What a year this has been!

What a year this has been!

As you can see from Doug Short's S&P chart, we're now up 171% from our 2009 low of 666 but the mission is not yet accomplished at 1,833 – not with 1,850 so close and obtainable as a target for a 2013 finish that will put this year firmly in the history books – as well as in brochures that will be used to entice more people into the market next year.

On an inflation-adjusted basis, we are still 11% below 2000's ridiculous highs but keep in mind those highs only seem ridiculous in retrospect – at the time, people were predicting Dow 40,000 etc. Actually, at +115% from the lows, adjusted for inflation, Doug points out that we are still miles behind 1982-2000's epic bull rally, where the market gained a devilish 666% over 18 fabulous years.

There was, however, no massive influx of free money and ultra-low interest rates driving the previous rallies, other than the New Deal Rally of 1932-1937 – but that one didn't end too well. We can't expect the past to guide us when we have a Fed that is pumping the GDP of Mexico into the US Economy each year while Japan adds the GDP of the Netherlands to their economy. Always keep in mind the charts don't show you HOW we got those results – it's only the results that matter in those index prints.

In the above charts (also Doug's), it's very clear that the actual economy is NOT improviing – in fact, it's obviously getting worse. In fact, it's almost getting catastrophic and will be if the actual data of the 2013 Holiday Shopping Season doesn't miraculously turn around in the last two weeks of the year. Consumer Spending is 70% of the economy and we KNOW Government Spending, which is 20%, (other than the Fed) isn't picking up the slack and Corporate Spending couldn't make up that difference – even if they wanted to.

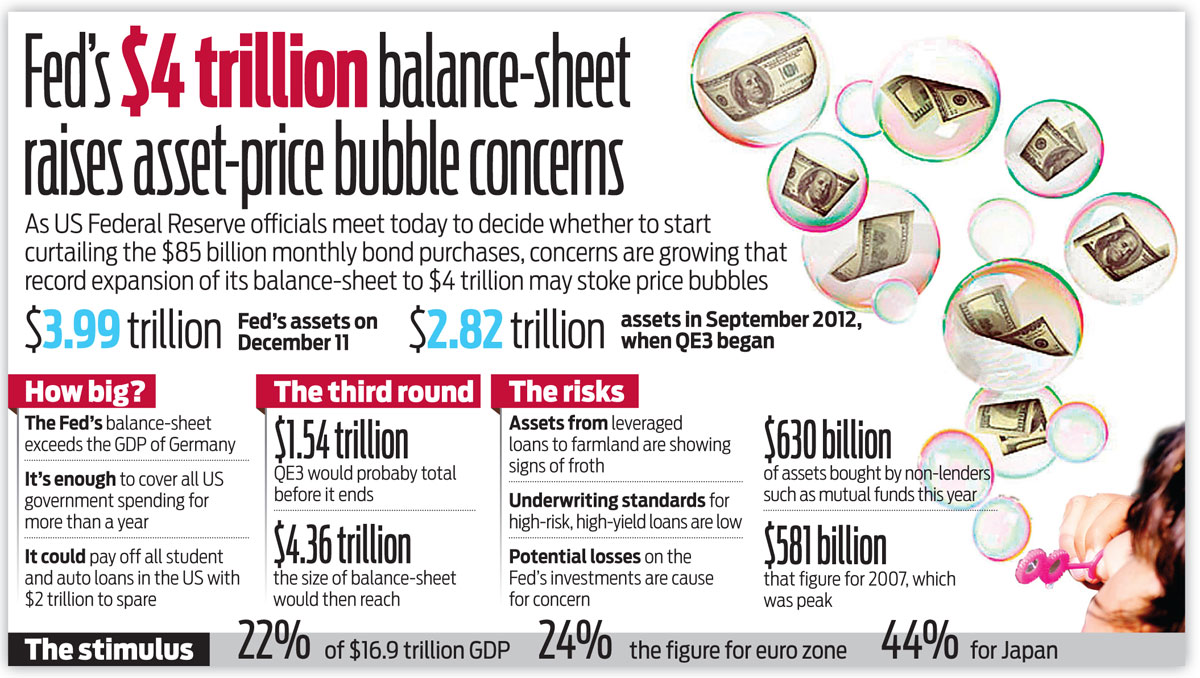

The fact that this "economic recovery" is completely unsustainable without the Fed is of no concern to TA people and it shouldn't be of any concern to us either, as the Fed is currently a FACT of the market and I'd say my biggest mistake in 2013 was not accepting that. Clearly they don't care about their $4Tn balance sheet and Congress and the Media don't care and we all continue to pretend it's not part of our national debt. Among Fed officials themselves:

The fact that this "economic recovery" is completely unsustainable without the Fed is of no concern to TA people and it shouldn't be of any concern to us either, as the Fed is currently a FACT of the market and I'd say my biggest mistake in 2013 was not accepting that. Clearly they don't care about their $4Tn balance sheet and Congress and the Media don't care and we all continue to pretend it's not part of our national debt. Among Fed officials themselves:

“There’s discomfort in the sense that the portfolio could grow almost without limit,” former Fed Vice Chairman, Donald Kohn, said last week during a panel discussion in Washington. Kohn said there was “discomfort in the potential financial stability effects” and added: “There’s some legitimacy in those discomforts.”

Fed Governor Jeremy Stein has said some credit markets, such as corporate debt, show signs of excessive risk-taking, while not posing a threat to financial stability.

The Fed’s balance sheet exceeds the gross domestic product of Germany, the world’s fourth-largest economy. It’s enough to cover all U.S. federal government spending for more than a year. It could pay off all student and auto loans in the country with $2 trillion to spare, Fed data show. The central bank’s assets are set to exceed the $4.1 trillion held by BlackRock Inc. (BLK), the world’s largest asset manager.

At 22 percent of the $16.9 trillion U.S. economy, the balance sheet is surpassed by those of other major central banks as a percentage of gross domestic product, according to third-quarter data compiled by Haver Analytics in New York. In the euro zone, the figure is 24 percent, and in Japan, it’s about 44 percent. The risk for the Fed is that rising interest rates reduce the value of its bond holdings, potentially causing losses if the central bank had to sell the securities back into the open market.

“QE turned out to be a safety net, a floor, a way to catch the economy to keep it from crashing,” said Steve Blitz, chief economist at ITG Investment Research Inc. in New York. “A safety net to catch a falling economy is not the same thing that can springboard the economy to a higher rate of growth.”

So, for as long as it lasts, we'll just have to hold our noses and BUYBUYBUY based on the sole premise that, no matter how poorly the actual economy is performing, the Central Banksters will paper it over until they get the charts they desire. Our trading "advantage" is going to have to be our skepticism, as we certainly don't want to be the last ones to leave this party!

Meanwhile, it' looks like it's going to be "party on" in 2014!