What a crazy market!

What a crazy market!

Super-fast drops followed by rocket pops. On the whole, we haven't really gone anywhere since Thanksgiving but, like any good roller-coaster that drops you off right where you started, what a ride!

In our Member Chat Room, we're in the process of identifying "5 Marco Trade Ideas for 2014" for Tomorrow's FREE Webcast (12 Noon), which you can sign up for RIGHT HERE.

This is a bonus Webcast to our usual weekly broadcast and you can join us today at 2pm using this link, which should be an exciting time for it! For the moment, we're going to have to respect the technicals and call yesterday's move bullish and constructive but not much of it matters ahead of the Fed and, if you haven't gone to cash – now is still a good time! That includes our recent "5 MORE Trade Ideas That Can Make 500% in an Up Market," which were:

- 10 QQQ March $83/88 bull call spread at $2.18 ($2,180), selling 1 AAPL 2015 $450 puts for $32.50 ($3,250) for a net $1,070 credit, now net $200 so $1,207 in pocket – up 112%

- DDM April $105/115 bull call spread at $5, selling CAT 2016 $60 puts for $4 for net $1, now $1.15 – up 15%

- 5 DBA 2016 $22/26 bull call spread at $2.20 ($1,100), selling 5 $21 puts for .65 for net $1.75 ($875) and one CAT 2016 $60 put for $400 for a net $175 credit, now net $895 – up 611%

- AAPL 2016 $450/600 bull call spread at $60, selling $400 puts for $35 for net $25, now $72.50 – up 190%

- T 2015 $30/35 bull call spreads at $3.45, selling 2016 $30 puts for $2.85 for net .60, now net -.42 – down 170%

4 out of 5 is not bad and T is at $34.15 so nothing to worry about – it's just the higher VIX making the puts and calls we sold more expensive relative to the calls we own but, if T expired at $34.15, that -42 would jump over 1,000% to +$4.15. This is why it is CRUCIAL that you LEARN about options and don't just trade them. If you don't understand WHY they show certain balances at certain times, you can get pushed out of perfectly good trades (like T) just because the balance currently LOOKS bad.

4 out of 5 is not bad and T is at $34.15 so nothing to worry about – it's just the higher VIX making the puts and calls we sold more expensive relative to the calls we own but, if T expired at $34.15, that -42 would jump over 1,000% to +$4.15. This is why it is CRUCIAL that you LEARN about options and don't just trade them. If you don't understand WHY they show certain balances at certain times, you can get pushed out of perfectly good trades (like T) just because the balance currently LOOKS bad.

That's why, at PhilStockWorld, we stress EDUCATION first, then play! So that T play is still EXCELLENT for a new trade and DBA is obviously good too but I'd take the money and run on the others – even though they still have plenty of upside remeaining as I just don't trust this market not to crash over the next 30 days.

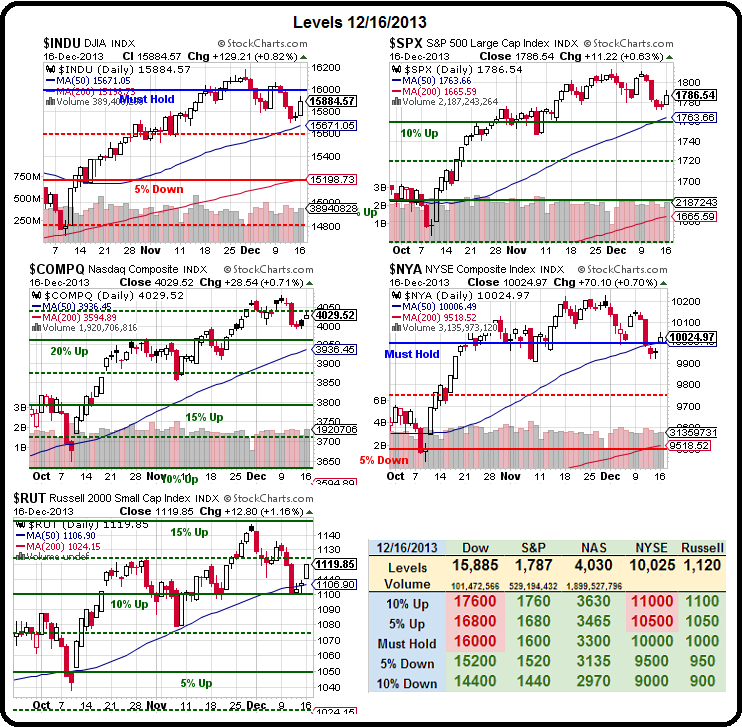

BUT, if it doesn't crash, we can use our bullish lines of Dow 16,000, S&P 1,800, Nasdaq 4,000, NYSE 10,000 and Russell 1,100 (3 of 5 is good) to set new bullish trades and that leads us to the part where we discuss our new candidates, but, unfortunately, only for our Members (you can become one here):

From chat yesterday, out top candidates are: ABX, CLF, GILD,

NLY, CIM, FTR, AAPL, F, SHLD, DE, TITN, CMCSA, BKW, NYMT, CP , AB, HBAN, SO, PBR, HOV, POT and IRBT. If I missed anything good – let me know in chat but let's take a crack at them all, alphabetically, I guess as they are all stocks that may be worthy of our new Income Portfolio in January.

How will we decide which ones to buy? Well, like T (which we should include), we'll pick the ones that get cheaper between now and then and wait PATIENTLY for the ones that are expensive to come back down again (as they usually do over time).

Goldman Sachs has put out their "Top 10 Macro Themes for 2014" and it's worth a read because a lot of people follow GS. It doesn't make them right but it does make them influential. The short story is GS is telling people to stick to developed markets, avoid commodities, no easing in sight and China growth stabilizes around 7.5%. I'd say the main way I disagree with them is I don't see how the Fed can keep this up for another year – we're really testing the concept of QEForever.

Let's talk commodities first. If the Global Economy is on the mend, then why not commodities? If the Dollar is racing the Euro, Yen, Rupee and Yuan to the bottom of the value pit – then why not commodities? Bitcoins are $1,000 because people don't trust currency but gold is $1,200 and silver is $19.50? Something is wrong (and it's probably Bitcoin!) so I do like gold plays like ABX ($17.05), NAK ($1.23), IAG ($3.50), HMY ($2.47) as well as CLF ($23.76 iron), FCX ($34.60 copper/gold), CP ($149.68 oil), PBR ($13.61 oil) POT ($30.74 fertilizer) and MJNA (0.10 pot).

We are, of course, already in some of these in various PSW porflios and we've discussed almost all of them at length over the course of the year but, for the purposes of a new entry at current prices, the edge goes to whoever has the best puts to sell to give us a cheap entry. That prize goes to:

- ABX, whose 2016 $15 puts can be sold for $2.92 for a net $12.08 entry, which is 29% below the current price. ABX is our favorite way to play gold.

- CLF, whose 2016 $18 puts can be sold for $4.40 for a net $13.60 entry, which is 42% below the current price.

- IAG, who's 2016 $2.50 puts can be sold for .55 for a net $1.95 entry, which is 44% below the current price

- POT, whose 2016 $25 puts can be sold for $2.70 for a net $22.30 entry, which is 27% below the current price.

Let's say we have a $500,000 Income Portfolio. Our allocation blocks would be $50,000 each (1/20th of our 2x buying power) and we'd be willing to risk owning up to $25,000 of any of these at a 30%ish discount. With ABX, for example, we could sell 20 of the 2016 puts and collect $5,840 and we obligate ourselves to buy 2,000 shares of ABX for net $12,08 ($24,160) should they be below $15 in 2016. Otherwise, we keep the $5,840 and move on.

Let's say we have a $500,000 Income Portfolio. Our allocation blocks would be $50,000 each (1/20th of our 2x buying power) and we'd be willing to risk owning up to $25,000 of any of these at a 30%ish discount. With ABX, for example, we could sell 20 of the 2016 puts and collect $5,840 and we obligate ourselves to buy 2,000 shares of ABX for net $12,08 ($24,160) should they be below $15 in 2016. Otherwise, we keep the $5,840 and move on.

Since the goal of an Income Portfolio is simply to make 10% a year ($50K) that's the only trade we need to make this month to be on track to our goal.

Or better yet (much better!), we don't put all our eggs in one commodity basket and do a smaller allocation for each of our top 4 picks in that sector. Then, next month, we'll see how they are performing – no rush when you REALLY want to own the stock and your short puts are all the way out to January, 2016. So, officially, we'll likely do about a $10K obligation for each one and see how it goes.

Next we'll talk Finance. Under that category (all very affected by Fed decisions), we'll include AB ($21.39 investment management, 7% dividend), CIM ($3.03 mortgage RIET 11.5% dividend), HBAN ($9.51 bank), HOV ($5.43 builder), NLY ($9.82 mortgage RIET 13.3% dividend) and NYMT ($7.27 mortgage REIT 15.9% dividend).

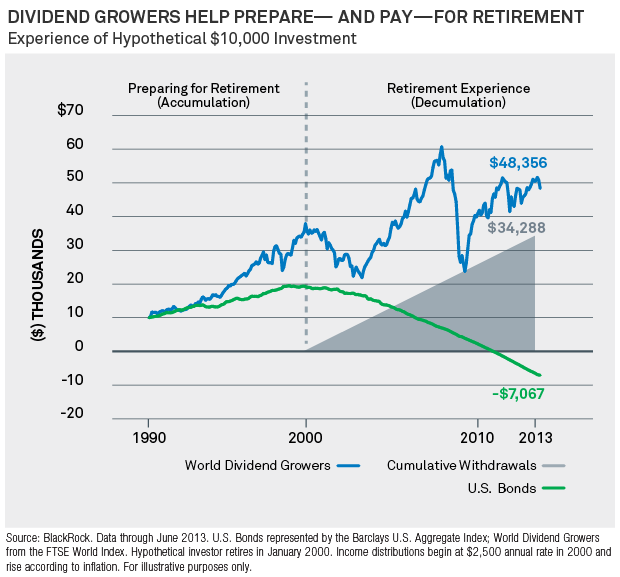

With the Dividend Payers, we make a different type of decision, as it's not always about getting a cheap entry but about capturing the dividend itself, which we need to do with stock ownership. As an Income Portfolio matures, dividend payers are the bread and butter of the group. For various reasons, I believe our 3 best bets in this category are:

- Buying CIM at $3.03, selling 2015 $2.50 calls for .70 and $3 puts for .45 for net $1.88/2.44

- Buying HOV 2015 $4/7 bull call spread at $1.30, selling 2016 $4 puts for .80 for net .50

- Selling NYMT July $7.50 puts for $1.20 for a net $6.30 entry

As with the commodities, we are best off allocating about $10K to each position so we'd buy 4,000 shares of CIM for $7,520, 25 of the HOV spreads where our worst-case would be a net $4.50 entry (17% off) and sell 15 of the NYMT puts and collect $1,800 for our troubles there because $1.20 is more than a year's dividend ($1.08) for NYMT so why buy them for $7.27 when we can net in for $6.30 (20% off) and, if they hold $7.50, we're making 19% in just 7 months.

This chart from BLK does a good job of illustrating the long-term value of dividend-paying stocks, especially when compared to bonds! This is the goal of our Income Portfolios, to allow us to draw a steady income from our stocks while letting the principle grow over time. As we plant our trees, we may have to cull some but many will bear friut – in the form of dividends, call and put sales or simple price appreciation and, if we're not too greedy and keep at it – eventually we'll have a forest of our own.

Well, time for the opening bell – we'll finish this up tomorrow.

Keep in mind these are plays for next year IFF our index levels are holding. If not, we wait for better opportunities!