Courtesy of Sabrient Systems and Gradient Analytics

With plenty of wind in their sails, bulls coasted comfortably into year-end to close out 2013 with a stellar performance, as Santa made his widely-expected appearance on Wall Street. In fact, stocks saw one of their best years ever and the strongest since 1997, with the S&P 500 boasting a total return around 30% while closing the year right at its all-time high. It is notable that more than 450 of the 500 stocks had positive returns, and about half of the gains for the year occurred after Labor Day. Also, for the last two months, bulls showed a noticeable preference for higher-beta, lower quality names (“risk-on”).

With plenty of wind in their sails, bulls coasted comfortably into year-end to close out 2013 with a stellar performance, as Santa made his widely-expected appearance on Wall Street. In fact, stocks saw one of their best years ever and the strongest since 1997, with the S&P 500 boasting a total return around 30% while closing the year right at its all-time high. It is notable that more than 450 of the 500 stocks had positive returns, and about half of the gains for the year occurred after Labor Day. Also, for the last two months, bulls showed a noticeable preference for higher-beta, lower quality names (“risk-on”).

Other asset classes faired much worse. The Barclays U.S. Aggregate Bond Index fell -3%, which was its first down year since 1999. Gold lost -28%, which was its worst year since 1981. Absent a constant threat of global economic meltdown, it seems that nobody anymore feels much need to keep stores of gold in their portfolio.

An analysis of S&P 500 sector performance for 2013 shows that Consumer Discretionary, Healthcare, Industrial, and Financial led the way, with each up by more than 30%. In retrospect, it was no surprise that some of the more economically-sensitive sectors led during an economic recovery and surging stock market. Not far behind were Technology, Materials, Consumer Staples, and Energy, which were each up north of 20%. At the bottom were defensive sectors Utilities and Telecom, which were up less than 10%.

If I look back at our SectorCast ETF rankings in January 2013, the top ranked sectors during the month included Healthcare, Technology, Industrial, Consumer Staples, and Financial, while Telecom and Utilities were ranked at the bottom. So, overall, it looks like it was pretty accurate, particularly when you consider the consistently high sector correlations all year. However, Consumer Discretionary also was ranked near the bottom, primarily on valuation even though it displayed one of the highest projected long-term growth rates, so the model definitely missed foreseeing the superb performance of this sector.

Of course, the strong market was driven largely by the Federal Reserve’s monetary stimulus program, which kept interest rates so low that capital had virtually nowhere to go but risk assets, particularly equities. However, liquidity couldn’t do it alone, and encouraging signs of U.S. and global economic recovery have supported the bull case, as has continued slow but steady corporate earnings growth.

Bears would argue that the Fed has merely created a stock market valuation bubble, as the extreme levels of liquidity have failed to trickle down throughout the economy in the form of lending, but instead have been used by banks’ trading departments, and the big corporations have chosen to use cash and cheap debt to buy back their shares rather than invest in PP&E and new hiring.

Indeed, P/E multiple expansion has been an undeniable contributor to the market’s stellar performance, as the S&P 500 average P/E has grown from the mid-13’s to the mid-16’s, versus a historical average of mid-14’s. True, the low interest-rate environment justifies higher multiples in equities, so current multiples are not yet unreasonable. But further market gains will need to come from robust corporate earnings growth — and that will require top-line revenue growth rather than cost-cutting, productivity gains, and efficiencies that is pretty much exhausted at this point.

For 2014, cash will continue to offer no return for the foreseeable future (i.e., “cash is trash”). Longer-term (10-20-year) Treasuries will be at risk of loss of principal as long-term rates creep higher, while mid-maturity (2-5-year) bonds will offer a small return without a significant risk to principal. However, Scott Minerd, Global CIO of Guggenheim Investments predicts the 10-year Treasury yield will remain range-bound with a peak at current levels around 3%, while the fed funds rate should stay near zero, perhaps until 2016.

So, the equities should remain the investment of choice, and the Federal Reserve has given the market two strong signals: first, that it sees sustainable improvement in the economy sufficient to begin “tapering” its quantitative easing, and second that it stands ready to support continued recovery as required (“Don’t Fight the Fed!”). But even the most bullish market commentators are forecasting only modest gains, perhaps no more than 10% at the top end, and many are suggesting that investors look overseas to Europe and emerging markets as the main beneficiaries of global recovery and “mean reversion,” since those areas have lagged US performance.

In any case, stocks finally might be ready to see their extraordinarily high correlations (i.e., “all boats lifted in a rising tide”) fall, which means that thoughtful stock-picking offers the potential for outsized gains. Moreover, this should translate into a “flight to quality” in which the best companies with the most sustainable earnings growth and reasonable valuations get the most attention, while the speculative high-flyers that have been coat-tailing on bullish exuberance fall back. By the way, Sabrient subsidiary Gradient Analytics is a forensic accounting research firm serving the institutional investment community that specializes in identifying those impostors with low quality and sustainability of reported earnings.

Even in the highly-correlated markets of 2012 and 2013, Sabrient has proven its ability to beat the market handily, as our Baker’s Dozen annual portfolio of high-potential GARP stocks tripled the S&P 500 return in 2012 and doubled it in 2013. The new portfolio for 2014 will be unveiled on January 13. The 2013 portfolio outperformed by a wide margin, more than doubling the S&P 500 return, with all 13 positions comfortably positive by double-digit percentages, led by Jazz Pharmaceuticals (JAZZ). In fact, 11 of the 13 positions outperformed the market average while enduring none of those upsetting meltdowns that can offset the strong performers, and we largely attribute this to screening with our proprietary Earnings Quality Rank (EQR), which is a pure accounting-based risk assessment signal based on the forensic accounting expertise of subsidiary Gradient Analytics.

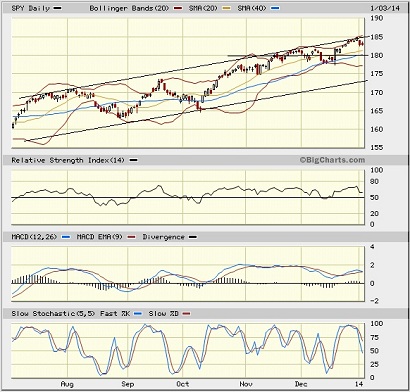

The SPY chart:

The SPDR S&P 500 Trust (SPY) closed Friday at 182.86, after closing the year in extremely overbought territory and at its all-time high of 184.69. Notably, the index remained comfortably above its 200-day simple moving average for the entire year, and has not had a serious breach of this important support level in over two years.

The 20-day and 50-day simple moving averages have been offering reliable support. Oscillators like RSI, MACD and Slow Stochastic have used the price consolidation of the first couple of days of the year to work off much of their overbought conditions. The long-standing bullish rising channel once again provided tough-to-crack resistance, but I think SPY will make another run at a bullish breakout during the month. If price falls further, the 50-day simple moving average and the 180 level should provide rock-solid support.

On Friday, the CBOE Market Volatility Index (VIX), a.k.a. “fear gauge,” closed at 13.82. Investors are showing no fear. However, some market observers are warning that we should expect higher volatility in 2014.

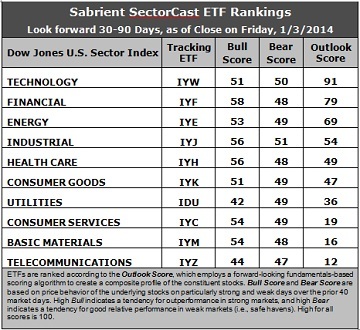

Latest rankings:

The table ranks each of the ten U.S. business sector iShares ETFs by Sabrient’s proprietary Outlook Score, which employs a forward-looking, fundamentals-based, quantitative algorithm to create a bottom-up composite profile of the constituent stocks within the ETF. The multi-factor model considers forward valuation, historical earnings trends, earnings growth prospects, the dynamics of Wall Street analysts’ consensus estimates, accounting practices and earnings quality, and various return ratios. In addition, the table also shows Sabrient’s proprietary Bull Score and Bear Score for each ETF.

High Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods. Bull and Bear are backward-looking indicators of recent sentiment trend.

As a group, these three scores can be quite helpful for positioning a portfolio for a given set of anticipated market conditions.

Observations:

1. Technology retains the top spot with a robust Outlook score of 91. Anything above 90 is very strong. Tech still displays a relatively low forward P/E, a solid forward long-term growth rate, the best return ratios, and strong sentiment among both Wall Street analysts (upgrades to earnings estimates) and company insiders (buying activity). Financial takes second place again with a 79. It displays one of the lowest forward P/Es and excellent sentiment among both Wall Street analysts and company insiders.

2. Telecom is in the cellar yet again with an Outlook score of 12. It scores among the lowest on almost every factor in the model, including the highest forward P/E, lowest return ratios, and a low projected long-term growth rate. However, sentiment among insiders and Wall Street analysts has improved somewhat. Materials has joined the bottom two with an Outlook score of 16 as analyst and insider indicators are poor.

3. This week’s fundamentals-based rankings have maintained their bullish bias, with economically-sensitive sectors Tech, Financial, Energy, and Industrial making up the top four. The most notable movement lately has been the fall in Materials as analyst and insider sentiment has soured, compared to the rise in Energy as analyst and insider sentiment has improved.

4. Looking at the Bull scores, Financial has been the leader on strong market days, scoring 58. Utilities is the notable laggard with a score of 42. The top-bottom spread has expanded to 16 points, which reflects somewhat lower sector correlations on particularly strong market days.

5. Looking at the Bear scores, there is some unusual activity going on as the top-bottom spread is only 4 points, which indicates high sector correlations on particularly weak market days. Strangely, economically-sensitive Industrial has been holding up among the best on recent weak market days, scoring 51, but in fact there is no clear leader when scores are this closely bunched. Defensive sector Telecom scores the worst at 47. I expect this situation to change as the month progresses.

6. Overall, Technology shows the best all-weather combination of Outlook/Bull/Bear scores. Telecom is the by far the worst. Looking at just the Bull/Bear combination, Industrial displays the highest score this week, which indicates good relative performance in extreme market conditions (whether bullish or bearish), while defensive sectors Utilities and Telecom score the lowest, which indicates investor avoidance (relatively speaking) during extreme conditions.

These Outlook scores represent the view once again that Technology and Financial sectors are still relatively undervalued, while Telecom and Materials may be relatively overvalued based on our 1-3 month forward look.

Stock and ETF Ideas:

Our Sector Rotation Model, which appropriately weights Outlook, Bull, and Bear scores in accordance with the overall market’s prevailing trend (bullish, neutral, or bearish), suggests holding IYW, IYF, and IYJ in the current bullish climate.

Some intriguing stocks from Technology and Financial sectors include Manhattan Associates (MANH), Cognizant Technology Solutions (CTSH), Altisource Portfolio Solutions (ASPS), and First Citizens Bancshares (FCNCA), all of which are highly ranked in the Sabrient Ratings Algorithm and score in the highest three quintiles of the Sabrient/Gradient Earnings Quality Rank (EQR). Other ETFs highly-ranked by Sabrient from the Technology and Financial sectors include the iShares Global Tech ETF (IXN) and the PowerShares KBW Property & Casualty Insurance Portfolio (KBWP).

Disclosure: Author has no positions in stocks or ETFs mentioned.

About SectorCast: Rankings are based on Sabrient’s SectorCast model, which builds a composite profile of each equity ETF based on bottom-up aggregate scoring of the constituent stocks. The Outlook Score employs a fundamentals-based multi-factor approach considering forward valuation, earnings growth prospects, Wall Street analysts’ consensus revisions, accounting practices, and various return ratios. It has tested to be highly predictive for identifying the best (most undervalued) and worst (most overvalued) sectors, with a 1-3 month forward look.

Bull Score and Bear Score are based on the price behavior of the underlying stocks on particularly strong and weak days during the prior 40 market days. They reflect investor sentiment toward the stocks (on a relative basis) as either aggressive plays or safe havens. So, a high Bull score indicates that stocks within the ETF have tended recently toward relative outperformance during particularly strong market periods, while a high Bear score indicates that stocks within the ETF have tended to hold up relatively well during particularly weak market periods.

Thus, ETFs with high Bull scores generally perform better when the market is hot, ETFs with high Bear scores generally perform better when the market is weak, and ETFs with high Outlook scores generally perform well over time in various market conditions.

Of course, each ETF has a unique set of constituent stocks, so the sectors represented will score differently depending upon which set of ETFs is used. For Sector Detector, I use ten iShares ETFs representing the major U.S. business sectors.

About Trading Strategies: There are various ways to trade these rankings. First, you might run a sector rotation strategy in which you buy long the top 2-4 ETFs from SectorCast-ETF, rebalancing either on a fixed schedule (e.g., monthly or quarterly) or when the rankings change significantly. Another alternative is to enhance a position in the SPDR Trust exchange-traded fund (SPY) depending upon your market bias. If you are bullish on the broad market, you can go long the SPY and enhance it with additional long positions in the top-ranked sector ETFs. Conversely, if you are bearish and short (or buy puts on) the SPY, you could also consider shorting the two lowest-ranked sector ETFs to enhance your short bias.

However, if you prefer not to bet on market direction, you could try a market-neutral, long/short trade—that is, go long (or buy call options on) the top-ranked ETFs and short (or buy put options on) the lowest-ranked ETFs. And here’s a more aggressive strategy to consider: You might trade some of the highest and lowest ranked stocks from within those top and bottom-ranked ETFs.