Told you so!

Come on, you have to give me that one! Back on August 28th we went against SocGen's call for $150 oil, which spiked the NYMEX contracts to $112.24 that week and we came up with various shorting strategies to take advantage of the 360,000,000 barrels worth of FAKE!!! open contracts that were, at the time, scheduled for November delivery.

Here we are, on the last trading day of the November contracts and all but 30M barrels (30,000 contracts) have been cancelled and half of those will be torn up today and moved to equally FAKE!!! December contracts, which are already bloated at 368,309 contracts (1,000 barrels per contract).

|

Click for

Chart |

Current Session | Prior Day | Opt's | ||||||||

| Open | High | Low | Last | Time | Set | Chg | Vol | Set | Op Int | ||

| Nov'13 | 99.06 | 99.10 | 98.79 | 99.02 |

07:21 Oct 22 |

– |

-0.20 | 1164 | 99.22 | 30678 | Call Put |

| Dec'13 | 99.47 | 99.59 | 99.25 | 99.46 |

07:21 Oct 22 |

– |

-0.22 | 21514 | 99.68 | 368309 | Call Put |

| Jan'14 | 99.61 | 99.70 | 99.39 | 99.61 |

07:21 Oct 22 |

– |

-0.15 | 6384 | 99.76 | 156801 | Call Put |

| Feb'14 | 99.41 | 99.44 | 99.19 | 99.41 |

07:21 Oct 22 |

– |

-0.08 | 3742 | 99.49 | 87835 | Call Put |

Oil is now below the $99 line and that's up $11 per contract from where I was banging my fist to short oil in late Aug and early Sept (yes, we had another chance on the 6th and the 9th). At $10 per penny, per contract, those contracts are up $11,000 each and we had 360,000 of them to short and had President Obama listened to me and given me the keys to the SPR (and $1.6Bn in margin), we could have made a cool $3.96Bn on our oil short – enough to pay a GOOD programmer to rewrite his health care system!

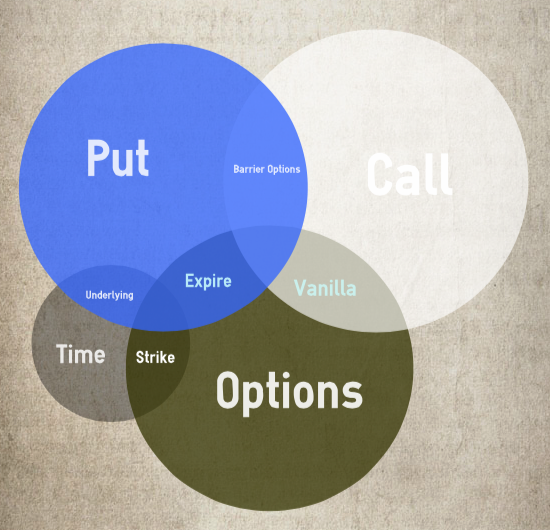

Even if you didn't have $1.6Bn laying around, shorting a NYMEX Futures contract uses just $4,500 in margin (and don't miss our Options and Futures Trading Seminar in Las Vegas, Nov 10th and 11th) the LOX3 November $110 Futures option I suggested as an alternative on 8/28 cost just $450 per contract and paid off $1,000 when it expired last week (options expire earlier than the Futures, which expire today) a quick gain of 122% on whatever cash (no margin required) you may have had laying around to make a play.

The real difference between an option contract and a futures contract is the option contract forced you to PAY $4,500 to bet oil would finish below $110 so the net gain was "just" $5,500 but, with the Futures contracts, you only need to set $4,500 aside to bet oil would finish below $110 and you collect the full $10,000 per contract at $100 last week ($11,000 now) for an 81% better profit.

The real difference between an option contract and a futures contract is the option contract forced you to PAY $4,500 to bet oil would finish below $110 so the net gain was "just" $5,500 but, with the Futures contracts, you only need to set $4,500 aside to bet oil would finish below $110 and you collect the full $10,000 per contract at $100 last week ($11,000 now) for an 81% better profit.

This is why we teach our Members not to fear, but to learn to understand Futures trading – not only can you make much, much more money on the same move, but the fee for making the trade is generally less than $10 per contract – which means you can also learn to quickly move in and out of trades without getting chewed up by broker fees and spreads.

Another way we play oil (and many things) at PSW is using an option spread. Also nowhere near as scary as it sounds, we are simply buying a contract like the November $110 oil put for $4.50 (trade idea from 8/28 as well) and selling premium to some sucker with the $105 puts for $2.30 for net $2.20 on what is now, for us, a $5 spread. As it worked out, this was a win-win as we made our full $5 (127%) that we prediced last month and the short put player we sold to made $2.80 (.10 more than we did) for a 117% gain of his own.

These are just, by the way, the trade ideas I put up in the Morning Post, that anyone could have read and acted on. In our Member Chat room, as you can see from our September Trade Review, we were able to constently make money almost every day playing with oil on the way down, using Futures and Options to leverage our bets to great effect.

We're not all bearish, of course. On Sept 10th, I wrote "Take Off Tuesday – 5 More Trades that Make 500% in an Up Market" as it's always important to have BALANCE in our portfolios (see this morning's early Member Chat for much more on that subject).

We're not all bearish, of course. On Sept 10th, I wrote "Take Off Tuesday – 5 More Trades that Make 500% in an Up Market" as it's always important to have BALANCE in our portfolios (see this morning's early Member Chat for much more on that subject).

In that post, our shortest-term trade idea was buying 8 QQQ Jan $75/80 bull call spreads for $3 ($2,400) and selling one ISRG 2015 $300 put for $2,350 for net $50 on the spread. QQQ is already $82.50 and the bull spread is now $3,280 and the short puts are $2,300 for a net return of $980 in cash on the $50 laid out (up 1,860%), which sounds good but the goal on this trade is to make $3,950 so we're merely "on track" on this one.

Of course, we were still shorting oil that day ($108.50) and I once again laid out my premise for why oil simply couldn't sustain $110 (Monday's opening price!) based on all those boring old geo politics I'm always yammering on about. The reason I talk about them is because – if you know WHY you are making a trade, you are more likely to be able to act when a trading opportunity presents itself (like a spike to $110 that makes no sense) or, as my Sept 10th self said at the time:

As usual, I can only tell you what is going to happen and how I think you can make money trading it – the rest is up to you! $106.50 is our immediate goal for oil today and we should get a bounce there ahead of tomorrow's inventory report, which is the bulls last hope. If they are wise, they'll take the opportunity to sell the optimists contracts down to $105 because they'll WISH they could get $105 if we put Syria to bed before the 20th.

It's those boring old macros that are keeping us cautious this morning as the rally may be a little tired up here. The Dollar's weakness (79.44) is masking the market's weakness but, even so, materials are falling due to lack of real demand. Our target for November oil was $98.50 and today is the last trading day for November but, if $98.50 doesn't hold on oil, then the energy sector will begin to sell off and oil-producing countries will begin to sell off and we could have a nice, little global collapse on our hand.

Only 148,000 jobs were created in September, missing Economorons' forecasts of 180K by more than 20%. On the bright side, August was revised up from a pathetic (but not as pathetic as September) 169,000 jobs to 193,000 jobs, about +15%. So, at the moment, the markets are encouraged by the fact that the Government doesn't seem to be able to count and all these statistics are essentially meaningless.

Meangless just happens to be the sweet spot for this markt, that is completely detatched from reality (see NFLX) at the moment. We'll probably flip long on oil (/CLZ3, December Futures) off the $99 line for now because less jobs means a lower Dollar and a lower Dollar means higher prices, despite the falling consumption. We used to call this "inflation" but now it's what the Fed calls "growth".

Speaking of "growth" – our beloved ABX is still cheap and, if you want one of those 500% upside plays – you can try selling the 2016 $15 puts for $2.60 and use that money to buy a 2015 $15/23 bull call spread at $3.45 for net 0.85 on the $8 spread. That has 841% of upside potential and you are starting out at $18.95, so $3.95 in the money is up 364% if it just flatlines at this price. It's very, very easy to make money in an up market – the trick is learning how to keep the money in a down market!

Be careful out there.