By Ilene

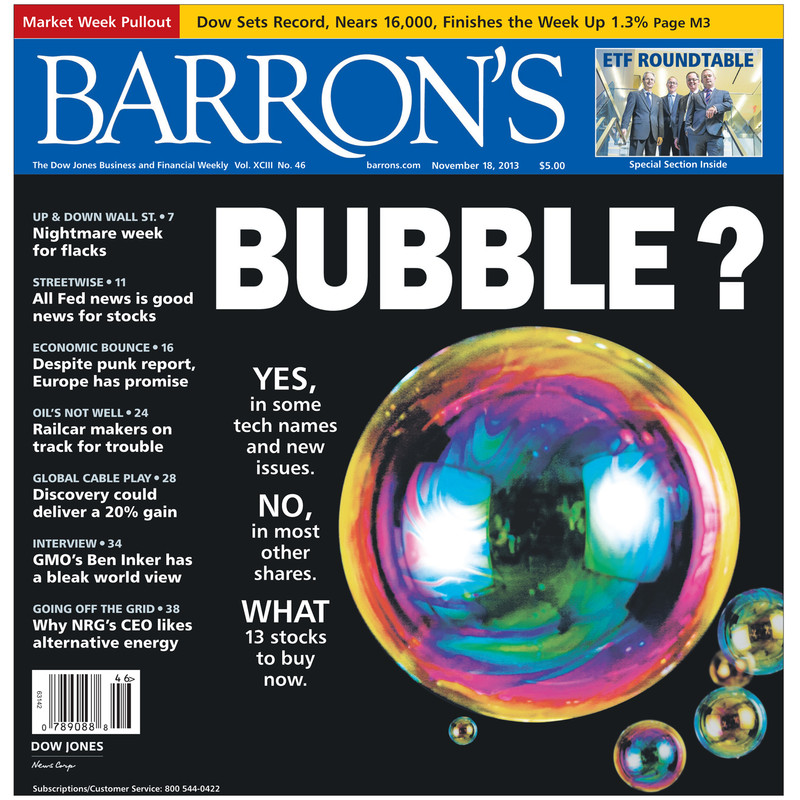

Are stocks in a bubble?

Doomsayers will argue that yes, stocks are at crazy high levels and this is another Fed-blown bubble. But Joshua Brown argues that only some stocks are in bubble territory; most aren't:

"Undeniably, there are few of them – in some areas of tech and in the IPO market. Also, some credit bubbles in terms of who can get debt financed at what price. But the entire marketplace or economy is not one giant bubble, as the Prophets of Doom will have you believe. Today’s Tech and IPO bubbles are symptoms of the economic improvement this time around – people feeling good about the future – but they are not the drivers of it." (Barron’s Gets the Bubble Meme Exactly Right)

So perhaps we're experiencing "bubblettes" rather than one gigantic all-encompassing bubble. Barron's agrees:

The widespread gains have prompted talk of a bubble similar to ones in 2000 and 2007. And in certain pockets of technology, including social media and cloud-related companies, that is no doubt true. Highfliers like Twitter (ticker: TWTR), LinkedIn (LNKD) and Workday (WDAY) all look overextended. And in the strongest IPO market since 2007, shares of up-start restaurant chains Noodles & Co. (NDLS) and Potbelly (PBPB) are rich enough to give you heartburn. (Bubble Trouble?)

According to Barron's, blue chip stocks, including financial, technology, and energy companies, are attractive with P/E ratios in line with long-run averages. The S&P 500 is currently valued at 16 times projected 2013 operating profits and at 15 times estimated 2014. Considering the very low interest rate environment, the S&P 500's valuation is not excessive. In addition, companies have room to further boost dividends. (Bubble Trouble?)

In other news, the countdown to the Debt Ceiling continues. The U.S. government will hit its borrowing limit on February 7, 2014. Major policy challenges are coming in January as government spending authority expires and ObamaCare continues its painful implementation.

Obamacare faces one problem after another. Cheaper rates will have to be offset with higher deductables. "Americans seeking cheap insurance on the Obamacare health exchanges may be in for sticker shock if they get sick next year, as consumers trade lower premiums for out-of-pocket costs that can top $6,000 a person" (Deductibles 26% Higher Make Cheap Rates a Risk).

In the stock market, Warren Buffett bought 40.1 million shares of Exxon Mobil. Berkshire Hathaway Inc disclosed a new $3.45 billion stake in Exxon, the world's largest publicly traded oil company. (Reuters).

JPMorgan agreed to pay $4.5bn to BlackRock and Goldman Sachs over "mis-selling" mortgage securities. This helps the company move on from litigation arising form its role in the mortgage crisis, but it's a separate deal from that with the US government over bad mortgages. (JPMorgan to pay $4.5bn over mis-selling mortgage securities).

Around the World

Venezuela is in chaos. The Financial Times reports: "Mr Maduro inherited an economic time bomb from former leader Hugo Chávez. Policy paralysis has led to dwindling hard currency reserves and galloping inflation of 54 per cent. There are rampant shortages of food and goods, which economists attribute to currency market distortions." Maduro's response, a war on "unfair prices," has lead to military occupation of electronic stores, looting and arrests of business people. (Venezuela’s president jails 100 businessmen in ‘economic war’)

China is moving broadly in the opposite direction by easing central controls and increasing "free market" activity. Ambrose Evans-Pritchard reports in China pledges free-market blitz but necessary freedom lags:

"China has launched the most radical reform blitz in more than 30 years, unveiling a raft of measures to ease social controls and pave the way towards a free-market consumer economy.

"The Communist Party vowed to break the suffocating grip of the giant state-owned companies, sweep away a tangle of price controls, move towards convertibility of the yuan and phase out caps on interest rates, all in the name of a 'mixed ownership economy'."

In addition to allowing more competitive pricing in various sectors in its "sweeping blueprint for reform," China plans to ease its ‘one-child’ policy. The Communist Party is promising "to loosen social controls including the decades-old 'one-child' policy and phase out state-controlled prices in a broad range of industries as part of an aggressive push to shore up support for continued authoritarian rule." (China to ease ‘one-child’ policy).

In the European Union, EU Citizenship Goes On Sale, Price War Breaks Out: "The path to residency and eventual citizenship has always been paved with money. The more money, the smoother the path. But now in the EU, citizenship (and a passport, one of the most prized in the world) is moving into the realm of not only the super-rich but the run-of-the-mill well-off. EU citizenship has become just another product that strung-out debt-crisis countries can sell in a competitive market by undercutting each other. And Malta just started a price war." Without govenment intervention, it looks like the price of EU citizenship is on its way down. Free market capitalism in action.

To counter low inflation and the treat of deflation, the ECB Considers Negative Deposit Rates. The Wall Street Journal reports, "The central bank's deposit rate has been set at zero for several months. Making it negative would effectively levy a fee on commercial banks that park funds at the ECB. That would be aimed at spurring bank lending to the private sector, which would boost growth and inflation. However, a negative deposit rate would also weigh on bank profits" (ECB Considers Negative Deposit Rates).

Curiosities

Have you been wondering what Timothy Geithner has been up to? Neither was I, but here's the answer: Nazis, Princesses, And Billion-Dollar Deals — Here's What You Should Know About The Firm Tim Geithner's Headed To.

All-nighters are not good for you. Adderall is not good for you. Taking Adderall to stay up all night isn't good for you. The details:

All-nighters cause the release of stress hormone and hormones to make you fat, wreak havoc with your concentration and memory, make you irrational and increase your risk illnesses (10 Ways Pulling An All-Nighter Messes Up Your Body). But you cannot fix the long-term effects with Adderall: "It's not all fun and games. Canada pulled the drug off the shelves in 2005 because it was believed to be the source of 20 deaths over ten years, according to NPR. So know what you're dealing with. (This Is What Adderall Does To Your Body.)

Crack cocaine isn't good for you either, but all Toronto can do about it mind-challenged mayor Rob Ford is to take away his money away and wait. "Toronto Mayor Rob Ford has made international headlines with his crazy antics this month — he's admitted to smoking crack cocaine in a 'drunken stupor,' made lewd remarks about oral sex at a press conference, and apologized for going on a bizarre, "extremely inebriated" rant about wanting to murder someone. It's mind-boggling that he's still in office and refusing to step down or take a leave, but there's really not much the city can do to remove him" (Here's Why Toronto Can't Fire 'Crack Mayor' Rob Ford). Now that's job security.

Have a message for that horrible ex-spouse of yours? Here's a unique way to convey it: Man Buys Home Next To Ex-Wife And Erects Giant Middle Finger Statue.