Welcome to the Grand illusion

Come on in and see what's happening

Pay the price, get your tickets for the showIf you think your life is complete confusion

Because your neighbors got it made

Just remember that it's a Grand illusion

And deep inside we're all the same. – Styx

Oh my God, I have run out of doveish metaphors to describe the Fed.

Like Austin Powers seeing a mole – all I can do is say dove, Dove, DOVE! Bernanke used his farewell speech last night to actually turn into a dove, fly around the room and poop on the Dollar, saying: "EVEN AFTER unemployment drops below 6.5%, and so long as inflation remains well behaved, the Committee can be patient in seeking assurance that the labor market is sufficiently strong before considering any increase in its target for the federal funds rate."

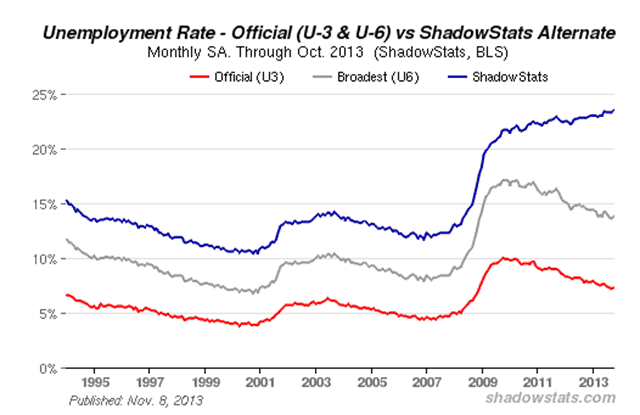

The OFFICIAL unemployment rate is just 7.3% and we're about 6 months away from seeing 6.5% – even if things go splendidly in the economy (and the Government doesn't shut down again in January) but the broader U6 unemployment rate is still more like 14% and ShadowStats calculates the actual unemployment rate (of actual people who want jobs but don't have them or people who want good jobs and have crap jobs) is more like 24% in the US, so we are miles and miles and miles and miles and miles away from 6.5%:

What the bulls should be concerned about is the LACK of reaction Bernanke's commentary is now getting. I attribute this to the fact that this amount of QE is more than fully baked into forward-looking market expectations and without MORE FREE MONEY (not same), there's nothing for the markets to get excited about. As I said to our Members in early morning Chat:

Put it this way: You are underwater and you are running out of air and you will drown if you don't get some so people bet you are going to die and your stock goes down.

Along comes the Fed and gives you oxygen and you feel better and now you're not going to pass out and you won't drown so your "stock" rises back to levels it was at before you started to drown.

The Fed keeps giving you oxygen and some people keep investing in your stock as if you will keep getting stronger and stronger until your stock is so high that you would have to win the triathlon to justify it, but both you and the Fed KNOW that the minute they take away the oxygen, you will simply begin to drown again…

The BEST case is you get back out of the water (out of trouble) and no longer need the oxygen – but that still doesn't magically make you a triathlete, does it?

Our markets are priced to win the Triathlon, the Decatlon and every other event next year, based on the fact that they have gotten over $2Tn worth of QE from the US, China and Japan this year, which added $3Tn worth of PRICE (not VALUE) to the S&P 500.

Our markets are priced to win the Triathlon, the Decatlon and every other event next year, based on the fact that they have gotten over $2Tn worth of QE from the US, China and Japan this year, which added $3Tn worth of PRICE (not VALUE) to the S&P 500.

Also factored in these days are Japan's "FANTASTIC" export numbers, which are nothing more than a reflection of the declining Yen. I had to scream about it last time there was a report and the Nikkei flew higher (and we shorted them successfully), but this time there's no reaction to the apparent 18.6% boost over last year, when the Yen was at 120 (now 100).

Interestingly, the Nikkei was 9,000 last year, now it's 15,000 – up 66% when, in fact, the economy is about the same. That's taking things a bit far on the expectations front and is a big part of the reason the World is in such a massive stock bubble. Now there's a wacky scheme to have tax incentives to push Japanese savers (who are sitting on about $8Tn) into the market. Why? Because without an influx of $1Tn next year, 15,000 on the Nikkei is unsustainable.

I like EWJ March $11 puts at .17 – 100 in the STP for $1,700 can turn into $5,000 on a $1 pullback (not even 10%) between now and then and we can pull 1/2 at .34 and have a free ride on the rest.

There are going to be lots of easy ways to make money in a declining market. In fact, we just picked a new TZA play in Member Chat on Monday that was net .13 on a $4 spread that will make 2,976% by January if the Russell drops 5% (to 1,060) over the next 58 days. You don't have to put a lot of cash into that hedge to protect a portfolio – do you?

Though the market didn't move down very much, we are so aggressively short in our Short-Term Portfolio that we gained a virtual $20,000 in a single day – THAT's how easy it is to make money in a bear market and THAT is why I wanted to have plenty of cash on hand – to take advantage of these opportunities as well as to lock in our ill-gotten gains on long positions.

Though the market didn't move down very much, we are so aggressively short in our Short-Term Portfolio that we gained a virtual $20,000 in a single day – THAT's how easy it is to make money in a bear market and THAT is why I wanted to have plenty of cash on hand – to take advantage of these opportunities as well as to lock in our ill-gotten gains on long positions.

Tomorrow, we're going to do a webinar with Wealth Creation Investing at noon (EST) tomorrow, where we will discuss these and other hedging strategies. You can sign up for it here.

Today's money-making opportunity should be oil shorts off the 10:30 inventory. We already had a bit of fun shorting the Futures (/CLF4) this morning but now they are having their normal 9am run into the NYMEX open and we'd love to see them get back to $94.50 again as we caught a $1 move down off that mark yesterday, which was good for $1,000 per contract on the short side! This morning it's nickels and dimes until the 10:30 inventory report, when those last few contracts will need to be rolled out by the end of the day.

We're importing 20% less oil than we did at the start of this century yet we're still paying 400% more than we did under Clinton in the 90's ($20 per barrel or LESS). Part of it is a reflection of the weaker Dollar and part of it is rising demand from China but most of it is because of the blatant manipulation of the energy markets that has been allowed under the Commodity Futures Modernization Act of 2000.

We're importing 20% less oil than we did at the start of this century yet we're still paying 400% more than we did under Clinton in the 90's ($20 per barrel or LESS). Part of it is a reflection of the weaker Dollar and part of it is rising demand from China but most of it is because of the blatant manipulation of the energy markets that has been allowed under the Commodity Futures Modernization Act of 2000.

It's not just energy markets that went wild under the relaxed regulations – derivatives are now topping $1,500,000,000,000,000 – $1.5 QUADRILLION Dollars or 25 times the size of the entire global economy. That's double the size it was at when Warren Buffett warned us about the danger of these "weapons of mass financial destruction", shortly before the last crisis and I warned you that you'd better practice saying Quadrillion to discuss the economy way back in January.

Just another one of those "tiny" bubbles the Fed is blowing…