Courtesy of Lee Adler of the Wall Street Examiner

The Labor Department reported that in the week ending November 2 the advance figure for seasonally adjusted initial claims was 336,000, a decrease of 9,000 from the previous week’s revised figure of 335,000 (was 340,000).

The consensus estimate of economists of 335,000 for the SA headline number was a near bullseye (see footnote 1). That’s two weeks in a row that they’ve been close to the mark. Let’s give credit where due. Prior to this they were consistently unable to guess the impact of the government shout down, severely underestimating claims in those weeks.

One of the best guides to this data is the real-time hard data on Federal Withholding taxes, which I track weekly in the Treasury Update.

The weekly ritual of the market reacting to fictional, seasonally adjusted headline numbers is ridiculous. But tracking the actual, not seasonally finagled number exactly as the Feds collect the actual filings from the 50 states gives us a good picture of the trend of the economy nearly in real time. The actual, unadjusted numbers give us a good idea of the underlying trend.

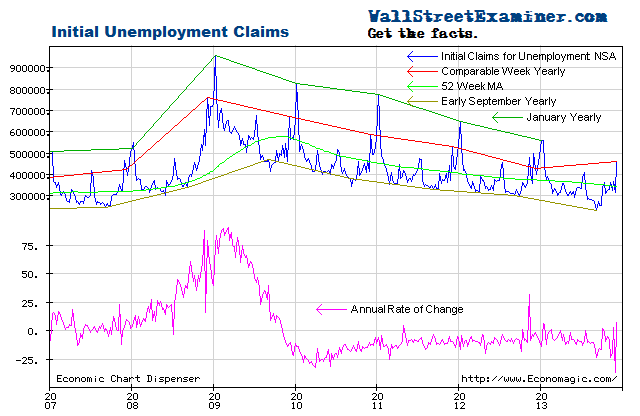

The headline seasonally adjusted data is the only data the media reports but the Department of Labor (DOL) also reports the actual data, not seasonally adjusted (NSA). The DOL said in the current press release, “The advance number of actual initial claims under state programs, unadjusted, totaled 327,074 in the week ending November 2, an increase of 4,222 from the previous week. There were 361,800 initial claims in the comparable week in 2012.” [Added emphasis mine] See footnote 2.

After jumping during the government shutdown, claims have returned to trend. In the latest week actual filings were down 8.8% versus the corresponding week last year, slightly better than the trend average of -7.8% per year over the past 104 weeks.

There’s significant volatility in this number, with a usual range of zero to -20%. In the second and third quarters, claims as a percentage of the total employed were at levels last seen at the end of the housing bubble, just before the market and economy collapsed. Since then they’re returned to a somewhat higher level, settling in at about 0.23%-0.24% of total employed.

The fact that the numbers rebounded immediately after Federal workers returned to work suggests that the shutdown has had no lasting impact on the economy, contrary to the panic among the economic chatterers before and during the shutdown.

The current weekly change in the NSA initial claims number is an increase of 7,000 (rounded and adjusted for the usual undercount) from the previous week. That compares with an increase of 22,000 for the comparable week last year. The first November reading was up in 7 of the prior 10 years. The average change for the comparable week over the prior 10 years was an increase of 15,000. This week’s number was better than last year and better than the prior 10 year average.

Federal withholding tax data slumped sharply in the first half of October. It then began a gradual recovery after mid month but that recovery has stalled and it is below the trend of the previous year. Since withholding is collected after the end of the pay period, the effects of Federal workers returning to work should have been seen fully in that data. I’ll report on that in greater detail with the usual graphs of the trends in the weekly Professional Edition Treasury update.

Based on the withholding trend for October as a whole, even with economists sharply lowering their non farm payrolls forecast from the rate of recent months, their guess looks too high, if we base the comparison on the entire month. However, during the month, particularly during the employment survey reference week ended October 12, withholding was all over the place, with both sharp declines and big increases depending on the day. The vagaries of the timing of the survey make October’s number a wild card. Consequently, I have no guess on whether the consensus will be too high or too low this month. I see the potential for a surprise in either direction, but it would be a statistical anomaly. The market may just ignore it and wait till November for an unpolluted number.

Current weekly claims would need to be greater than the comparable week last year to signal a weakening economy. With the exception of the October 5 week, which got a mulligan because of the government shout down, that has not happened. The trend had previously been one of accelerating improvement in spite of the fact that the comparisons are now much tougher than in the early years of the 2009-13 rebound. The data has returned to trend over the past three weeks. With now much tougher comparisons versus the prior year, I would expect some slowing in the rate of improvement to be normal, and not an indication of a weakening economy.

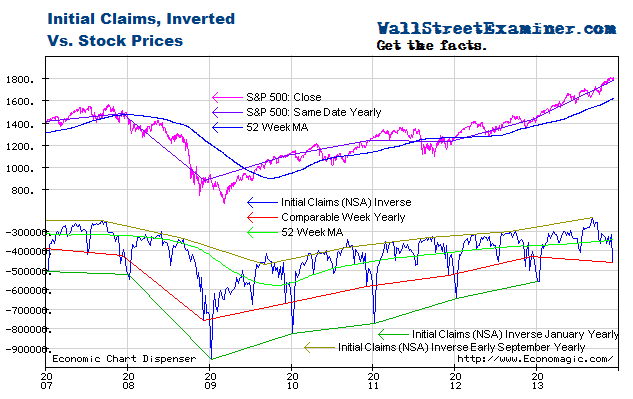

Relative to the trends indicated by unemployment claims, stocks have been extended and vulnerable since May. QE has pushed stock prices higher but has done nothing to stimulate jobs growth.

I plot the claims trend on an inverse scale on this chart with stock prices on a normal scale. The acceleration of stock prices in the first half of 2013 suggested that bubble dynamics were at work in the equities market, thanks to the Fed’s money printing. Those dynamics appeared to have ended in July but the zombie has kept coming back to life. I address the specific potential outcomes in my proprietary technical work.

Get regular updates the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, in the Fed Report in the Professional Edition, Money Liquidity, and Real Estate Package. Click this link to try WSE's Professional Edition risk free for 30 days!

Copyright © 2012 The Wall Street Examiner. All Rights Reserved. The above may be reposted with attribution and a prominent link to the Wall Street Examiner.