What a crazy weekend!

What a crazy weekend!

As expected, Angela Merkel was re-elected with a resounding (for Germany) 41% of the vote – allowing her the choice of any party she wishes to work with (as long as they have 9% or more) to form the new coalition Government.

It's Angie's way or the highway in Germany as the 59 year-old former East German Physicist led her CDU Party to a 311-seat victory in Parliament, just 5 seats short of a manority there and miles ahead of the second-place SDP, with 192 seats.

The CDU's strong support also was an endorsement of Ms. Merkel's handling of the euro zone's debt crisis since 2009. Although her emphasis on fiscal discipline and market-friendly overhauls has divided Europeans, it has won widespread backing from Germans across the political spectrum. Hopes around Europe that Berlin might pursue a more generous approach to the euro zone's financial and economic crisis—even in the event of a grand coalition—are likely to be disappointed.

Meanwhile, in Kenya, 68 people are dead with 40 people still trapped as hostages in day 3 of a terrorist seige of a shopping mall. Attackers stormed at least three entrances to the mall simultaneously when the attack began Saturday. Gunfire ripped through open-air cafes at the main entrance, while a grenade exploded in the rooftop parking lot and another group of shooters opened fire in the basement garage.

Meanwhile, in Kenya, 68 people are dead with 40 people still trapped as hostages in day 3 of a terrorist seige of a shopping mall. Attackers stormed at least three entrances to the mall simultaneously when the attack began Saturday. Gunfire ripped through open-air cafes at the main entrance, while a grenade exploded in the rooftop parking lot and another group of shooters opened fire in the basement garage.

"They were questioning people, and they said, 'If you are Muslim you are on the safer side, but if you are Hindu or Christian you will be killed,' " said a person who was working inside the mall. 175 people are reported injured so far and 1,000 have been safely evacuated but attackers still hold the building.

In more mayhem news, at least 70 people were killed and 100 more injured in a twin suicide bombing of a church in Pakistan. "I've never seen such piles of human bodies," said Arshad Javed, chief executive of Peshawar's Lady Reading Hospital. The U.S., meanwhile, has been targeting Taliban leaders operating in Pakistan's tribal areas with drone strikes, a practice that the Pakistani government says it opposes.

In more mayhem news, at least 70 people were killed and 100 more injured in a twin suicide bombing of a church in Pakistan. "I've never seen such piles of human bodies," said Arshad Javed, chief executive of Peshawar's Lady Reading Hospital. The U.S., meanwhile, has been targeting Taliban leaders operating in Pakistan's tribal areas with drone strikes, a practice that the Pakistani government says it opposes.

"Until drone strikes are stopped, we will continue with this. Consider this the first of our actions," Ahmed Marwat, a militant commander of Jandullah, a group that works closely with the Pakistani Taliban, said after the Peshawar bombings. "Whoever is non-Muslim will be targeted."

I know it's not the normal market news but, when you have multiple massive terror incidents on the same weekend – you'd better believe it's going to have an effect on Global commerce down the road. Fear of terrorism on two continents has a way of knocking consumer sentiment way down and especially an attack at a MALL – this is not something you want to see spreading. Even my kids (11 and 13), have expressed concern – and they haven't even engaged in the feedback loop of gossip that goes on at school yet.

I know it's not the normal market news but, when you have multiple massive terror incidents on the same weekend – you'd better believe it's going to have an effect on Global commerce down the road. Fear of terrorism on two continents has a way of knocking consumer sentiment way down and especially an attack at a MALL – this is not something you want to see spreading. Even my kids (11 and 13), have expressed concern – and they haven't even engaged in the feedback loop of gossip that goes on at school yet.

As noted in the cartoon above, Merkel's decisive victory is no win for Greece or other EU nations that were hoping austerity would fall to the back burner. In fact, the biggest gainer among Germany's majority parties was the "Anti-Euro" party, which was only founded months ago but got an astounding 4.7% of the vote on the platform of telling the rest of Europe to stuff it.

I don't have much more to say about the economy than I said last Monday when, as noted in Stock World Weekly, I had said in the Monday morning post:

Europe is still a mess, Asia is a boarderline disaster and the bottom 80% of our country can barely bring themselves to get out of bed in the morning but – So What? – MORE FREE MONEY!!!! That's the deal from the Fed this week (or so the bullish traders believe) and we should be able to peg those highs again, at least until Wednesday's FOMC Statement (2pm)or Bernake's 2:30 press conference after the meeting.

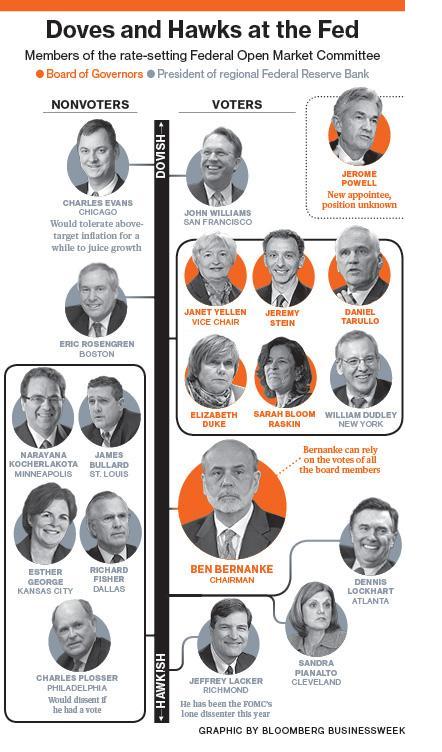

Friday is a regular Fed-A-Palooza, with George (hawk) speaking at 12:30, Tarullo (dove) at 12:40, Bullard (hawk) at 12:55 and Kocherlakota (hawk) at 1:45 to close out the quarter on a Quad Witching Options Expiration Day. I am declaring Friday an UN-Vacation. You CANNOT be away that day – it could get pretty crazy!

I can only tell you what is going to happen and how I think you can make money trading it – the rest is up to you!

We have plenty of Fed action again this week with Lockhart (major hawk) and Dudley (slight dove) dueling it out at 9:30 this morning with Fisher (King hawk) getting his swings at 1:30. Tomorrow it's George (hawk) at 12:30, ahead of the 2-year auction at 1:30 and we have a 5-year auction at 1pm Wednesday with no speakers but Stein (dove) steps in at 10:10 on Thursday, followed by Kocherlakota (hawk) at 12:15 to make sure the 7-year auction goes smoothly at 1pm that day. George (still dove) goes again at 9:15 pm Thursday and at the unGodly hour of 5:45 am on Friday, Evans (uber dove) speaks at the same time as Rosengren (dove) and Dudly (dove) bats clean-up at 2pm on Friday.

We have plenty of Fed action again this week with Lockhart (major hawk) and Dudley (slight dove) dueling it out at 9:30 this morning with Fisher (King hawk) getting his swings at 1:30. Tomorrow it's George (hawk) at 12:30, ahead of the 2-year auction at 1:30 and we have a 5-year auction at 1pm Wednesday with no speakers but Stein (dove) steps in at 10:10 on Thursday, followed by Kocherlakota (hawk) at 12:15 to make sure the 7-year auction goes smoothly at 1pm that day. George (still dove) goes again at 9:15 pm Thursday and at the unGodly hour of 5:45 am on Friday, Evans (uber dove) speaks at the same time as Rosengren (dove) and Dudly (dove) bats clean-up at 2pm on Friday.

So, we have hawks wheeled out ahead of our note auctions to keep the Dollar up while people are bidding on notes that are priced in them but then, on Friday – it's a dove attack to take us into the end of the calendar quarter to goose the markets.

Last Monday we looked at the SQQQ Oct $23/26 bull call spread at .45 and that's fallen to 0.20 but now you can just buy the $23 calls for .30 and that's the way to go as you can sell half on any kind of dip in the Nasdaq and then get a free ride on the rest. From an allocation perspective: Let's say you expect to lose $10,000 on a 10% dip in the Nasdaq that would pop SQQQ 10% from $20.50 to $24.60.

At $24.60 the $23 calls would be at least $1.60 so, if you wanted to mitigate half the damage, then 30 would pay $4,800 so you can buy 30 calls for $900 and that then becomes the cost of your insurance. If the bulk of your $100,000 portfolio is otherwise engaged in selling premium (as described in our new "7 Steps to Making 40% Annual Returns" video) of about 3% per month, then a flat or up market MAKES you $3,000 (as evidenced by our current Butterfly Portfolio, which is up a virtual 7% in less than two months selling premium) and the $900 you lose all or part of is simply the insurance premium that steadies you out through choppy market waters.

Speaking of choppy waters, I also completed Part 2 of our Philstockworld August Trade Review this weekend and I cannot emphasize enough how useful it is to review what we were thinking and what trades worked in retrospect so, when similar market situations arise – we can act with confidence.

Speaking of choppy waters, I also completed Part 2 of our Philstockworld August Trade Review this weekend and I cannot emphasize enough how useful it is to review what we were thinking and what trades worked in retrospect so, when similar market situations arise – we can act with confidence.

The seminal event in August was the release of the Fed minutes on August 21st and we had similar disappointment on lack of more doveish language than was expected to what we had last week. Of course, on Aug 22 (Thursday) – the Nasdaq had their outage and then Icahan did his famous Apple tweet, which saved us from a big sell-off right as we began to fail the 1,645 line on the S&P that day – the exact spot we had predicted a week earlier, per our 5% Rule.

Those who forget the past – something, something…