Wheeee, what a ride!

Wheeee, what a ride!

Those 10 Oil Futures (/CL) contracts I mentioned as a short in yesterday's morning post gained another $23,000 during the day as oil plunged back to $95.50 – not a bad pick for the first post of the year. We set our stops at $95.80 to lock in gains and we already took our USO puts off the table as they were up 100% and we hate to be too greedy, though we're happy to re-enter them if they get cheap again.

We still have our SCO (ultra-short oil) plays in place, to take advantage of a proper break-down. They had a longer time-frame so we chose to leave them active as we feel USO will be well below that $33 line ($92.50 oil) but, as Dave Fry notes in his chart, inventories are today and anything can happen.

The Nikkei is another Futures play (/NKD) I've been banging the table on, shorting them whenever they go over the 16,300 line and we got the big pay-off yesterday, as the index fell all the way down to 15,900 for a lovely $2,000 per contract gain. Don't worry if you missed that one, this index is like a yo-yo!

The Nikkei is another Futures play (/NKD) I've been banging the table on, shorting them whenever they go over the 16,300 line and we got the big pay-off yesterday, as the index fell all the way down to 15,900 for a lovely $2,000 per contract gain. Don't worry if you missed that one, this index is like a yo-yo!

As I reminded you yesterday, when we added 2 more trades for 2014, our big trade idea for 2014 is AAPL and, this morning, Cantor's Brain White agrees with me and makes it his top pick for 2014 as well. White declares Apple's valuation (just 9x his calendar 2014 EPS estimate exc. cash) "remains depressed," and predicts "new product innovations" will help it return to growth after posting its first EPS declines in a decade. He also expects Apple, which opposes Carl Icahn's buyback proposal but says it's still weighing cash-return options, to return more cash to shareholders in 2014.

We were actually hoping AAPL would take more of a dip and give us a cheaper entry, but White may have screwed that up for us by re-ignighting excitement in the stock. Oh well, there's bound to be other fun things to buy. CLF, for example, went down a bit yesterday but ABX (also featured in yesterday's post) flew higher as gold raced along to $1,230, where we took the money and ran on our Futures longs.

We were actually hoping AAPL would take more of a dip and give us a cheaper entry, but White may have screwed that up for us by re-ignighting excitement in the stock. Oh well, there's bound to be other fun things to buy. CLF, for example, went down a bit yesterday but ABX (also featured in yesterday's post) flew higher as gold raced along to $1,230, where we took the money and ran on our Futures longs.

The nice thing about being mostly in cash is we can get right back to it over the weekend and we have no desire to spin that wheel this early in the year.

Our first day picks worked like clockwork so now we'll see what kind of bounce we get and, probably, by Tuesday we'll be ready to make another set of predictions for the next week.

The volume around the holidays is simply too low to draw any conclusions from. We are, however, watching the NYMO closely as yesterday's little sell-off took it back to 20 (barely oversold) so we'll see what today's bounce does for it but, as we expected, it doesn't look like we're likely to have more than a 5% correction, at most, based on looking at this advance/decline study.

The volume around the holidays is simply too low to draw any conclusions from. We are, however, watching the NYMO closely as yesterday's little sell-off took it back to 20 (barely oversold) so we'll see what today's bounce does for it but, as we expected, it doesn't look like we're likely to have more than a 5% correction, at most, based on looking at this advance/decline study.

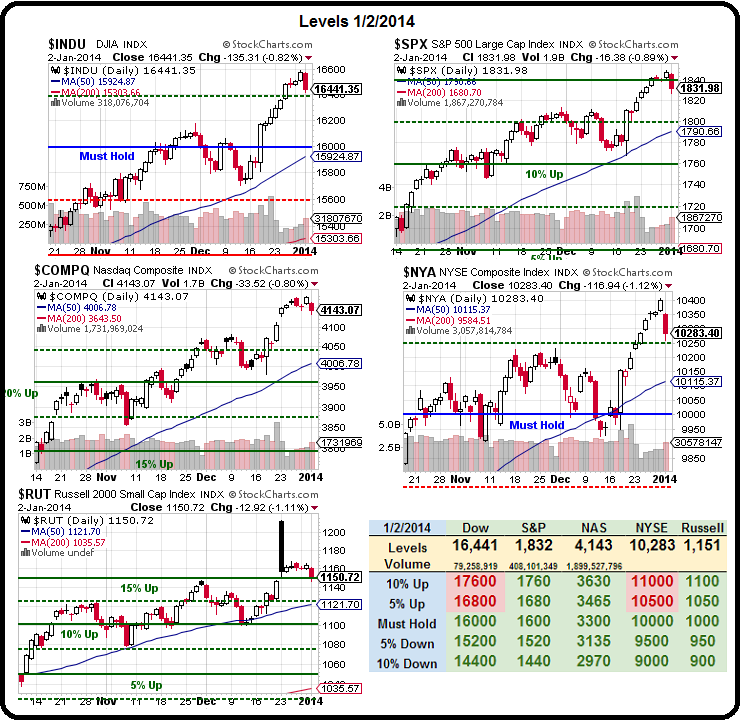

We're also keeping an eye on our Big Chart, espectially the 15% lines on the RUT (1,150) and the S&P (1,840), whichever side of those lines these two indexes are on is likely to be our market direction. With all our Indexes, we're looking for pullbacks to test the 50-day moving averages at (rounding) Dow 15,900, S&P 1,790, Nasdaq 4,000, NYSE 10,100 and Russell 1,120. We'd love to see those levels tested Tuesday and, if they hold, THEN we can get excited about some bottom-fishing.

Have a great weekend,

– Phil