Courtesy of Pam Martens.

Unless you’ve been lost at sea since 2008, you’ve likely heard time and again that the Federal Reserve is creating money out of thin air. Type the words “Federal Reserve creates money AND thin air” into the Google search engine and you’ll find about 2.4 million people weighing in on the subject, including folks at PBS.

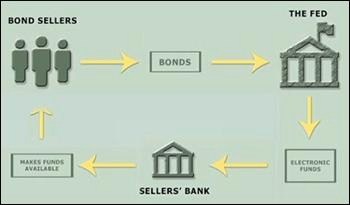

There’s no reason for the debate. The Federal Reserve has put out its very own video explaining how it creates money. It prefers the phrase “newly created electronic funds” to the colloquial “out of thin air.”

The video is narrated by Steve Meyer, a Senior Advisor to the Federal Reserve Board of Governors, who explains how the Fed has been paying for those trillions in bond purchases since the 2008 crash. Meyer says on the video:

“You may wonder how the Federal Reserve pays for the securities it buys. The Fed does not pay with paper money. Instead, the Fed pays the seller’s bank using newly created electronic funds; and the bank adds those funds to the seller’s account. The seller can spend the funds, or, can simply leave them in the bank. If the funds stay in the bank, then the bank can increase its lending, purchase more assets, or build up the reserves it holds on deposit at the Fed. More broadly, the Fed’s securities purchases increase the total amount of reserves that the banking system keeps at the Fed.”

The Fed has even included a cute little graphic, included above, to educate the public on how this all works.

…