Courtesy of Mish.

Both the ISM Report and the Markit PMI report show strengthening US manufacturing.

ISM: The December 2013 Manufacturing ISM Report On Business® shows Economic activity in the manufacturing sector expanded in December for the seventh consecutive month.

“The PMI™ registered 57 percent, the second highest reading for the year, just 0.3 percentage point below November’s reading of 57.3 percent. The New Orders Index increased in December by 0.6 percentage point to 64.2 percent, which is its highest reading since April 2010 when it registered 65.1 percent. The Employment Index registered 56.9 percent, an increase of 0.4 percentage point compared to November’s reading of 56.5 percent. December’s employment reading is the highest since June 2011 when the Employment Index registered 59 percent. Comments from the panel generally reflect a solid final month of the year, capping off the second half of 2013, which was characterized by continuous growth and momentum in manufacturing.”

Markit: Here is a look at the Markit US Manufacturing PMI.

Key Points

- PMI rises to 11 – month high, indicating solid improvement in business conditions

- Output supported by strong increase in new orders

- Employment growth quickens to nine – month high

- Input price pressures intensifies

Summary

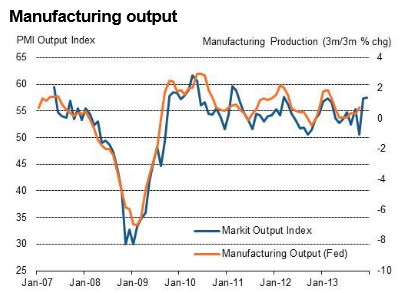

Business conditions in the U.S. manufacturing sector improved at the fastest rate since January, according to the final December Markit U.S. Manufacturing Purchasing Managers’ Index™ (PMI™). At 55.0, up from 54.7 in November and above the earlier flash estimate of 54.4, the PMI indicated a solid rate of expansion.

Production in the series average and the fastest since March 2012. All three market groups (consumer, intermediate and investment) posted higher levels of output in December, with manufacturers of investment goods posting the fastest rate of increase.

Manufacturing Output

Company size analysis

Large manufacturers (more than 500 employees) reported a marked rise in output during December. This generally reflected a sharp increase in new business , with the rate of new order growth the joint – fastest since late – 2009. In contrast, new order growth was only modest at small manufacturers (less than 100 employees), with new export work having fallen since November.

“Measured Pace” Tapering

The consensus will start looking for additional Fed tapering, perhaps at an accelerated pace….