Rally time!

Rally time!

The futures are holding yesterday's gains quite well this morning. Oil is almost back at $98 and it's hard to short anything in this FREE MONEY BONANZE but we are sticking to shorting that line on /CLH3. The Dollar is at 80.67, so it can go lower and push things higher still, so keep an eye on that and, of course tight stops! Gold is looking dead at $1,205 but it bounced off $1,200, which is the -2.5% line and that should hold, maybe a long opportunity (/YG in the futures) if retested.

Notice Dave Fry got a higher volume reading than I saw in Etrade and Etrade now says 126.6M on the Dow, so a ton of stuff came in at the end but you have to respect a move like this – especially if it holds through Monday. As Dave notes:

" Lastly, we should remember the taper is merely symbolic as the Fed’s balance sheet will continue to expand and QE will continue to go directly to the Primary Dealer network. These funds should then trickle down, as has been the pattern, to the stock market."

Better to be in cash than having flipped all short but, obviously, it would have been nice to join the bottom-fishers (who once again were rewarded) for a big win. We went over our top trade ideas for 2014 in yesterday's Webcast and, if we hold these levels, then we have plenty of places to deploy our sideline cash.

Better to be in cash than having flipped all short but, obviously, it would have been nice to join the bottom-fishers (who once again were rewarded) for a big win. We went over our top trade ideas for 2014 in yesterday's Webcast and, if we hold these levels, then we have plenty of places to deploy our sideline cash.

Still, we certainly made a big enough list of stocks over the last two days to play if this rally holds – so no lack of things to do with cash and no lack of potential returns if 2014 is as crazy as 2013 was.

Quad witching Friday is the watch-word, it's the EOQ for options and people who want to cash out gains before capital gains go up next year only have 7 more sessions to do so. Also, notice the volume bar for this week – yes it's 3 days but look how low – I'm sorry but yesterday's move still doesn't make for evidence of anything – notice last year on the chart – big blow-off spike on Dec 19th (Tuesday before expirations) to Dow 13,351 then back to 12,900 on the 31st (Monday) but THEN it flew up to 13,400 again on Jan 2nd. Let's face it, this market is insane.

But, that was 2,800 points ago (21%) and it's possible the forced the Dow down to 12,900 on 12/31 to hit the 13,100 finish to make the gains that much more impressive-sounding in 2014 – it's not like the Banksters didn't KNOW the Fed was going to give them $850Bn this year. As Dave continues in his morning post:

One thing Bernanke stated during his news conference was an acknowledgment that banks have adequate reserves currently. They’re not making sufficient business and consumer loans, meaning that even if the Fed supplied them with more money they wouldn’t be lending it. That was something striking that got little in the way of news or follow-up questions in my opinion.

The first move in the stocks after the Fed announcement was a sharp decline. But in keeping with the maxim, “the first moves the wrong move," stocks rallied back sharply nearly setting new highs as most indexes soared nearly 2%. Even if slightly reduced, QE would continue and so would low interest rates for a long time. The only fly in that ointment is bond vigilantes can always force a change in that theory.

I'm a little more concerned with what China was so upset about this morning. The Hang Seng and the Shanghai fell 1% and India was down 0.7% and the Nikkei gave up 1/3 of their gains but finished up 1.74% at 15,859 after hitting our shorting line at 16,000 EXACTLY and turning back down. Our trade idea for shorting the Nikkei at this level is the EWJ March $11 puts at .17.

I'm a little more concerned with what China was so upset about this morning. The Hang Seng and the Shanghai fell 1% and India was down 0.7% and the Nikkei gave up 1/3 of their gains but finished up 1.74% at 15,859 after hitting our shorting line at 16,000 EXACTLY and turning back down. Our trade idea for shorting the Nikkei at this level is the EWJ March $11 puts at .17.

There was good data on Housing Starts, 1.09M is the first time over 1M since 2008, so that's nice. It also means the Fed may be jamming us right back to a bubble but more housing is very good for the economy – so we'll call that a win and it's good for HOV, REITs as well as our material plays.

Europe is thrilled, they are up about 1.5% across the board. People are so happy, they may even free Pussy Riot.

I'm still happier in cash into New Years, it's not like it's going to be hard to make money if we're still over our lines (Dow 16,000, S&P 1,800, Nasdaq 4,000, NYSE 10,000 and Russell 1,100) in Jan and yes, we will be moving the Must Holds on the Big Chart up 10% when and if the Dow crosses 16,800 (and holds it) OR the NYSE crosses 10,500 (and holds it) but, for now, like early December, we still need them to prove these levels for more than a couple of days.

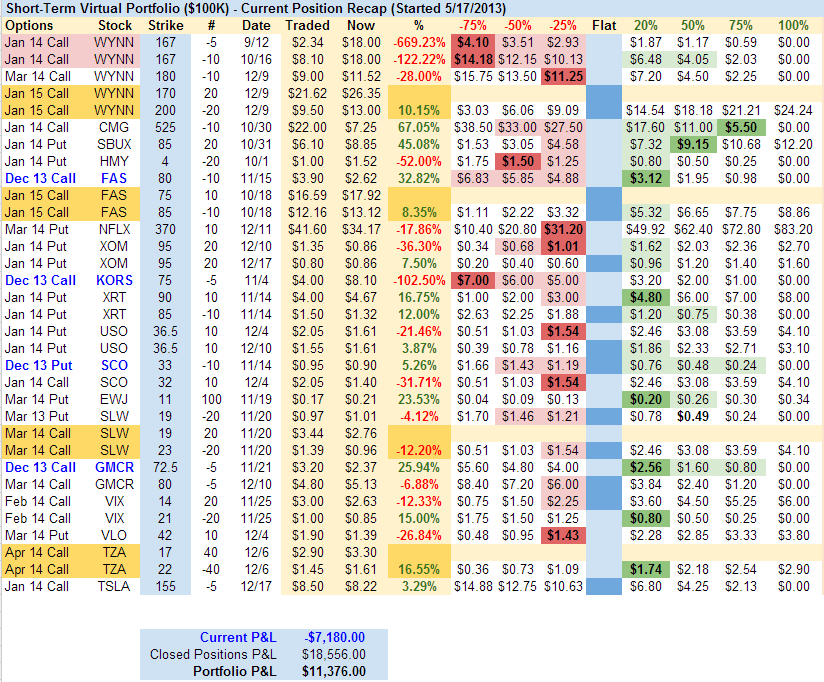

As I noted in yesterday's Webcast (and often this month) we were playing our Short-Term Portfolio short because the risk/reward profile was very skewed to reward a downside move. We expected the market to stop back here, at the prior highs, which gives us a chance to say we were wrong about the Fed crashing the market (we were) and get out of the trades with small losses.

As I noted in yesterday's Webcast (and often this month) we were playing our Short-Term Portfolio short because the risk/reward profile was very skewed to reward a downside move. We expected the market to stop back here, at the prior highs, which gives us a chance to say we were wrong about the Fed crashing the market (we were) and get out of the trades with small losses.

Had the market gone the other way, then our $11,376 gain (as of yesterday morning, now probably zero), would have quickly doubled and possibly had much farther to go. So better reward than risk, but now we'll see what the risk truly cost us. We're going to want to see more than just a day or two at these highs before we capitulate – especially with tomorrow being the last option expiration day of 2013, but next year, we're very happy to go bullish – providing these levels hold because, if nothing else, they give us very clear stop lines to get out if the market breaks the other way.

As of yesterday's close, Tuesday's DDM trade idea was still at just $1.15 (out of a potential $15), so I still like that one a lot for an upside play on the Dow! We already officially added T as a long-term trade and we'll see how our other ideas play out while we anticipate (assuming the market stays bullish) picking up the laggards after the holidays.

As of yesterday's close, Tuesday's DDM trade idea was still at just $1.15 (out of a potential $15), so I still like that one a lot for an upside play on the Dow! We already officially added T as a long-term trade and we'll see how our other ideas play out while we anticipate (assuming the market stays bullish) picking up the laggards after the holidays.

Meanwhile, the Fed just said there would be $120Bn less Dollars to play with next year than there were this year. I know, we are all very jaded and $120Bn doesn't seem like a lot of money but, even in today's World, it still is (the Ukraine only needed $15Bn and that was considered a crisis – perhaps AAPL should have bought them with money they can find under the sofa). So I'm still waiting to see if China's lack of excitement spreads out to other markets.

But that would be rational – we don't do rational in this market…