Courtesy of Lee Adler of the Wall Street Examiner

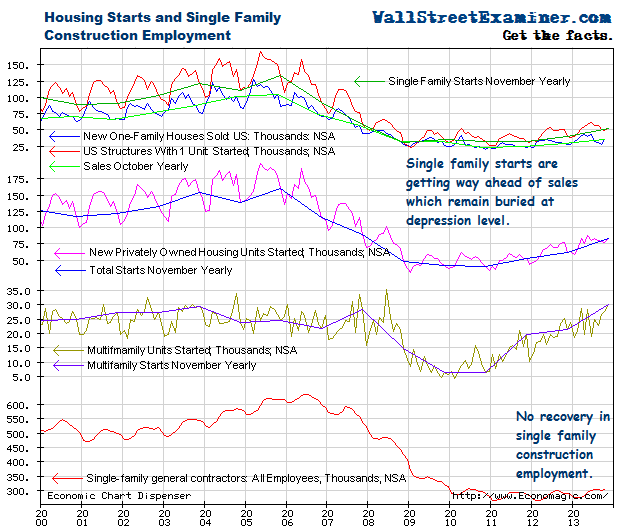

Looks can be deceiving, especially when they are financial news headlines. The way the media is reporting this morning’s housing starts news, you would think that housing is booming. The headline number for total starts, seasonally adjusted and annualized (in other words total statistical BS) was reported at 1.09 million units. The consensus expectation was for 950,000. The headline writers went nuts on that. But the chart above provides some perspective. It shows the actual monthly numbers, not seasonally adjusted, along with lines showing the year to year trend for the current month going back to 2000 for perspective.

The “recovery” in total starts is mostly driven by the boom in multifamily. Single family starts are well off the lows, but they are still only half of the levels 2000-2002, when the US was in another recession. Not shown on the chart, the current level of single family starts is only equal to 1991 levels. That’s in spite of the fact that the nation’s population has grown by 25% since then. And 1991 was a terrible year.

Two other trends are notable on the chart. The gap between single family starts and sales is growing. Supply is outrunning demand in new single family construction. Inventory is building. That trend will force a slowdown in starts at some point unless sales increase faster, which doesn’t seem likely.

Meanwhile single family construction employment is stuck near the depression lows. Builders have found ways to increase production without increasing employment much. There’s no contribution to overall employment growth here.

So much for the widely touted recovery in housing starts. It’s not what the headlines make it out to be.

Get regular updates on the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, in the Fed Report in the Professional Edition, Money Liquidity, and Real Estate Package. Click this link to try WSE's Professional Edition risk free for 30 days!

Copyright © 2012 The Wall Street Examiner. All Rights Reserved. The above may be reposted with attribution and a prominent link to the Wall Street Examiner.