It's that time yet again.

It's that time yet again.

Back in early September, when we broke over the 5% line on the S&P (1,680), we decided it was time for "5 More Trade Ideas That Make 500% in an Up Market" as a follow up to our April 14th's 5 Trade Ideas, that were already on the way to hitting all of their goals. Those 5 new trade ideas were:

- ABX 2015 $13/18 bull call spread at $2.80, selling 2015 $15 puts for $2.05 for net .75, now .26 – down 65%

- 8 QQQ Jan $75/80 bull call spreads for $3 ($2,400), selling 1 ISRG 2015 $300 put for $23.50 ($2,350) for net $50, now net $2,072 – up 4,044%

- HOV 2015 $3/5 bull call spread at $1.25, selling $4 puts for .90 for net .35, now net .57 – up 62%

- EWZ 2015 $44/49 bull call spread at $2.60, selling $35 puts for $1.95 for net .65, now net $1.30 – up 100%

- CROX 2015 $12/17 bull call spread at $2, selling $12 puts for $1.90 for net .10, now net .35 – up 250%

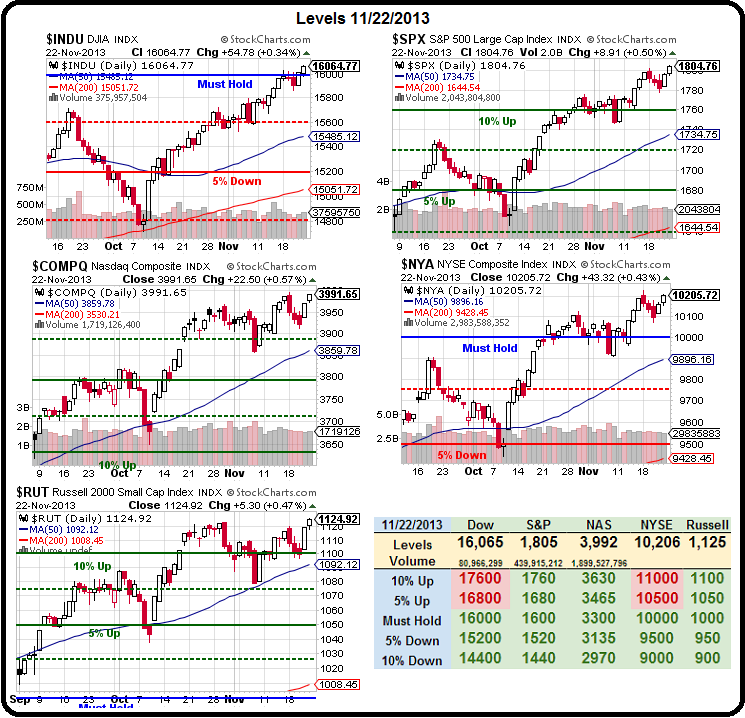

ABX is "off track" (so we like it for a new play) and QQQ is way ahead of projections and the others are merely "on track" for our expected gains. Now that we have our holy trinity of index levles (Dow 16,000, S&P 1,800 and Nasdaq 4,000), we can use the 2 out of 3 rule to make some new aggressive plays on the indexes – as we have excellent indicators that tell us exactly when to stop out (failing 2 of 3 lines).

With EWZ "only" up 100%, gaining .65 out of our expected $3.35, it still has a long way to go and we do expect Brazil to catch up if the rest of the Global markets keep going like gang-busters. We don't like playing China because, if the wheels are going to fall off this wagon, those wheels are very likely to be the first to go!

As we have discussed ad nauseum, all of the global equities have become dangerously over-priced but that's because the coordinated policies of the World's Central Banksters is to chase people out of all alternative forms of saving and into the equities markets where the IBanks, Brokers and Fund managers can make a fortune in fees and our Corporate Masters are able to have access to all the capital they could possibly want at depression-level prices.

As we have discussed ad nauseum, all of the global equities have become dangerously over-priced but that's because the coordinated policies of the World's Central Banksters is to chase people out of all alternative forms of saving and into the equities markets where the IBanks, Brokers and Fund managers can make a fortune in fees and our Corporate Masters are able to have access to all the capital they could possibly want at depression-level prices.

Still, no point complaining about it, those are the rules of the game and, if we're going to play the game – then we need to follow the rules, right? For now, the rules say equities and our ABX trade is a hedge against people panicing out of equites so we'll take that as a given and let's go on and pick 5 new trades that can make us winners if the game continues as is (and our index levels let us get out with little damage):

QQQ is still my favorite long because, if Nasdaq 4,000, why not Nasdaq 5,000? That only gets us back to where we were in 2,000 and it's been 13 years, so why not? Well, I could list 1,000 reasons why not but that's not the topic of today's game.

Today we have the BOE (run by GS alumni Mark Carney) promising to continue QE and the BOJ celebrating nearly dropping the Yen to 102 to the Dollar last night (down 25% in just one year!) and we're even letting Iran join the party (see Morning Alert to Members for news, which I tweeted too)

- Assuming the Nasdaq goes up 5% more by March (or next week, the way it's been going), I like the QQQ March $83/88 bull call spread at $2.18 and we can, like the above spread, offset some of those with a short put on something we'd REALLY like to own if the market does sell off, like AAPL 2015 $450 puts at $32.50. As long as you REALLY want to own 100 shares of AAPL for $450, you sell one of those contracts for $3,250 and use it to buy 10 of the spreads for $2,180 and you still net a credit of $1,070 with a potential upside of $6,070 (567%).

- As you can see from our Big Chart – the Dow is the lagging index and we always like DDM and last week's Dec $102/110 bull call spread at $4.50 is already up 36% in a week so why not play it for the longer-term and use the April $105/115 bull call spread at $5, which has 100% upside on it's own and we can drop that by $4, selling CAT 2016 $60 puts. That obligates us to buy CAT for $60 (now $82.88), which is 27% off the current price – not the worst outcome! If all goes well, we pick up $10 on the spread and the short puts expire worthless for a 900% gain.

See how easy it is to make money in an up market? I keep pointing this out in our monthly Trade Reviews, where most of our trade ideas are bullish and we've been getting ridiculous results like 86 out of 102 (84%) winners in Sept and, so far, in our October review, it's 38 winners and 6 losers (86%). Keep in mind that we PURPOSELY pick trades on both sides so we don't get too bullish or too bearish so, if we get to 100%, we're probably not doing our job correctly!

See how easy it is to make money in an up market? I keep pointing this out in our monthly Trade Reviews, where most of our trade ideas are bullish and we've been getting ridiculous results like 86 out of 102 (84%) winners in Sept and, so far, in our October review, it's 38 winners and 6 losers (86%). Keep in mind that we PURPOSELY pick trades on both sides so we don't get too bullish or too bearish so, if we get to 100%, we're probably not doing our job correctly!

In truth, we shouldn't be making this kind of upside money – it's ridiculous. That's why we got very nervous last week and I called for CASH, which means taking all these short-term winners off the table and making sure the long-term trades we're leaving on are well-hedged. That's make minced-meat out of our Short-Term Portfolio, which is now way too bearish – but it's easy enough to fix with a few upside trades like the ones we are discussing here.

We're still short in the short-term view and these upside trades (we'll find more in our Member Chat) are hedges that will pay us well IF the market keeps going higher. Trading in this low-volume, holiday-shortened week will not tell us anything useful but, with these very obvious stop lines – there's no harm in taking some more bullish pokes.