Courtesy of Lee Adler of the Wall Street Examiner

The Labor Department reported that in the week ending November 9 the advance figure for seasonally adjusted initial claims was 339,000, a decrease of 2,000 from the previous week’s revised figure of 341,000 (was 336,000). That’s the headline number, not the actual number, which I’ll get to. First, let’s look at the problem with the headline number.

The consensus estimate of economists of 330,000 for the SA headline number was too optimistic (see footnote 1). That follows two weeks in which they were close to the mark. Prior to that they were consistently unable to guess the impact of the government shout down, severely underestimating claims in those weeks. This looks like a return to that pattern, which is mystifying since the real-time hard data on Federal Withholding taxes, which I track weekly in the Treasury Update, was soft during the shutdown, and the subsequent rebound was also weak.

The ritual of the media reacting to fictional, seasonally adjusted headline numbers goes on. It’s especially nutty this week where the seasonal adjustment factor is even more out of whack than usual. The media made much of the fact that the prior week’s number was revised up by 5,000. The number is always revised up because the advance number reported the first week does not include all interstate claims. By the following week they are all counted. The usual upward revision is from 1,000 to 4,000. This one was larger than typical. But looking at the not seasonally adjusted actual count of claims which the 50 states submitted to the Labor Department, the upward revision was just 1,277. Let me emphasize that those are actual counts, not estimates, and not seasonally finagled hocus pocus.

So how did the seasonally adjusted upward revision turn into a big number of 5,000, when the actual change was 1,277? Without going into the arcana of the abstract impressionist work of seasonally adjusting real numbers into an idealized image, one factor stands out. In 2012, the comparable week saw a massive spike in claims in the immediate aftermath of Superstorm Sandy hitting the East Coast. That certainly has something to do with it, because the seasonal adjustment process attempts to idealize the trend by incorporating the average of the past 5 years. If one of those years has an unusually large change, that skews the average.

The headline seasonally adjusted data is the only data the media reports but the Department of Labor (DOL) also reports the actual data, not seasonally adjusted (NSA). The DOL said in the current press release, “The advance number of actual initial claims under state programs, unadjusted, totaled 357,836 in the week ending November 9, an increase of 26,485 from the previous week. There were 478,543 initial claims in the comparable week in 2012.” [Added emphasis mine] See footnote 2. The 2012 number was boosted sharply by Superstorm Sandy, which had swept across the northeast coast of the US the week before.

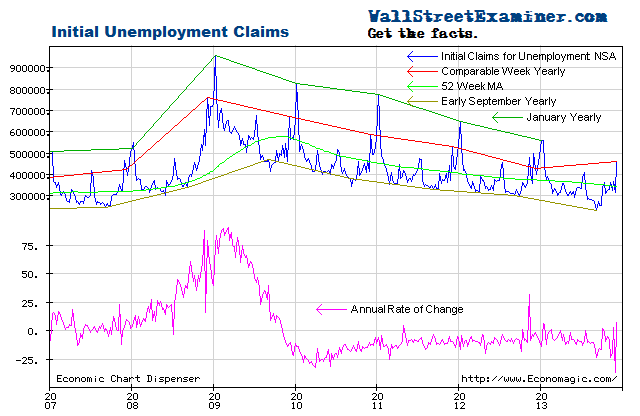

After jumping during the government shutdown, and excluding last year’s anomaly, claims have returned to trend. Actual filings last week were down 25.2% versus the corresponding week last year. That’s an outlier due to the post Hurricane Sandy spike that week of 2012. This comp should return to trend over the next week or two. The trend average is -8.1% per year over the past 104 weeks.

There’s significant volatility in this number, with a usual range of zero to -20%. In the second and third quarters, claims as a percentage of the total employed were at levels last seen at the end of the housing bubble, just before the market and economy collapsed. Since then they’re returned to a somewhat higher level, settling in at about 0.23%-0.26% of total employed.

The current weekly change in the NSA initial claims number is an increase of 28,000 (rounded and adjusted for the usual undercount) from the previous week. That compares with an increase of +117,000 in the post Superstorm Sandy comparable week last year, but it’s very close to the 10 year average for this week of +26,000. The second November reading was up in 7 of the prior 10 years. The current number is entirely consistent with the trend.

Federal withholding tax data slumped sharply in the first half of October. It then began a gradual recovery after mid month but that recovery has stalled and it is below the trend growth rate of the past year. I report on this data in greater detail with graphs of the trends in the weekly Professional Edition Treasury update.

Current weekly claims would need to be greater than the comparable week last year to signal a weakening economy. That has not happened. The trend had previously been one of accelerating improvement in spite of the fact that the comparisons are now much tougher than in the early years of the 2009-13 rebound. The data has returned to trend over the past three weeks. With now much tougher comparisons versus the prior year, I would expect some slowing in the rate of improvement to be normal, and not an indication of a weakening economy.

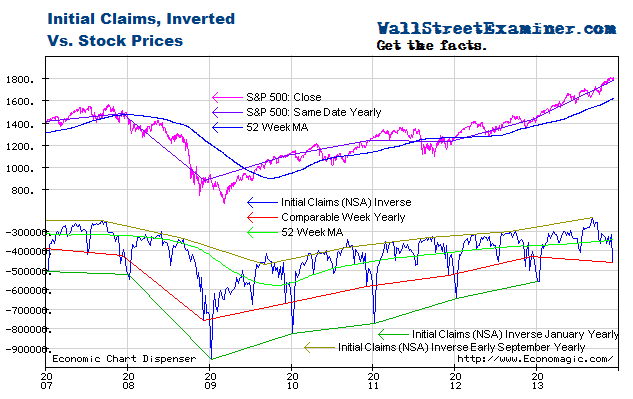

Relative to the trends indicated by unemployment claims, stocks have been extended and vulnerable since May. QE has pushed stock prices higher but this short video shows that it has not helped employment. In fact, QE 3-4 has correlated with a stall in jobs growth.

I plot the claims trend on an inverse scale on this chart with stock prices on a normal scale. The acceleration of stock prices in the first half of 2013 suggested that bubble dynamics were at work in the equities market, thanks to the Fed’s money printing. Those dynamics appeared to have ended in July but the zombie has kept coming back to life. I address the specific potential outcomes in my proprietary technical research.

Get regular updates on the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, in the Fed Report in the Professional Edition, Money Liquidity, and Real Estate Package. Click this link to try WSE's Professional Edition risk free for 30 days!

Copyright © 2012 The Wall Street Examiner. All Rights Reserved. The above may be reposted with attribution and a prominent link to the Wall Street Examiner.