Strap yourselves in folks, it's going to be a wild one!

Strap yourselves in folks, it's going to be a wild one!

As I told you on Wednedsday morning, we were getting way too overbought to keep going much higher. This stuff isn't complicated folks, it's just physics. When the Market did pop after the Fed at 2:30 on Wednesday, I said to our Members in Chat:

Gotta love IWM at $107 (RUT 1,070) for a short. Actually, TZA is more fun with the Oct $22/25 bull call spread at 0.96 so 20 of them in the STP to start and happy to DD if they get cheaper.

That was, so far, the bottom of TZA and that thing is going to fly if the Russell falls back below 1,070, so it's a fantastic hedge that pays $6,000 back on $1,920 if TZA gets back to that $25 line into October expirations. We also took the opportunity (4 minutes later) to sell FAS calls into the spike in XLF, with me saying to our Members:

FAS/STP – Let's sell 5 Oct $80 calls for $1.55 ($775) and we'll buy more longs if they hold $75 into Friday (also riding out the short $70 call, now $7).

Already yesterday, those FAS short calls closed at $1.30, which is up a quick $75 (10%) in just one day. These are action/reaction plays and we had a discussion in Chat, in fact, about how understanding implied volatility and the way it changes and affects option pricing helps you gain the confidence to make these day trades. Also, by the way, I'm not really an "I told you so" kind of guy but, if I don't point out that I told you so – then how will you know the next time we see a similar thing that maybe I know what I'm talking about?

Oh boy did I tell you so – over and over again – on oil. Again, this is physics to us, not guessing. There were far too many contracts and they are fake, Fake, FAKE and, one day, hopefully we can just make a book collecting all my various proofs that NYMEX trading is nothing more than a massive scam perpetrated on the American people in order to massively overcharge them for the 2nd most abundant liquid on the planet.

It's OK though, as long as you people can't be bothered to write to your Congresspeople and DEMAND ACTION, we can keep using this scam to our own advantage and short their fake rallies, like the one pictured here – which banged right into our $108.50 target (a bit over) and then plunged all the way to $106 for a $2,500 PER CONTRACT gain.

Just go back and read my last month's worth of posts and see how many times this worked – I definitely told you so on that one. Am I that good? No – IT'S A SCAM!!! It should be illegal, but no one stops it so we may as well trade it, right? At least over in Europe they are trying to reign in the madness but, despite some of our Members sending articles like this one to their Congresspeople – we are unable to get traction against this nonsense in the US..

In more manipulative nonsense news: We have 4, count them: 4 Fed speeches this afternoon and we had a detailed discussion about this in Monday's post so we'll just summarize the schedule here:

3 Hawks and one Dove in the sandwich means we can be pretty sure that 80.50 will hold on the Dollar and that will put pressure on stocks and commodities while also pressing mortgage rates lower into the weekend – which is something we really need to do before housing falls off a cliff. Carl Icahn had this to say about housing (and other things) on CNBC yesterday:

3 Hawks and one Dove in the sandwich means we can be pretty sure that 80.50 will hold on the Dollar and that will put pressure on stocks and commodities while also pressing mortgage rates lower into the weekend – which is something we really need to do before housing falls off a cliff. Carl Icahn had this to say about housing (and other things) on CNBC yesterday:

- Icahn: Market is fully valued, but Apple is a buy. (video) Billionaire investor Carl Icahn said Thursday he thinks the stock market is fully valued but still sees Apple as a buying opportunity. "I think that right now, the market is giving you a false picture. The market tells you you're doing well, but I don't think a lot of companies are doing that well," Icahn told "Closing Bell," adding that while his firm is up 30 percent year to date, it still has a "huge hedge" on. Still, Icahn continues to view Apple as "very undervalued" because it has a low multiple and the underlying company has a tremendous amount of cash on hand and remains profitable. Icahn said he continues to buy shares of the tech company. Elsewhere in the market, Icahn said real estate is "ridiculously overvalued," especially in urban centers. "It's just absurdity, and I really can't understand it," Icahn said. "I think real estate again is coming to the top of a bubble."

That TZA hedge hasn't gotten too expensive yet and it's something worth considering, along with Dave Fry's list of things we should probably still be concerned about:

That TZA hedge hasn't gotten too expensive yet and it's something worth considering, along with Dave Fry's list of things we should probably still be concerned about:

- The economy is slowing down and not rising fast enough given recent data.

- Bernanke-led Fed is not willing to abandon its policies too soon, at least from their view.

- This is probably Bernanke’s last rodeo (unless he’s drafted to stay) and he stubbornly wants to maintain policies he's created.

- With no taper and 3 episodes of QE, the economy hasn’t gained much ground: unemployment is still too high, wages and incomes are still in decline, and housing is only better as beaten down regions have improved or housing in money center urban areas have benefited by stock markets.

- A large stock market rally and a reversal in commodity and bond market mean the liquidity bubble will remain.

- A tale of two realities–a stock market liquidity bubble vs. weak GDP growth.

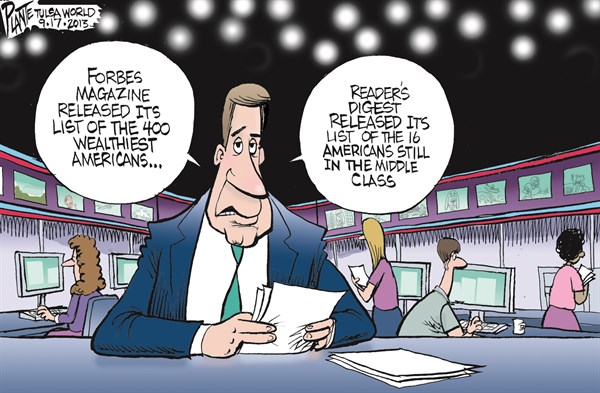

- An increasing divide between rich and poor due to Wall Street and those involved in financial services benefiting while Main Street sees cutbacks.

- Investors now have the December Fed Meeting to worry about since a taper then would be a lump of coal for investors.

- Equity markets are at critical resistance levels and much overbought

- The entire rally is built on foam from money printing.

Have a great weekend,

– Phil