Happy New Year!

Happy New Year!

We ended 2013 with a bang. As you can see from Dave Fry's SPY chart, the last hour was all window-dressing but we couldn't quite get to 1,850 on the S&P, closing at 1,848.36 for the year, up 29.1% in 12 months, which was a big 7.5% behind the small-cap leadership of the Russell, which finished the year officially at 1,1656,64, up 36.6% or an average of 3.05% each and every month of the year!

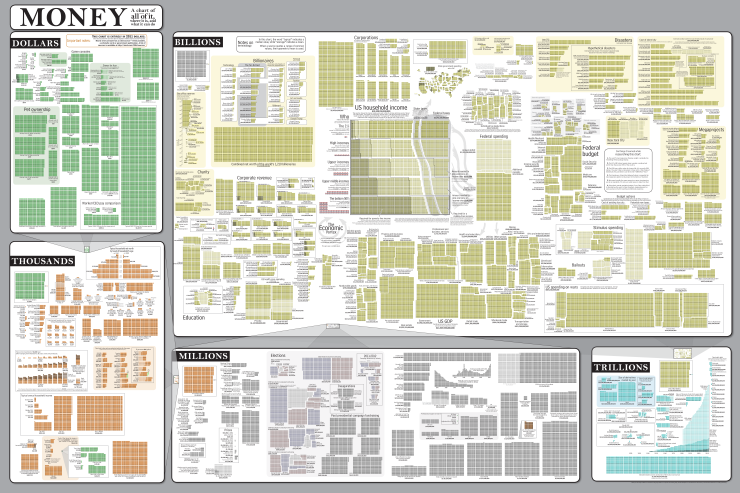

If we take just $100,000 and compound it at a rate of 3.05% per month for 10 years, we get $3.64 MILLION Dollars. 10 years later, it's $132.7M and 10 years after that, we have $4.8Bn so, if you want to be a multi-Billionaire in 30 years, just put $100K into the Russell and go fishing, I suppose.

That's what the Pundits and Financial Advisers are telling you when they say last year was "normal" or that we have a "new paradigm" and it's OK to chase performance, despite the fact that history has shown us, over and over and over again – that it's usually not. My very simple investing premise for 2014 is to buy the worst performer of 2013, which is gold, which fell 28.2% for the year. It seems to me that if everyone who has $100,000 today and sticks it into an index fund has $4Bn in 30 years, they might choose to buy something shiny for their spouse down the road.

As we noted on Tuesday, there are 373M people in the World with more than $100,000 today and they average, if you include the top 29M (the top 0.4%) they average $491,689 each so, by bullish market logic, they should have an average of $23.8Bn each in 30 years and that's $8.87 QUADRILLION or 40 times more money, just for the top 5%, than there is TOTAL in the World today.

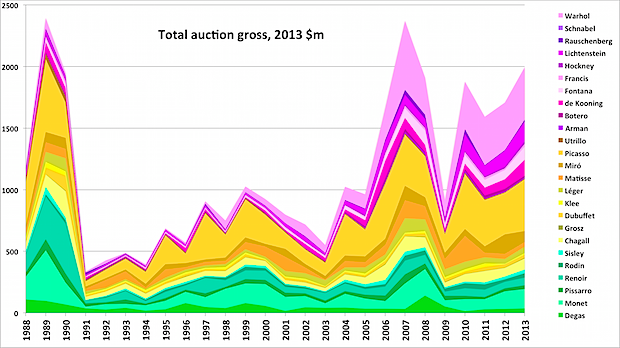

So, if the markets are going to continue to go up, I humply submit that there MAY be just a little more inflation on scarce things that rich people like to buy. Stocks are one of those things, of course and art and, of course, GOLD! Between now and the time our 3D printers will be able to print gold from lead, gold is likely to go up in value as the rich get richer. So, if you are not able to go to Christies and bid $100M on a Warhol, I humbly suggest gold as a nice long-term investment for us little guys (those with under $50M liquid).

Betting against gold is betting against 100,000 years of human nature. What civilization, even before they encountered each other, didn't love gold? When in human history has gold not been considered valuable? Pretty much only in 2013, so far. Not only do I like gold as an inflation hedge in the continuation of the never-ending bull market but I also like it as a crash hedge – should things not go quite as well as planned. We went over some gold plays I liked in our last couple of Webacasts (see Twitter feed for links) but here's one more I like if you want to put $100,000 to work in 2014:

Buy 100 ABX 2016 $13/20 bull call spreads for $3, sell 100 ABX 2016 $13 puts for $1.80 for net $1.20 ($12,000 net cash, about $13,350 in margin). This trade will pay you back $70,000 (+483% on cash) if ABX closes over $20 in Jan 2016. The very good news is it's currently $4.63 in the money, so this trade returns $46,300 (285% profit) if ABX just flat-lines at $17.63 and the worst case is ABX falls below $13 and you end up owning 10,000 shares of it for net $14.80, which is $148,000 or about $74,000 of ordinary margin.

So there you go. That's our one trade for 2015 (and 2016). You can make this one and take the year off. I also like our AAPL trade (Monday's seminar) and we'll put both of them in our new Income Portfolio to get us off to a good start.

So there you go. That's our one trade for 2015 (and 2016). You can make this one and take the year off. I also like our AAPL trade (Monday's seminar) and we'll put both of them in our new Income Portfolio to get us off to a good start.

A note on managing a spread like that, by the way: While our WORST case is owning ABX at net $14.20, which is 19.4% off the current price, if ABX should go up over $20 again, that case becomes very unlikely and we could then put stops on the trade and begin to consider the bulk of the $74,000 we allocated to the position (in case we end up owning ABX) to be usable for other things. So we're not "missing out" on a huge rally by tying up an allocation in a trade like this – if gold rallied more than we thought – then our original bets will be freed up to roll into more aggressive plays.

Also note that PSW Members have been acquiring ABX at much lower prices, as I've been banging my fist on the table for this company for quite some time. Even at a considerably higher price, I still think they are the best way to play gold for the long term. Another trade I like that PSW Members are already up huge on is CLF, who were the second-worst performer on the S&P last year (NEM was worse), with a 29% drop for the year.

Fortunately, we picked them up when they were down 55%, so a near double for us already back at $26.21 but, if you are going to believe in the continued expansion of the Global Economy, why would a company that makes iron ore pellets for a recovering US Manufacturing base not do well? Our favorite thing about playing CLF is they have very expensive options (high premium) to sell, so our trade idea is:

Fortunately, we picked them up when they were down 55%, so a near double for us already back at $26.21 but, if you are going to believe in the continued expansion of the Global Economy, why would a company that makes iron ore pellets for a recovering US Manufacturing base not do well? Our favorite thing about playing CLF is they have very expensive options (high premium) to sell, so our trade idea is:

Buy 30 CLF 2016 $20/30 bull call spreads for $4.25 ($12,750), sell 20 CLF 2016 $20 puts for $4.20 ($8,400). That's net $4,350 in cash for $30,000 worth of spreads that are $18,630 in the money (+328%) to start, with CLF at $26.21 and the upside potential at $30 (12.6% up from here) is $25,650, up 589% on cash, if all goes well. The downside is owning 3,000 shares of CLF for net $21.45 per share ($64,350) so we allocate $32,000 worth of margin for this trade but we're only using net $6,375 of it on the short puts and, like ABX, we can free some up for other projects if CLF goes firmly over $30.

Who says there's nothing to buy in a bull market? AAPL is getting cheaper as we spreak and earnings will give us another crack at a bunch of companies who disappoint investors this month. We will be doing some bargain-hunting with our Members in order to begin filling our new Income Portfolio.

We're already bearish on oil and that's going to be a nice offset to our two bullish commodity plays above. In our Long-Term Portfolio, we shorted 10 oil contracts (/CLG4) at $98.78 but we hedged them with long Dec 2019 contracts ($79.80) to keep us from being burned too badly if oil goes the other way. I do feel that oil will go as low as $85 this year but, as usual, it will have it's ups and downs. This morning it's trading at $97.65, good for more than $10,000 in profits on 10 contracts (about $45,000 in margin).

We're already bearish on oil and that's going to be a nice offset to our two bullish commodity plays above. In our Long-Term Portfolio, we shorted 10 oil contracts (/CLG4) at $98.78 but we hedged them with long Dec 2019 contracts ($79.80) to keep us from being burned too badly if oil goes the other way. I do feel that oil will go as low as $85 this year but, as usual, it will have it's ups and downs. This morning it's trading at $97.65, good for more than $10,000 in profits on 10 contracts (about $45,000 in margin).

I put out an Alert to our Members early this morning to short oil as it fell off the $99 mark again so a nice $1,000+ per contract gain is a great way to start off the new year! On Tuesday morning, our play was to long gold over $1,190 and that took us to $1,220 this morning – good for another $1,000 per contract on those Futures (/YG). This move up in gold is DESPITE the Dollar zooming up to 80.83 (up 0.8%) but we though the move down was manipulated anyway.

Looks like it will be more of the same in 2014 and that's lots of fun for us – because we SELL premium to the people who think they can beat the market – and that gives us the leverage and the leeway to do very nicely from the HOUSE side of the table.

Have a great 2014!