To shop or not to shop, that is the question?

To shop or not to shop, that is the question?

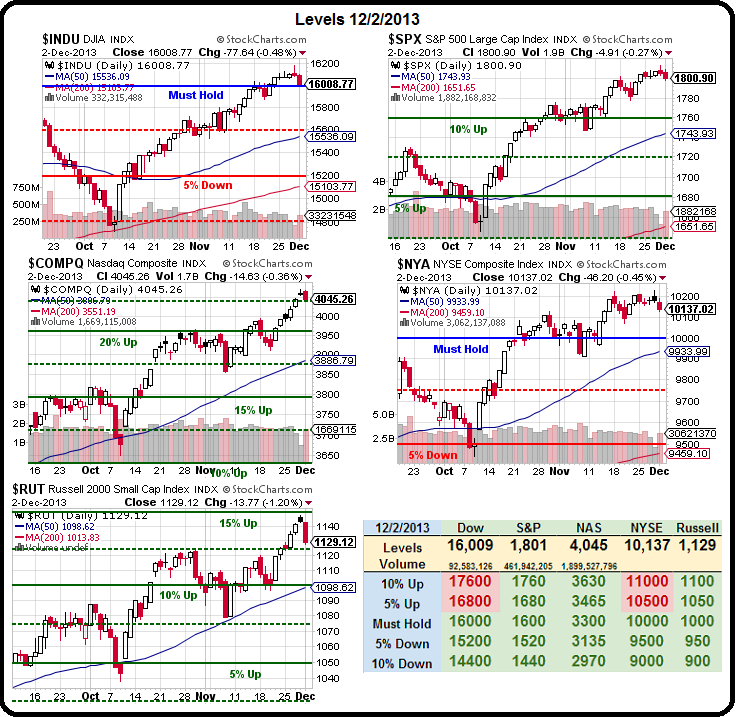

Today the question is also whether or not we should do a little bottom-fishing on this very minor pullback in the markets. To date, bottom fishers have been continuously rewarded (while our short positions have been pounded) but, on the whole, this is nothing more than the sell-off we expected – and just the start of it at that.

Our premise is that the Fed is already well baked into these index levels and now we need to see improving economic numbers to back up the exhuberance, which has taken us up about 15% since early October (1/2 the gains for the year).

Does 15% in 2 months seem like a lot to you? If we keep going at this pace, we'll be up 90% in 12 months and, while that may seem extreme, the S&P was at 666 in March of 2009 and now, just 4.5 years later, it's at 1,800 – up and AVERAGE of 37.5% per year since the Fed started meddling in the markets.

The Fed is not likely to stop meddling and, if we assume they meddle perfectly and there is no blowback ever, then we can look forward to another 37.5% next year and the Fed seems to have "learned their lesson" from the end of previous QE programs and is running QE3 without an end date, as the ends of QE1, QE2 and Twist all lead to decent pullbacks:

As we have demonstrated 3 times this year with our series of "5 Trade Ideas that can Make 500% in a Rising Market," as long as we can count on the Fed to keep things going, we will have endless opportunities to increase our wealth. I just finished writing up the first two weeks of our October Trade Review and a ridiculous 51 out of 59 trade ideas are already winners – and that includes the hedges! I'd say it's like shooting fish in a barrel but good luck shooting 86% of the fish…

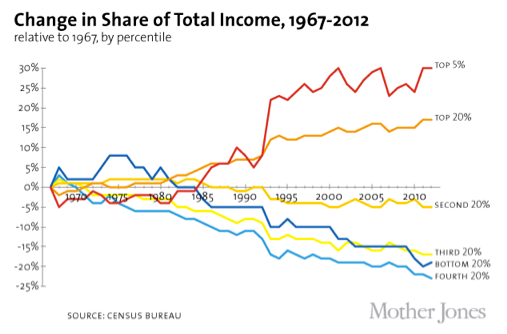

This is how the Fed transfers money to the top 1% folks. They pay the poor folks 0% on their savings while encouraging them to spend money in our factories and businesses with low financing rates.

This is how the Fed transfers money to the top 1% folks. They pay the poor folks 0% on their savings while encouraging them to spend money in our factories and businesses with low financing rates.

That, then pushes them into debt spending (what do we care, as long as we get our cash?) and the poor folks are placated because they can still afford a few nice things (XBoxes, IPads, IPhones, Cars…). Meanwhile, we turn around and invest the money they give us into the ever-rising equity markets while paying ultra-low margin rates so we can lever our already tremendous advantage.

With the speed at which the wealth gap is widening in the US, you are either playing this game or your are going to be left at the station!

The Fed is dilluting the money supply at a rate of nearly 10% per year and, of course, the money they spend only increases the overall debt the little people will have to pay down the road (while we get our tax cuts to stimulate the economy).

The Fed is dilluting the money supply at a rate of nearly 10% per year and, of course, the money they spend only increases the overall debt the little people will have to pay down the road (while we get our tax cuts to stimulate the economy).

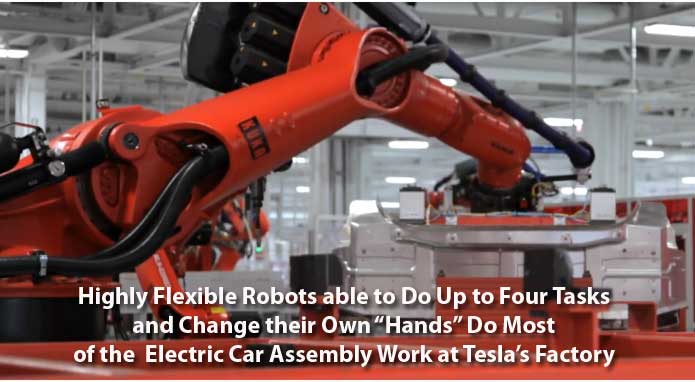

Rather than finding ways to create jobs, guys like Jeff Bezos realize they can borrow Billions at very low rates to invest in robots to run his warehouses and even to deliver his merchandise – how long before millions of additional jobs are replaced by the next generation of machines – Bezos hopes 5 years or less!

The math is simple, I can hire a kid to deliver pizza for minimum wage and pay him $15,000 a year or I can buy a $40,000 drone that I'll own for 10 years and pay it off with 3% financing for about $400 a month ($4,800 a year). At $1,250/month for the kid, the drone would have to cost $160,000 before it wasn't worth considering – below $80,000, it's a no-brainer and, if I don't do it, my competition will and price me out of business. Ah, Capitalism – what a bitch!

That's why we, at PSW, are smacking our lips as IRBT finally comes down in price again. A move back over $32.50 (200 dma) is now a buy signal for us and the lower they go, the more we will want them as IRBT ultimately has a million-man army to replace with battle drones. If you think you local pizza shop is excited about having robots that don't call in sick and don't get lost and just follow orders 24/7 – imagine how badly the army wants automated killing machines…

That's why we, at PSW, are smacking our lips as IRBT finally comes down in price again. A move back over $32.50 (200 dma) is now a buy signal for us and the lower they go, the more we will want them as IRBT ultimately has a million-man army to replace with battle drones. If you think you local pizza shop is excited about having robots that don't call in sick and don't get lost and just follow orders 24/7 – imagine how badly the army wants automated killing machines…

What we really need, however, is robots that shop because Black Friday was a bust based on the 2.8% week-to-week decline in ICSC-Goldman's same-store sales index. Despite extra store hours and heavy promotions, the report says consumers were cautious in their spending. In an offset, ICSC-Goldman's year-on-year rate shows more strength, at plus 2.5 percent in the latest week with the 4-week average slightly higher than October in what is a positive sign for the government's ex-auto ex-gas reading. Redbook will post its results for the Black Friday week later this morning at 8:55 and that one will really tell the tale.

Speaking of Goldman, they agree with my China idea from yesterday's post and have decided to add it to their "Top Trade Ideas for 2014" – it always makes me nervous when GS agrees with me but this one seems kind of obvious. Also obvious today was a long play on TSLA as Germany cleared them of having any manufacturing defects that led to their 3 recent fires on Model S cars. It's too late for the easy money as they are up about 6% pre-market (to $132) but that will trigger our own standing long covers over the $130 line.

A very easy way to get bullish on TSLA is the 2015 $80/145 bull call spread at $30.30. Yes, I know that seems silly but that's what it is with all the volatility. TSLA is at $130 and the 2015 $80 calls were $53 at yesterday's close while the $145 calls were $22.70 so net $30.30 on the spread with a $34.70 upside (114%) at $145 and, the best part is, the trade is STARTING OFF $44 in the money (even more this morning). IF TSLA goes down, you can THEN sell the 2016 $70 puts for $25 or better (now $14.50) to essentially pay for the spread and then your worst case is owning them for about net $75.

A very easy way to get bullish on TSLA is the 2015 $80/145 bull call spread at $30.30. Yes, I know that seems silly but that's what it is with all the volatility. TSLA is at $130 and the 2015 $80 calls were $53 at yesterday's close while the $145 calls were $22.70 so net $30.30 on the spread with a $34.70 upside (114%) at $145 and, the best part is, the trade is STARTING OFF $44 in the money (even more this morning). IF TSLA goes down, you can THEN sell the 2016 $70 puts for $25 or better (now $14.50) to essentially pay for the spread and then your worst case is owning them for about net $75.

This is just one of those 59 trade ideas we put up for Members every couple of weeks that people look back later and say "how did I miss that one?" That's why we do our trade reviews, to put some context into our picks so that, when similar conditions arise in the future, you are better ready to react to changing market conditions – because it's nothing we haven't seen before.