Courtesy of Mish.

With September out of the way, most economists now expect a December tapering event. Steen Jakobsen, chief economist at Saxo Bank in Denmark is not one of them.

Via email, Steen writes …

More QE, Less growth, Less Inflation and Less Upside

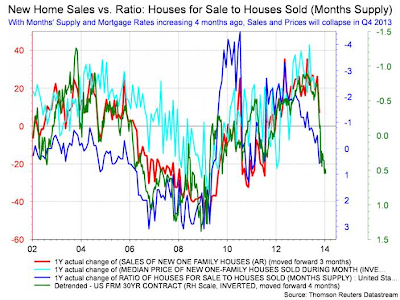

I have mentioned a few times how I see the fourth quarter having a dramatic slow-down effect, mainly due to unemployment rising, but also due to a serious drop in US housing activities. Please see the chart below. It clearly shows not only why housing will fall (correlation with a lag of mortgage rates) but also why we will see more quantitative easing (QE) rather than less.

With Months’ Supply and Mortgage Rates Increasing, Sales and Prices Will Collapse in Q4 2013

Tapering will not happen in October or in 2013 for that matter. Not a single economic vector in our model is pointing up. All indicate less growth, less inflation and less upside. The problem? The market is still talking recovery, despite the US this year being barely able to muster 1.5 percent growth after 2.5 percent last year. If this is recovery, I don’t want to experience recession.

Non-Tapering Changed Fixed Income’s Relative Value Over Equities

Again, we are increasingly confident about our 2.25 percent 10-year US bond rate call by the end of Q4-2013 versus 2.65 percent now. The Federal Open Market Committee’s fixed income put issued by the Fed’s recent non-tapering act has changed the relative value of fixed income over equities. This story has only just begun.

Alpha-wise, increasingly my Gold calls still see 1525/75 before falling again, and finally I continue to play the US dollar short as the path of least resistance will be a lower US dollar to help refuel emerging market currencies.

Housing Bulls Increasingly Optimistic

Curiously, housing bulls in the US are increasingly optimistic.

For example Bloomberg reports Blackstone Said to Gather $2 Billion for Real Estate. It’s important to note that Blackstone is raising money for European real estate (but it also has huge US commitment as well).

…