$5,937,500,000 to be exact.

That's the gain on my Sept 18th trade idea for Apple, Inc. to utilize some of the cash they have sitting on the sidelines:

How about they (AAPL) sell 2.5M 2016 $400 puts for $65 ($16.25Bn) and, worst case is they have a buy-back of 250M shares for net $335 ($83.75Bn), which is about what they are planning anyway over 2+ years (and they have $180Bn of cash and are making $40Bn more per year!). If the stock is over that price, they can bonus their 75,000 employees $216,667 each and, if not, they were going to do a buyback anyway and this saves them money!

Those puts are now $41.25. It's too bad for AAPL's 75,000 employees that they didn't listen to me, they would have been getting $79,166 each already – just 40 days later. Even if you didn't have the margin to promise to buy 250M shares of AAPL at net $335 ($41.875Bn), any portion you did have would have returned 36% in 40 days.

Making 1% a day selling risk to others is the cornerstone of PhilStockWorld's BE THE HOUSE, Not the Gambler strategy that we're emphasizing in Q4 and you can see it in action in Part 2 of our September Trade Review, where we sold tons of premium on trade ideas that made tons of money in very short order. The margin on the short puts is "just" $40 per contract, so it's a very margin-efficient trade as well, that has, so far, returned 59% on that margin in a month + 10 days.

Obviously, unless you really, Really, REALLY want to own AAPL for net $335, you should take your 59% return on margin and run at this point – it's not nice to risk $79,177 bonuses on earnings, no matter how much of a fan you are of a company! We reluctantly had to place some covers on AAPL positions in our virtual portfolios because, as you can see from the chart above, we already got a 15% move in the underlying stock from our bottom call in September.

As to the broader market – needless to say, I still have my reservations. I already warned our Members in early morning Chat (4:50 am) that the move up in the Futures seemed fake, as it all came in one big push at the open. Not surprisingly, we've now turned read as our weekend reading gave us nothing very supportive to go on – other than the constant wish that the Fed will continue to ease forevermore.

As to the broader market – needless to say, I still have my reservations. I already warned our Members in early morning Chat (4:50 am) that the move up in the Futures seemed fake, as it all came in one big push at the open. Not surprisingly, we've now turned read as our weekend reading gave us nothing very supportive to go on – other than the constant wish that the Fed will continue to ease forevermore.

As John Mauldin and many other note, we may not be at the top (who could have called the very top in 1999?) but the level of investor complacency is clearly at an all-time high – and only 5 years after complacency cost investors half of their portfolios in the last crash. Margin debt is over 1999 levels and less than 10% below the 2007 peak already and the junk bond market has swollen from $200Bn in 2008 to $1.7Tn at last estimate as the Fed squeezes return-seekers into ever-riskier forms of debt. Mauldin's new book, Code Red, sums it up so nicely that I must post it here:

In the four years since the Lehman Brothers bankruptcy, central bankers have torn up the rulebook and are trying things they have never tried before. Usually interest rates move up or down depending on growth and inflation. Higher growth and inflation normally mean higher rates, and lower growth means lower rates. Those were the good old days when things were normal. But now central bankers in the US, Japan, and Europe have pinned interest rates close to zero and promised to leave them there for years. Rates can't go lower, so some central bankers have decided to get creative. Normally central banks pay interest on the cash that banks deposit with them overnight. Not anymore. Some banks like the Swiss National Bank and the Danish National Bank have even created negativedeposit rates. We now live in an upside down world. Money is effectively taxed (by central bankers, not representative governments!) to get people to spend instead of save.

These unconventional policies are generally good for big banks, governments, and borrowers (who doesn't like to borrow money for free?); but they are very bad for savers. Near-zero interest rates and heavily subsidized government lending programs help the banks to make money the old-fashioned way: borrow cheaply and lend at higher rates. They also help insolvent governments by allowing them to borrow at very low costs. The flip side is that near-zero rates punish savers, providing almost no income to pensioners and the elderly. Everyone who thought their life's savings might carry them through their retirement has to come up with a Plan B when rates are near zero.

In the bizarre world we now inhabit, central banks and governments try to induce consumers to spend to help the economy while they take money away from savers who would like to be able to profitably invest. Rather than inducing them to consume more, they are forcing them to spend less in order to make their savings last through their final years!

The whole article (and book) is a great read and I very highly recommend! Still, as Barry Ritholtz reminds us, it is our job to help our readers see the World as it is, not as we want it to be and, at the moment, we are only HEDGING bearish against our many, Many, MANY long-term bullish positions (again, see our monthly trade reviews, with literally hundreds of bullish trade ideas).

The whole article (and book) is a great read and I very highly recommend! Still, as Barry Ritholtz reminds us, it is our job to help our readers see the World as it is, not as we want it to be and, at the moment, we are only HEDGING bearish against our many, Many, MANY long-term bullish positions (again, see our monthly trade reviews, with literally hundreds of bullish trade ideas).

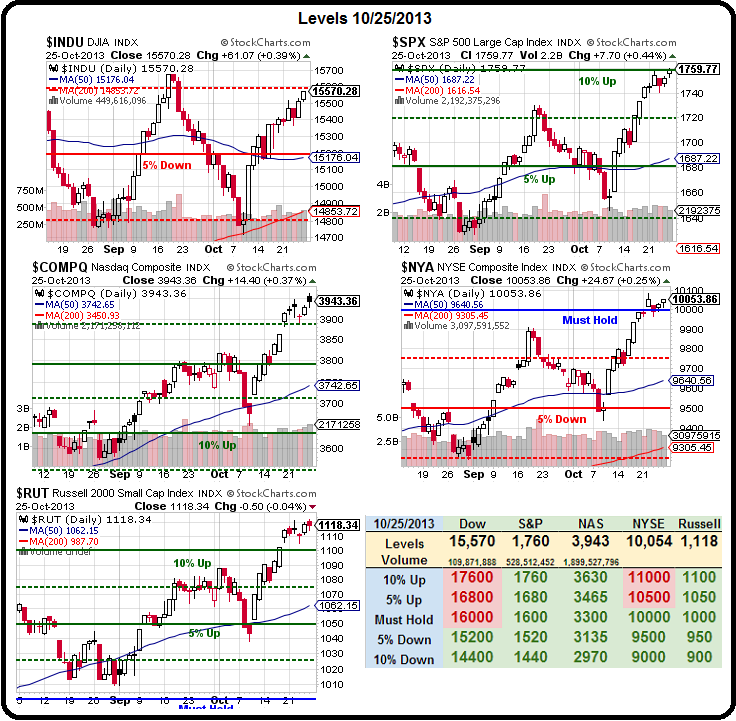

I have also urged a move back to CASH (meaning well-hedged longs or simply cash) as the market tests 15% gains over our Must Hold lines on the Nasdaq and the S&P even though the dow hasn't broken 16,000 (its must hold) and the NYSE has only just barely taken out 10,000.

To some extent, the change-up in the Dow components makes that index hard to read but not so the NYSE, which will ultimately tell the tale for the entire market this week. Another reason we conduct our Trade Reviews is to remind ourselves what worked and what did not under similar circumstance in the past and it was indeed, just a month ago, that we were concerned that our indexes were overbought in mid-September. Being right about that saved us all a lot of heartache on the way down.

And here we go again.

And here we go again.

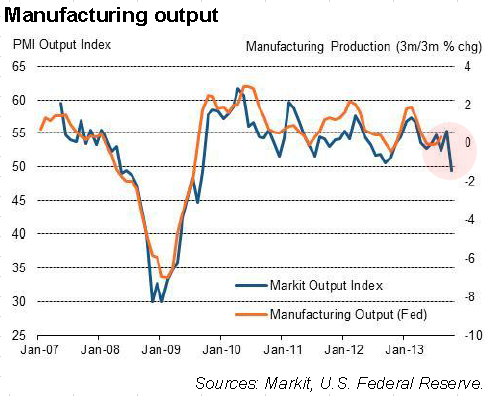

Tons of earnings this week including AAPL tonight and then we have the Fed meeting tomorrow and making their policy statement on Wednesday. We also have a ton of economic data as we catch up from the two weeks we were closed during the shutdown and the shudown itself is likely to give us a lot of erratic readings, notably the first fall in US Manufacturing Output since 2009.

Aside from the numbers, this means loss of well-paying manufacturing jobs and further economic weakness. Congratulations go to the elected officials in Washington who helped create this mess.

Nonetheless – it's party on markets until the Fed takes that punch-bowl away!