Courtesy of Lee Adler of the Wall Street Examiner

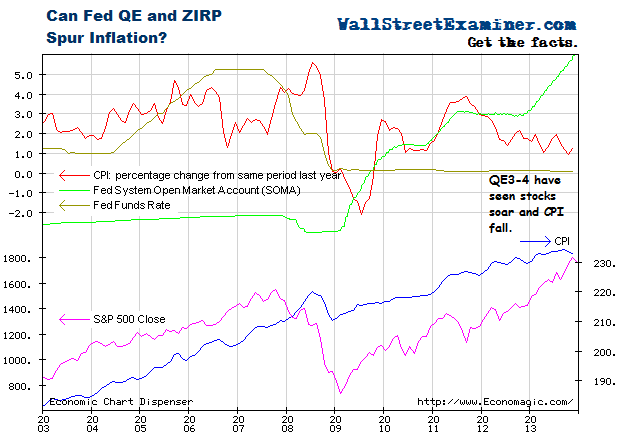

The headline Consumer Price Index for November was 0%, which was below the consensus guess of economists of 0.1%. Since the onset of QE3 and 4 in November 2o12, CPI has trended from an annual rate of 2% to now 1%. With the latest CPI data now posted, it’s an opportune time to go back and look at several other economic indicators, including key measures adjusted for inflation to show the growth rate in real constant dollar terms.

Last week I posted a chart of PPI showing that the Fed’s policies, far from boosting inflation, which is the Fed’s aim, are actually deflationary. The CPI shows more of the same. The latest round of QE accompanying a Fed Funds rate near zero have seen the CPI go negative month to month and approach 1% year to year.

The Fed is like a rat chasing its tail. The more money it prints and the more income it steals from America’s middle class and elderly savers, the less inflation it gets. The less inflation it gets, the more it is encouraged to print more money and keep ordinary Americans from earning a dime on their savings. In fact, the Fed is content to force many elderly Americans to consume their savings and be forced on to food stamps and Medicaid. Oh, sorry. No food stamps for you! Congress has cut those benefits to save a pittance on the deficit while restoring billions in military cuts.

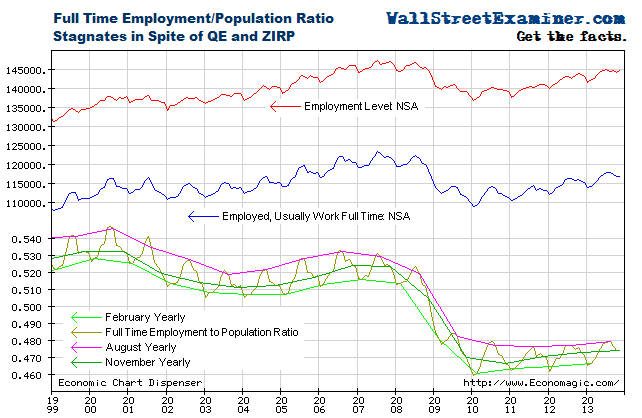

The Fed’s primary goal of QE and ZIRP is for stocks to rise so that all that newly created wealth (AKA fictitious capital) in the hands of the top 7% of the income strata will trickle down to the masses. After nearly 5 years of this shit, we are still waiting for that to happen, as a growing number of Americans constantly fall out of the labor force and those who remain see their wages stagnate. Five years of pumping free money to banks and leveraged speculators have left us with still only 47.5% of Americans having full time jobs.

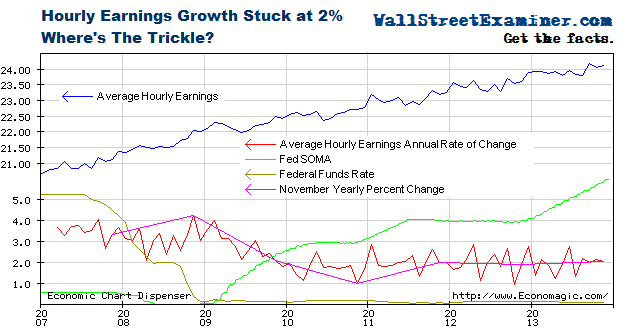

While the Fed has enforced ZIRP, the nominal growth rate of average hourly earnings has been stuck around 2%. For most of the past 4 years, that’s been at or below the CPI growth rate. Real wages have not grown at all. This has held whether the QE spigot was on or off. The Fed has pumped furiously for the past year and wages of the 48% of Americans who actually have a job have stayed stuck at 2% nominal growth. At least that’s better than for the millions who don’t have work at all. Meanwhile housing prices have risen 12.5% and stock prices 28%.

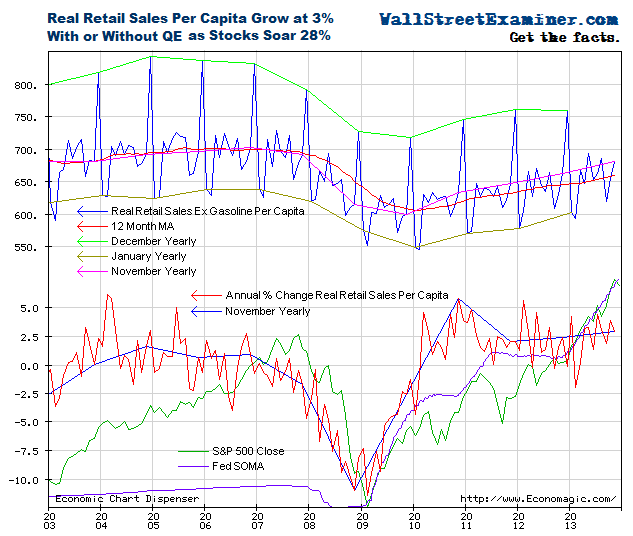

Real retail sales per capita, ex gasoline sales, rose 2.9% year over year in November. They’re all the way back to 2003 levels! But what’s responsible for that growth? Not most of the 52% of Americans not working. And not the 48% whose wages are growing at a 2% nominal rate. No, most of it is coming from that small percentage of Americans at the top of the income spectrum along with millions of foreigners who came to the US to shop. Many are ordinary Canadians who cross the border to shop a couple of times a month. Others are foreign tourists who come to the US from all over the world and spend thousands on every trip.

The data show that QE and ZIRP are failing to stimulate retail spending. Real retail spending growth per capita peaked at 5.8% in November 2010 after a 6 month pause in QE. The Fed started pumping again through June 2011 (QE2). Retail spending growth fell to zero over the course of QE2. The Fed then paused for 17 months over which time spending growth per capita rebounded to average around 2.5%. When the Fed started QE3-4 in November 2012, the growth rate was 2.5%. As of November 2013, the growth rate had risen to 2.9%. Over a trillion in printed money added to the financial repression of ZIRP in this round of QE has been associated with a net gain in real retail sales per capita of 0.4%. We can surmise where that came from. It was not the majority of Americans. These policies do not work for them.

The Fed’s aims for QE and ZIRP are to stimulate the economy, create jobs, and drive just a little inflation. It’s clear that the more it pursues these programs the less they work. They were correlated with a rebound in 2009 and 2010, but whether they actually caused that rebound or the economy had simply stretched as far as it was going to on the downside and was destined to recoil anyway can’t be known. The pundits who proclaim that the Fed “saved the world” are stating their assumptions, not fact.

Since the 2009-2010 rebound, it has become abundantly clear that the apparent correlation between QE/ZIRP and economic recovery no longer exists. Stock market gains have not trickled down. Inflation is subsiding, not increasing. While the rich get richer from their QE driven stock market gains, ZIRP continues to rob millions of Americans of their life savings and reduce their spending power. These immoral policies can no longer be justified on the grounds that they work. They do not.

Money printing and ZIRP are great for asset inflation–bubbles, if you will, but they actually depress CPI inflation and even cause deflation.

Get regular updates on the machinations of the Fed, Treasury, Primary Dealers and foreign central banks in the US market, in the Fed Report in the Professional Edition, Money Liquidity, and Real Estate Package. Click this link to try WSE's Professional Edition risk free for 30 days!

Copyright © 2012 The Wall Street Examiner. All Rights Reserved. The above may be reposted with attribution and a prominent link to the Wall Street Examiner.