We have a budget deal.

We have a budget deal.

We don't have all the details yet but it seems like unemployment benefits won't be extended and that means about 1.5M people will no longer be considered unemployed – problem solved! The question for next week then is, will this cause the Fed to begin tapering and the answer is – NO!

Don't be silly, the Fed is not going to taper right before Christmas and we won't get the minutes of this meeting until late January so other than the usual 4-6 word change in the statement, what do people think is going to happen next Wednesday?

This will not stop the Financial Media from filling page after page and hour after hour of TV time with endless speculation on what the Fed will do next week and what it means for the economy and the markets but we're not going to play that game. They won't taper and then the media will seamlessly flip to speculating on the next meeting, giving no indication that they wasted your time for two weeks wondering about the last meeting.

Of course, wasting your time is what the Media is all about. 160M Americans don't work at all and 40M of the 140M that do work are only working part-time so the MSM better distract the proles before they look around and realize how badly they are being screwed by the top 10M people, who have made 95% of the economic gains in the past 30 years.

As long as we can keep our lower classess comfortably numb, all is well and we can keep on raking in the big bucks. We held our weekly Webinar yesterday at 2pm and, at about 2:40, I showed our Members a simple way to profit from the end of day market manipulations on the Russell by selling TNA puts. In this case, we sold the TNA weekly $72 puts for $2.22 into the close and they closed at $1.95, which was up 12% in about an hour and should do even better this morning. Beats working at Wal-Mart, right?

Even a Wal-Mart worker could have put some cash into our weekend trade on ABX (in a post we tweeted out), which was buying the 2015 $15/25 bull call spread for $2.30 and selling the 2016 $13 puts for $2.25 for net .05. Assuming they had the margin ($140 per contract), a minimum wage worker could have put $200 cash into 40 contracts and already that spread is worth $100 per contact or $4,000 off of $200 invested in just 2 days (up 1,900% on cash), gaining about 6 months of take-home pay at WMT in 48 hours.

The only problem is, the average Wal-Mart employee doesn't have $5,600 in margin, nor do they have options accounts, nor do they have time to invest because they are busy WORKING! This is how The Man (that's us!) keeps the workers down. We pretend it's the land of opportunity but the barriers we erect in our playgrounds assure us that only people who are like us can get in. Thus, the rich get richer while the poor watch TV.

We added another ABX play for our seminar people who missed the original entry (see out Tweet for details) while we pressed our bearish bet on oil by taking off our hedged short call on SCO. That left us very bearish on oil (/CL on the Futures) at the $98.50 line into today's inventories but, as I explained in the seminar, there are macro forces at work that make us confident.

Yesterday morning, I pointed out that our 10 QQQ March $83/88 bull call spreads, paid for by selling a single AAPL 2015 $450 short put for net $430 was already at $610, which was a ridiculous 42% gain in 2 days but now, a day later, it's $760, now up 76% on day 3! How can people not see we're in a bubble when you can make money this quickly? Well, we'd better get ours while it lasts, right?

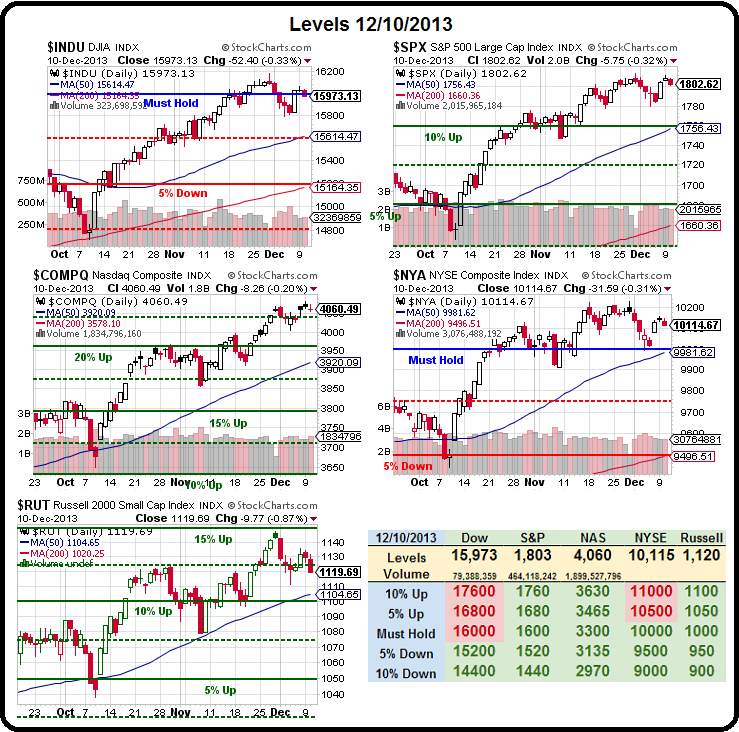

We took that money and ran in our Short-Term Portfolio yesterday as we were concerned the Nasdaq would sell off and it did, but not very much but that's OK as we have plenty of other trade ideas still in progress with 500% or better upsides and I still have 3 more to add to our weekend spread. As long as we have these lovely support lines to play off of (stopping out of our if they fail), then we're not too worried about making aggressive upsdie trades – as we've been doing all year long each time they find new support on our Big Chart:

The budget deal should get the Dow back over the 16,000 line and you can still play the DDM April $105/115 bull call spread from our pre-Thanksgiving post (5 MORE Trade Ideas That Can Make 500% in a Rising Market) but we'd have to find another offset as CAT went off to the races on us, which was great for the trade (now up 150%) but not good for a re-entry.

FCX, on the other hand, is at $34.89 and you can sell the 2016 $30 puts for $4.25 and that net's you into the $10 DDM spread for net 0.75 with a $9.25 upside (1,233%) and DDM is already at $107.05, $2.05 in the money (up 173% to start if FCX stays over $30 and the short puts expire worthless). Since your worst case on this trade is owning FCX for net $30.75 and that's 12% off the current price – this is a very reasonable, but very aggressive bullish play to make while the Dow is over 16,000.

FCX, on the other hand, is at $34.89 and you can sell the 2016 $30 puts for $4.25 and that net's you into the $10 DDM spread for net 0.75 with a $9.25 upside (1,233%) and DDM is already at $107.05, $2.05 in the money (up 173% to start if FCX stays over $30 and the short puts expire worthless). Since your worst case on this trade is owning FCX for net $30.75 and that's 12% off the current price – this is a very reasonable, but very aggressive bullish play to make while the Dow is over 16,000.

So attention Wal-Mart workers, we have another trade idea for you and, as long as you have $3,000 in margin, you can invest net $750 of cash into this trade and hopefully get $10,000 back in April if the Dow keeps going higher. If the market crashes (and you fail to stop out below the 16,000 line), the worst case is you'll have 1,000 shares of ABX for $30,750 in your retirement account – best of luck and thank you for working at Wal-Mart!

Please keep in mind that we are BEARISH and these are defensive upside hedges that should be stopped out if S&P fails 1,800 or Dow fails 16,000 or Russell fails 1,120 or NYSE fails 10,000 or Nas fails 4,000 (any two is a signal to get out!), We are very bearish in our Short-Term Portfolio but that's no reason we can't profit on these silly moves up while we wait…