Are we overbought yet?

Are we overbought yet?

Not so much according to Dave Fry's NYMO chart, where it looks like we can get away with another few days before gravity takes its toll on our indexes and that will take us right into next week's Fed meeting and… uh oh…

Darn, we were so worried about International terror with Syria and China that we forgot about the Domestic Bankster Terrorists, who are celebrating 40 years of destroying the working class (since Nixon took us off the gold standard and allowed workers to be paid in scrip).

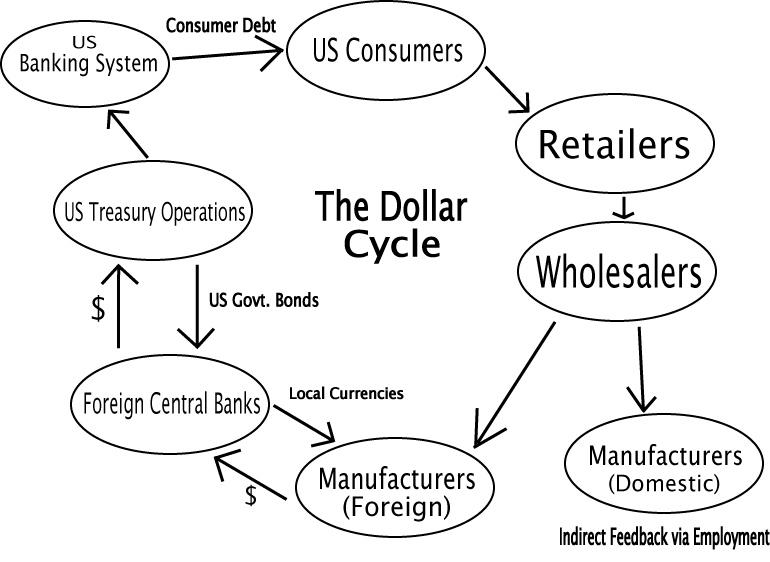

Since that time, the scam has been refined and now, as you can tell from this chart, we have lost the majority of the "feedback" we used to get from Domestic Manufacturing jobs and have, instead, substituted the supply of fresh money by having the Fed simply print it, hand it to the banks, who drive the consumers into debt to keep things going for another cycle.

But the banks aren't even lending to bottom 90% consumers anymore, they are lending to the manufacturers and retailers who are busy buying each other with all the free money (artificially inflating their stock prices) or buying back their own stock (artificially inflating their stock prices) or investing in automation that enables them to lay even more people off (naturally inflating their stock prices).

The question is, are ther manufacturers laying off workers fast enough and saving enough money to justify the artificially inflated prices (from M&A) that were based on their POTENTIAL to do the same. You may have noticed that I didn't mention expanding sales. That's because our global GDP is up 2% and our stock market is up 20% so this is not real expansion of commerce, sales gained by one seller are lost by another for the most part.

There's nothing wrong with this plan, from the view of the top 1%. We can, in theory, keep expanding our profits for quite a long time as Corporate Profits (the ones we report, wink wink) are only 10.3% of the GDP after taxes but wages are still, despite our best efforts, still 43.7% of the GDP.

That means, if we can just drive wages down another 10%, that 4.37% would boost our profits by 42%! This is a great plan – I love this plan – I'm glad to be a part of it (beats the hell out of being on the other side)!

That means, if we can just drive wages down another 10%, that 4.37% would boost our profits by 42%! This is a great plan – I love this plan – I'm glad to be a part of it (beats the hell out of being on the other side)!

Historically, after-tax Corporate Profits were around 5% of the GDP and that seemed fair as the top 1% made 5% of the money (more actualy as they also made a disproportionate share of the income) and the bottom 99% made 95%(ish). All we had to do was detach the vaule of money from reality and keep paying our workers with money (while we bought hard assets and they bought consumables that we sold them) and time did the rest for us.

Workers wages as a percent of the GDP are down 19% since 1970 and our Corporate Masters are up over 100% – ain't that America? The buying power of real wages is collapsing in the US but it's OK because we now have a global economy and we don't have to rely on those people anymore. We are NOT all in this together – there are only so many life-boats and they are up on the first class deck.

Speaking of lifeboats – here's a cool whiteboard promoting physical gold that makes some very good economic points:

That's what the Fed is doing – they are promising (by creating money that has no physical backing) a lot more lifeboats (goods and services that you would ultimately want to exchange your Dollars for) than they can ever deliver. While everyone is sitting on their fake money, unwilling to spend it, no one realizes it's fake (and Corporations even have record piles of cash now). When a lot of people begin to take their fake money to the store to buy things – there won't be enough things and the prices will rapidly increase due to demand (ie. rapid inflation).

Our entire Global economy is built on tens of Trillions of Dollars in debt that can never logically be repaid – yet that debt is the basis of "healthy" balance sheets around the World. In 2008, people began to question those balance sheets and the whole system began to unravel but since has been bandaged up and all is well – until we hit the next iceberg.