) – especially when it could be off by 30%!

Also, unemployment is down to 7.3%, which is what the Fed looks at, not the number of jobs created and what the Fed doesn't look at is the Labor Force Participation Rate, which is down to 63.2%, the lowest level since 1978, at the tail of another recession.

The average workweek for all employees on private nonfarm payrolls increased by 0.1 hour in August to 34.5 hours. Average hourly earnings for all employees on private nonfarm payrolls rose by 5 cents to $24.05. These are not very exciting gains and, like yesterday's productivity numbers, don't indicate any particular hiring pressure.

The average workweek for all employees on private nonfarm payrolls increased by 0.1 hour in August to 34.5 hours. Average hourly earnings for all employees on private nonfarm payrolls rose by 5 cents to $24.05. These are not very exciting gains and, like yesterday's productivity numbers, don't indicate any particular hiring pressure.

Lack of jobs and low pay for jobs means lack of demand for Dollars and that's spiked both gold and oil up about 1% this morning while sending the Dollar as low at 81.93 on the report but now it's stabilizing back at 82.35, still 0.4% lower than yesterday and accounting for almost 100% of the index gains in the futures. This is certainly not a rally we should be buying into.

Speaking of things people shouldn't be buying into – TSLA is testing $170 and that's now $103 higher than Aswath Damodaran, who famously nailed the drop in AAPL last year. He's a finance professor at the Stern School of Business at NYU who teaches a course on stock valuations. His findings, even using the most untraditional metrics, suggest the stock’s fair value is $67.12, or about 60% below Wednesday’s close.

Speaking of things people shouldn't be buying into – TSLA is testing $170 and that's now $103 higher than Aswath Damodaran, who famously nailed the drop in AAPL last year. He's a finance professor at the Stern School of Business at NYU who teaches a course on stock valuations. His findings, even using the most untraditional metrics, suggest the stock’s fair value is $67.12, or about 60% below Wednesday’s close.

“You can accuse me of being too pessimistic in my assumptions, but the narrative that underlies my valuation is an optimistic one,” Mr. Damodaran said in a blog post summarizing his findings. “I am assuming that Tesla will grow to be as large as AudiNSU.XE +1.42%, while delivering operating margins closer to Porsche’s. Even with these assumptions, I cannot see a rationale for buying the company at today’s market price, but that is just my personal judgment.”

When it comes to Tesla, Mr. Damodaran said “it seems absurd” to slap a $20 billion market value on a company with revenues of $1.33 billion and an operating loss of about $217 million over the past 12 months. “At close to 15.4 times revenues, Tesla is being valued more like a young technology company than an automobile company,” he says. “However, these standard metrics are also often misleading with young companies, since value should be driven not by revenues and earnings today, but by expectations for these values in the future.”

Nothing we haven't been saying since they topped $85 but here we are at $170 – 100% over our original target from back in January, when we were long on them at $35!

Have a great weekend.,

– Phil