And the madness continues!

And the madness continues!

We had our fabulous Las Vegas Conference last weekend so we're a bit behind this month and we ended the week at record highs. Our September Trade Review (Part 2) wasn't done until 11/2 anyway and Part 1 of September was completed on Oct 13th, when the market was just beginning to fly. (Chart by Dave Fry) We called the September action almost perfectly and, out of 112 trade ideas for the month, 96 (85%) were winners – an incredible percentage that actually improved upon August's 81%!

For some reason, people think I'm too bearish but that's because our SHORT-TERM Portfolio is full of bearish offsets to the bulk of our positions, which are NOT tracked until the reviews, because they are longer-term trades or day trades. Also, if we tried to track 112 additional trade ideas per month, we'd be just about getting to February now!

Options are not like stocks, we don't want 1,000 people all following the same trade (as I noted last month as well). That's why PSW is an educational site where our goal is to teach you to identify your own opportunities to BE THE HOUSE, Not the Gambler. By putting up an average of 5 trade ideas every trading day – we give our Members a huge variety of trade ideas that can fill in any portfolio. These trade ideas are highlighted daily in our Member Chat Room at PSW! Keep in mind that this is an arbitrary point in time and some trades could have had better (or worse) exits in between – we're not doing this to keep score, just to get an idea of what worked and what didn't in the past month so, hopefully, we can make better decisions this month.

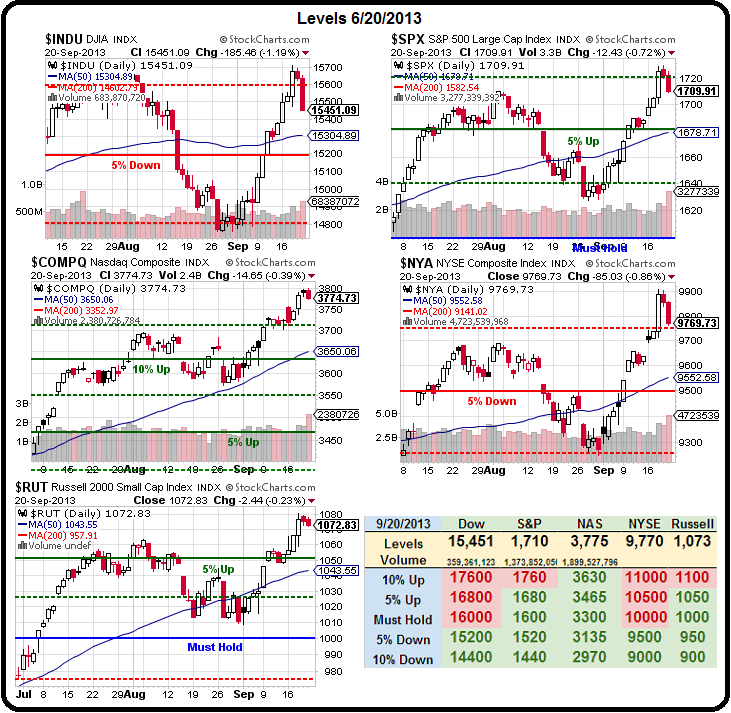

We left off on Friday, September 20th and we were bearish and catching a nice market turn lower. The market continued down, all the way back to 1,660 on the S&P and 14,800 on the Dow and we were focused with a vengeance on shorting oil ($108 at the time). That Friday morning I had said to our Members "Strap yourselves in folks, it's going to be a wild one!" and, as you can see from that day's Big Chart – we fell hard and fast into the weekend.

We left off on Friday, September 20th and we were bearish and catching a nice market turn lower. The market continued down, all the way back to 1,660 on the S&P and 14,800 on the Dow and we were focused with a vengeance on shorting oil ($108 at the time). That Friday morning I had said to our Members "Strap yourselves in folks, it's going to be a wild one!" and, as you can see from that day's Big Chart – we fell hard and fast into the weekend.

I will predict that we do not repeat our incredible September performance as 85% winners is tough to beat at the best of times and the market pulled a sharp U-Turn early in the month and surprised us with an unrelenting move up but let's see how the trade ideas played out:

Sept 23: Monday Mayhem: Merkel Wins, Mall Madness, Church Massacre

As expected, Angela Merkel was re-elected with a resounding (for Germany) 41% of the vote – allowing her the choice of any party she wishes to work with (as long as they have 9% or more) to form the new coalition Government.

Meanwhile, in Kenya, 68 people are dead with 40 people still trapped as hostages in day 3 of a terrorist seige of a shopping mall. Attackers stormed at least three entrances to the mall simultaneously when the attack began Saturday. Gunfire ripped through open-air cafes at the main entrance, while a grenade exploded in the rooftop parking lot and another group of shooters opened fire in the basement garage.

In more mayhem news, at least 70 people were killed and 100 more injured in a twin suicide bombing of a church in Pakistan.

It's an uncertain World and markets that are priced to perfection tend to forget that. Still, we play the cards that are dealt and our trade ideas for the day were:

- TZA Nov $23/26 bull call spread at .80, selling ABX Jan $16 puts for .82 for net .02, still .02 – even

- DIA Oct $155 calls at $1.20, expired at $4.30 – up 258%

Sept 24: Technical Tuesday – New Dow Components Enter on a Whimper

Sept 24: Technical Tuesday – New Dow Components Enter on a Whimper

Welcome GS ($165), V ($196) and NKE ($69)– Goodbye to AA ($8), BAC ($14) and HPQ ($21).

The changing of the Dow replaced $43 worth of stocks with $430 worth of stocks and, in the price-weighted index, this is a major shift of balance. Rather than over-analyze it, let's just say that it shifts the Dow to a far more consumer-spending orientation and GS pumps up the sensitivity to the banking sector. What we're taking away from, once again is the "Industrials" which, much like America, are barely a part of the Dow Jones Industrial Average anymore… As Taibbi concludes abotu Goldman Sachs:

So even forgetting the fact that this company on a good day makes its money rigging metals prices, stage-managing IPOs to help insiders, falsifying documents, selling phony mortgages to institutional investors while betting against their own product and engaging in highly dubious high-speed proprietary trading programs that mysteriously allow the firm to pick winners every single time – even all that wasn't enough, and Goldman still would have gone out of business, had all of us parasites not been pressed into service to rescue the company with our tax dollars.

- Oil (/CL) Futures long at $102.50, out at $103.50 – up $1,000 per contract

- EWJ Oct $12 puts at .27, out at .54 – up 100%

- TZA weekly $21.50 calls at .98, expired at $1.30 – up 32%

Sept 25: Will We Hold It Wednesday – Cruz Missiles Fired on Washington

Sept 25: Will We Hold It Wednesday – Cruz Missiles Fired on Washington

Cruz has, this year, been specifically tasked by the Heritage Foundation (yes, as an acting US Senator!) to tour the nation this Summer and do whatever it takes to shut down the Affordable Care Act. They pay for the food, the drinks, the private jets, the staff for Cruz's quest to repeal affordable health care before it begins and Heritage, of course, gets their money from the Health Care Industry.

- RIG 2015 $40 puts sold for $4, now $1.30 – up 67%

- Gasoline (/RB) Futures short at $2.69, out at $2.695 – down $210 per contract

- Oil (/CL) Futures short at $103.50, out at $102.75 – up $750 per contract

- ED at $56.30, selling 2015 $52.50 puts and calls for $9.20 for net $47.10/49.80, now $58.07 – on track

- AAPL 2016 $400 puts sold for $55, now $36.60 – up 33%

- AMD 2016 $3.50 puts sold for $1, now $1.15 – down 15%

- TASR 2015 $12 puts sold for $1.60, now $1.25 – up 21%

- 1 TASR 2015 $15/20 bull call spread at $1.50, selling 2 2015 $12 puts for $1.60 for net $1.70 credit, now 0.70 credit – up 58%

- TZA 11/4 $21 calls at $1.85, out at $2.05 – up 11%

- SLW Oct $24/26 bull call spread at $1.03, selling Jan $20 puts for $1.05 for net .02 credit, now 0.64 (waiting for puts to expire) – up 6,300%

This is a very good time to point out how good Long-Term Trades are. Many Members want the excitement of short-term trading but, just because you enter a long-term trade, it doesn't mean you can't make short-term profits. Look at TASR above – up 21% in a month! AAPL is up 33%, RIG is up 67%… Not only are you well-rewarded for a good move up but the nature of our long-term trading strategies (see How To Buy a Stock for a 15-20% Discount) means we are very well-hedged – just in case we happen to be wrong. You just don't get that with a short-term trade.

Sept 26: Thrilling Thursday – California Hike Wages 25%, Saves US Economy!

Sept 26: Thrilling Thursday – California Hike Wages 25%, Saves US Economy!

California is raising the Minimum Wage to $10 an hour!

Unfortunately, not until 2016 but this is exactly what we need to really move the economy forward so first break in the dam, thank goodness. Still, it's a 25% increase over 2 years, not bad and not a bad reason to buy gold and silver (yesterday's play on SLW is a good start) as California, no matter how wacky you think they are, usually leads the nation in necessary reforms and this is one that's been a long time coming. See "Inflation Nation", where I laid out the bull case for inflation way back in 2008.

- TZA 10/4 $21 calls at $1.08, out at $2 – up 85%

- CZR 2015 $7.50 puts sold for $1.90, now $1.20 – up 36%

- 3 CZR short Dec $15 puts at $2.10 ($630 to pay Vegas Seminar), DD at $2.65 for 6 at $1,425) now .30 ($180) – up $1,245 (87%)

- TSLA Jan $125 puts at $4, now $7.70 – up 92%

- Oil (/CL) Futures short at $103, out at $103 – even

- EBAY 2015 $50 puts sold for $6.80, now $5.05 – up 25%

- EBAY 2015 $50/65 bull call spread at $6.60, selling 2015 $50 puts for $6.80 and Oct $55 calls for $2.30 for net $2.50 credit, now 0.30 – up $2.80 (112%)

- BRCM 2015 $20/28 bull call spread at $4.70, selling 2015 $25 puts for $3.10 for net $1.60, selling 1/2 Jan $30s for $1 for net $1.10, now net $2.88 – up 161%

Sept 27: Fed Fueled Friday – CASH Proves King as we Make $2,500 in 61 Minutes!

Sept 27: Fed Fueled Friday – CASH Proves King as we Make $2,500 in 61 Minutes!

$2,500 in 61 minutes!

Is that a good hourly wage – I haven't had a real job in years, so I'm a bit out of touch. That's what we accomplished yesterday in our Member Chat Room as I put out a note at 10:12 to add 50 TZA (and ultra-short ETF on the Russell Index) next weekly (Oct 4th) calls at $1, saying:

Those TZA Next WEEK $21.50s are down to $1 with TZA at $22.25 and that's too good to pass up – 50 in the STP with a stop at .75.

Then, just 61 minutes later, at 11:13, we took the money and ran as I said to our Members:

Wheeee on the Russell – TZA $21.50s are already $1.50 and THAT is the way you make a very quick $2,500 and we're done in the STP as we're back at the 1,070 line that's been holding in the Futures (/TF) and we have plenty of other long-term short plays if we keep going down.

This was our 3rd day in a row using TZA to make quick money OFF THE SAME LINE and we exited at about the same spot – it's just that, this being the 3rd time in a row, we were smart enough to place a big bet in our virtual portfolio (the first two times we had just tossed out the trade idea without officially including it). This is not really that complicated folks – we see a pattern, we wait for it to repeat and we place the most optimal bet we can on it.

We don't go over our Short-Term Porfolio in these revues but that trade was worth mentioning. It was part of a +$50,000 run between Sept 27th and Nov 12th of our picks in that virtual portfolio. We officially closed off a set of Oil Futures short positions we'd been riding down since $108.50 at $102.50 (our primary goal ahead of $98.50) as well as short position on USO and SCO (long on the ultra-short). We close positions that are ahead and open new ones that have less downside risk – very simple, actually.

- SCO Jan $24/28 bull call spread at $2.50, now $3.70 – up 48%

- USO Oct $40 puts at $1.50, closed at $3.50 – up 133%

- Dow (/YM) Futures long at 15,200, now 15,921 – up $3,605 per contract

- Russell (/TF) Futures long at 1,070, now 1,114 – up $4,400 per contract

- ABX 2015 $15 puts sold for $2.05, now $1.55 – up 29%

- Oil (/CL) Futures short at $102.50, now $94.50 – up $8,000 per contract

- Gasoline (/RB) Futures short at $2.65, now $2.66 – down $420 per contract

Sept 29: Are There Trades You Can't Lose? Here's One:

Sept 29: Are There Trades You Can't Lose? Here's One:

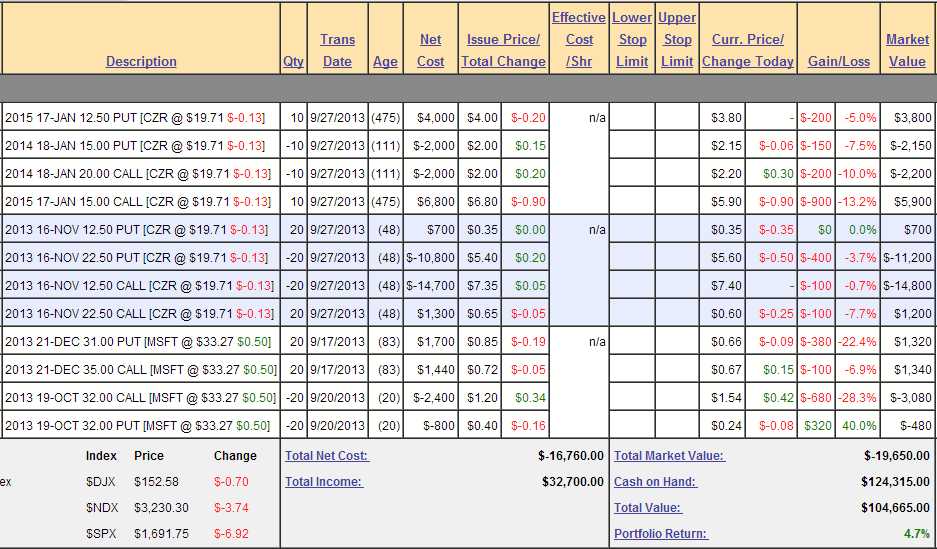

There was a strange trade on CZR and a normal trade. The problem with the strange trade is that the short calls kept getting assigned and, after a while, we flipped to selling the Oct $17.50 calls, which had a lot more premium and didn't keep getting assigned to us.

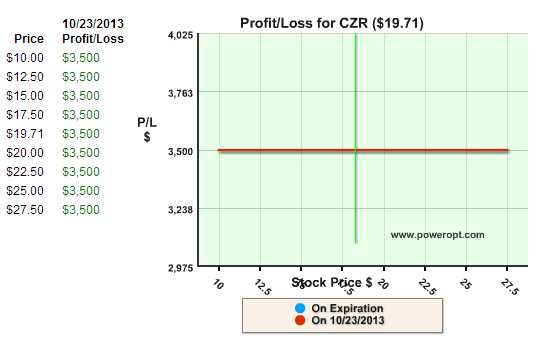

CZR was spinning off a unit and raising capital and the prices of the options had ridiculous amounts of premium in it and we took advantage of it with:

- Buy CZR Nov $12.50 puts for .35 (20 = $700)

- Sell CZR Nov $22.50 puts for $5.40 (20 = $10,800)

- Sell CZR Nov $12.50 calls for $7.35 (20 = $14,700)

- Buy CZR Nov $22.50 calls for $6.50 (20 = $1,300)

The net on the trade was a $3,500 credit and, yesterday, all four legs cancelled out for the full amount (up 100%) with CZR at $19.87. This was a math trade – they come up once in a while but they are only useful if you understand the tools well enough to be willing to use them. Even as this trade developed, we had a contingency of traders who simply thought "too good to be true" was a literal expression despite the VERY extensive logical run-through I gave it in this post.

The net on the trade was a $3,500 credit and, yesterday, all four legs cancelled out for the full amount (up 100%) with CZR at $19.87. This was a math trade – they come up once in a while but they are only useful if you understand the tools well enough to be willing to use them. Even as this trade developed, we had a contingency of traders who simply thought "too good to be true" was a literal expression despite the VERY extensive logical run-through I gave it in this post.

Granted, there were scary warrants out there and market manipulators played off people's fears to scare others out of this trade and it MIGHT have gotten ugly if all the doom and gloom predictions about phantom assignments came to pass – but they didn't – and logic won the day after all.

This is why I stress teaching people to UNDERSTAND options, rather than just throwing out a bunch of trades. These are very volatile instruments and the PRICE of the options can vary wildly over short periods of time but, if you understand the VALUE of your position – you can ride out the ups and downs with the aplomb of a professional trader.

Sept 30: Repub Baby Budget Battle Breaks the Market

Sept 30: Repub Baby Budget Battle Breaks the Market

As we expected, the Futures are off about 1% this morning and down about 3.5% on the Dow, S&P and NYSE since Thursday, the 19th, when we told you to ignore the Fed rally and the painted charts and focus on the FUNDAMENTAL ISSUES that were going to drive the market lower.

Not that our own economic data is reliable. Our last NFP report had revisions to previous reports that were more than 1/3 of the current amount – that borderlines on being completely useless from a data point of view. However, our job is not to measure how useful the data is, our job is simply to predict the market reaction to useless data so we can make some money from the idiocy of others.

- TSLA 2015 $380 calls sold for $8, now $1.60 – up 80%

- Oil (/CL) Futures short at $102 – out at $102.10 – down $100 per contract

- P March $29/23 bear put spread at $3.50, selling $29 calls for $3 for net .50, now -$1.50 – down 200%

Oct 1: Turned Off Tuesday – America's Closed, Go Home!

Oct 1: Turned Off Tuesday – America's Closed, Go Home!

Ironically, the Affordable Care Act, the ones the Republican'ts are trying to shut down, WON'T be shut down because it's already fully funded. Again, someone is an idiot – but I won't point fingers… The IRS has to cancel all audits, another victory for the tax-cheating constituency and, in one of the stupidest cuts of all, Members of Congress will begin losing staff – at the same time as they're supposed to be working on a solution to the funding issue! The National Weather Service is shut down, so there may be a hurricane comming – we just don't know. We also don't know anything about the economy, as all statistics are on hold – including Friday's critical Payroll Report!

We're already shorting the Futures this morning at 1,075 on the Russell (/TF) and $102.50 on oil (/CL) and, if you don't know why, then you weren't reading what I was just saying. This is serious stuff folks, it's not a joke – which is what they scychophantic media morons are trying to paint it as as their Republican Masters have pushed the Doomsday button and now they have to cover up the mess they've made before the voting (and investing) public wises up.

- Oil Futures short at $102.50, out at $102.30 – up $200 per contract

- Russell (/TF) Futures short at 1,075, out at 1,072 – up $300 per contract

- QQQ weekly $79.50 puts at .80, finished at $1.20 – up 50%

- Oil Futures short at $102.50, out at $102 – up $500 per contract

- Nasdaq (/NQ) Futures short at 3,220, out at 3,220 – even

- Oil (/CL) Futures short at $102.50, out at $101.50 – up $1,000 per contract

- Gold (/YG) Futures long at $1,290, out at $1,295 – up $166 per contract

- GLW May $14 puts sold for $1.05, now .33 – up 68%

- ESC March $17.50 puts sold for $1.70, now .50 – up 70%

- NAK at $1.64, out at $1.80 – up 10%

Oct 2: Whipsaw Wednesday – Bernanke Bounce at 3pm

Oct 2: Whipsaw Wednesday – Bernanke Bounce at 3pm

Oh sorry, I'm not supposed to say these things until AFTER they happen (Rule #1 of time travel).

Well, the cat's out of the bag and we all know Bernanke has a press conference at 3pm and, since the rest of the Government is shut down – there will be much more attention than usual on the Chairman so it's no surprise (or it won't be in 7 hours) that the markets once again popped (will pop) into the close as AAPL breaks (will break) over $500 to lead the Nasdaq to another closing high.

Already this morning we made a very quick $500 per Futures contract going BULLISH on oil (/CL) at the $101.50 line. If you want to play along at home and are too cheap to subscribe to our Member Chat, you can still follow us on Twitter(soon to go public and boost our GSVC pick!), where I put up the occasional trade idea – including this mornings $500 in 3 hours trade on oil.

- Oil (/CL) Futures long at $101.50, out at $102 – up $500 per contract

- Oil (/CL) Futures short at $102.50, out at $102.60 – down $100 per contract

- ALU 2015 $3/5 bull call spread at .75, now .85 – up 13%

October 2nd, 2013 at 3:24 pm TSLA fire/Wombat – Oh wow, I wonder if that's real. Seems legit:

Fire/Shadow – Whatever it is, I think it will have more than a day's impact. TSLA says car COLLIDED with an object (not another car) in the road and that is what ruptured the battery and caused a fire that melted the car. Well, don't we just all feel better now?

Oct 3: Thursday Folly – Watching Our GDP Fade Away

Oct 3: Thursday Folly – Watching Our GDP Fade Away

Speaking of bumpy rides – TSLA shares are down again as one of their Model S cars burst into flames yesterday. I already tweeted out my take on that so I won't re-hash it here and DB has already leaped in to defend them and slapped a $200 target on them to help stop the bleeding at $175. The pre-market manipulation of the stock by German Banksters does not change my earlier thesis in the slightest.

And PLEASE, don't let the fact that DB is a major shareholder of Capital Research who are, in turn a 5% owner of TSLA let you think that this kind of pre-market upgrade is illegal pumping by a nervous shareholder who just so happens to have an International soapbox – I'm sure it's all disclosed properly – somewhere…

- OIl (/CL) Futures short at $104, out at $103 – up $1,000 per contract

- TZA Nov $22/25 bull call spread at $1, expired worthless – down 100%

- TSLA short at $175, now $124.17 – up 29%

- HOV 2015 $4 puts sold for .80, now .60 – up 25%

- AAPL 2016 $340 puts sold for $30, now $13.50 – up 55%

- KO 2015 $30 puts sold for $1.10, now .50 – up 54%

- CREE short at $72.50, now $57.36 – up 21%

- MCP 2015 $7 puts sold for $2.35, now $2.95 – down 25%

- TSLA 2015 $70 puts at $5.60, now $8.20 – up 46%

Oct 4: TGIF – Ending the Week With a Whimper

Oct 4: TGIF – Ending the Week With a Whimper

What is holding up the Nasdaq?

As you can see from the Big Chart, even the Russell is getting realistic and taking a little dip but the Nasdaq keeps chugging along near it's highs. Of course I told you Wednesday morningthat the Nasdaq would be jacked up into the close and we didn't quite make a new high that day but boy did we give it right back yesterday (also as expected). Still, not too much damage so far – all things considered.

Given the morning dose of sunshine and lollipops, the almost total lack of economic data (great report on what we won't be seeing next week) and the inability of Richard Fisher to spook the markets this morning, we'll be looking for some bounce action in our indexes.

- Oil (/CL) Futures short at $104, out at $102 – up $2,000 per contract

- IMAX 2015 $25 puts sold for $3.70, now $2.20 – up 40%

Be your own IMax analyst: If you want to put Mike Hickey out of a job, feel free to look at the IMax schedule and then pontificate about how the slate of upcoming films will affect their revenues in 2014. I cannot believe people take these analysts seriously!

Metallica Movie – Out now. Gravity – Out Now. Thor, Ender's Game, Hunger Games, Hobbit – all by XMas – next year Frankenstein, Robocop, The 300 (2), Divergent, Madagascar, Godzilla, Edge of Tomorrow (Tom Cruise), Transformers, another Hobbit… Those are just what's already announced….

- Dow (/YM) Futures short at 15,000, out at 14,800 – up $1,000 per contract

TSLA is flashing a sign like that, they can't find enough buyers to bounce them and, very soon, the sellers will give up and hit the "resume" button. That's where the timing component comes in – there were people anxious enough to sell the stock off $30 from $194 to $168 ($26 = 13.4%) in 3 sessions. Now, one session later, we're having trouble at $175, which is $7/26 (27%) off the bottom – right between a strong and weak bounce.

But, with the 5% Rule, we like to go from consolidation to consolidation and $195 was the trouble line TSLA could not go over and a line doesn't have to be hit or crossed to be rejection (for the same reason you don't actually have to walk into a wall to know that's where you should stop). So we have the $160 line as clear support in the first half of the month and then 20% up is $192 and TSLA was testing that exact line Mon-Weds last week (see 5-min chart).

Using those lines, we have 32 points on the move and that means $6.5 and $13 would be a normal retrace back to $179 and you can see how sharp the drop was when that line fell. On the bounces, the same $6.50 and $13 give us $166.50 (about where they held) and $173 (where they are drifting) BUT we haven't actually hit $160 yet. The fact that the $160 lines strong and weak bounces are in play indicates the $160 line is still in play for TSLA. We're not there yet.

What a great way to start the month! 59 trade ideas in two weeks (and, don't forget, these do not include picks for our virtual porfolios!) and only 8 of them were misses giving us an 86% winning percentage to start October. Whenever I do these reviews, one of the things I look for are which losers might now be a better entry than the one we had at the time. For example, AMZ 2016 $3.50 puts we sold for $1 ran up to $1.15 and cost us 15% on paper so far but I still like them as a new entry for the better price of $1.15.

And that's exactly how we arrive at trade ideas at PSW – we discuss many, many stocks and we trade our favorites regularly – because we know them well. When an opportunity comes up – we take it and, as you can see, even the "long-term" trades can generate some pretty exciting short-term profits, especially in a crazy up market like this one.

And that's exactly how we arrive at trade ideas at PSW – we discuss many, many stocks and we trade our favorites regularly – because we know them well. When an opportunity comes up – we take it and, as you can see, even the "long-term" trades can generate some pretty exciting short-term profits, especially in a crazy up market like this one.

Since the majority of our trade ideas are bullish and, as you can see a very high percentage are successful – our Short-Term Portfolio tends to be bearish. It's always important to have hedges, but hedges don't do you any good if you are over-hedging so always make sure you have a good balance (see Smart Portfolio Management) – something we'll be discussing in our Webinar series.