89% of Republicans and Democrats agree on one thing!

89% of Republicans and Democrats agree on one thing!

That thing is that the economy is the number one issue facing our nation. Just like it was when Clinton said it in 1992, when he first used the phrase in campaign to unseat Bush the 1st, it has been in 2004, 2008, 2010 and 2013 – the economy matters more, followed closely by Unemployment as a bi-lateral concern.

Presumably, from the way the stock martet behaved in 2013 – going up about 30% in a single year (as opposed to the 5 years it usually takes to gain that much), the economy must be booming – so why all the concern? Well, the simple answer to that is that the economy isn't benefitting the bottom 90% very much – from their point of view, things have not gotten much better at all. Not only that, but now we've cut off the Unemployment Insurance to 1.3M already struggling Americans.

As I noted in our Member Chat Room this morning:

As I noted in our Member Chat Room this morning:

As I said about that last week, screw those guys (from a top 1% perspective) because they only get about $1,200 a month so 1.3M of those lazy bastards losing their benefits is only $1.5Bn a month taken out of consumer spending – not a big effect – unless you happen to be one of those losers, then it's a life-changing effect but, hey, by the end of the year we save $18Bn, that's enough to paint an aircraft carrier – with the blood of those 1.3M of the families we're supposedly protecting…

Wall Street seems to have had a much better recovery than Main Street. Asset prices have responded vigorously while real wages have been squeezed. Inequality has been widening (see Free exchange). It is hardly surprising that voters have become discontented, with a surge in support for the populist right in Europe and plenty of partisan bickering in Washington. The combination of an angry electorate and nervous governments may lead to unpredictable policy measures–and an atmosphere that is hardly helpful to either business or investor confidence.

According to Business Insider: Investors' optimism appeared to be borne out by trends in the American economy, the world's largest, as third-quarter growth figures were revised higher on December 20th to show an annualised gain of 4.1%. Even so, there is something slightly odd about this rosy picture. Economic growth is good for the stockmarket because a healthy economy should boost profits. But the data show that profit growth slowed significantly in the third quarter. Total corporate profits in America grew by $39.2 billion over the three months to September, compared with a $66.8 billion rise in the second quarter; domestic profits rose by $12.7 billion, down from $37.8 billion.

As a result, the big gains of 2013 were caused by investors re-rating the equity markets (giving shares a higher valuation) rather than because of the profit fundamentals. Total profits for S&P 500 companies in 2013 are likely to have risen by only 7.7%, a long way short of the gains in the index. rapidly-growing companies trade on a high multiple of current profits because their future profits are expected to grow strongly. But American companies do not fit the template. They are trading on a high multiple at a time when profits are already historically high and growth appears to be slowing.

As you may be aware, we went to cash into the year's close and we are determined to go with the flow this year but one bet we did leave on was a bearish bet on oil, which we closed out on Friday at $94 – up $47,800 from our 10-contract entry on 12/19. Even if you were not a PSW Member, you still could have picked up $37,650 off my reminder in Thursday's post.

Also featured in Thursday's post was our trade idea on ABX for 100 2016 13/20 bull call spreads at $3 ($30,000), selling 100 2016 $13 puts for $1.80 ($18,000) for a net $12,000 spread. That spread closed Friday at net $17,800, up 48% in two days, which is good as that was one of our trades of the year.

If you want to get these trades live, when they happen – you can subscribe HERE.

We shorted Futures again this morning at the $94.50 line, an Alert that was sent out to our Members at 7:12, and we got the signal we expected as the Dollar moved back over the 81 line. We expect Dollar strength and a market sell-off this week as Treasury has about $100Bn worth of notes to sell and they sell a lot better when people are worried about equities.

That's all this is – just a big game with many forces manipulatiing the market while the Financial "News" Networks pretend it's not a farce. While I do complain about the shenanigans and wish we had an honest system, I often say to our Members that:

That's all this is – just a big game with many forces manipulatiing the market while the Financial "News" Networks pretend it's not a farce. While I do complain about the shenanigans and wish we had an honest system, I often say to our Members that:

"We don't care IF the markets are rigged as long as we are able to understand HOW they are rigged so we can place our bets accordingly."

This is how the top 1% gets richer and richer and, until the bottom 90% wise up and start building some guilotines, it's going to continue to be a profitable game indeed! Goldman Sachs, the dungeon master of the markets, steered their beautiful sheeple into disastrous China trades last quarter, and already they are back-peddling today, saying: "Admittedly, our upgrade has been challenged by several recent developments," noting the year-end cash crunch and weaker manufacturing and service-sector data last week – something we've been tracking since the summer, keeping us miles away from Chinese investments and shorting the Nikkei from 16,300 (so far, so good on that one too, now 16,035!).

Of course, as you can see from the JPM chart above, Japan is a bargain relative to US equities at the moment., with the US Markets a full 2 standard deviations above their average valuation – by far, the most expensive of all developed countries' stock markets. As I said last quarter, there simply isn't anywhere else for money to go compared to other asset classes but, to deny that US Equities are in a bubble is REALLY putting your head firmly in the sand….

Keep in mind, I only want you to remain AWARE of these issues, we're still playing the technicals and, as long as they keep pointing up, we'll keep playing it that way, just remember not to take all this manipulatd nonsense too seriously. After all, as Alice Cooper said:

Keep in mind, I only want you to remain AWARE of these issues, we're still playing the technicals and, as long as they keep pointing up, we'll keep playing it that way, just remember not to take all this manipulatd nonsense too seriously. After all, as Alice Cooper said:

I know we have problems,

We got problems right here in Central City,

We have problems on the North, South, East and West,

New York City, Saint Louis, Philadelphia, Los Angeles,

Detroit, Chicago,

Everybody has problems,

And personally, I don't care." – Elected

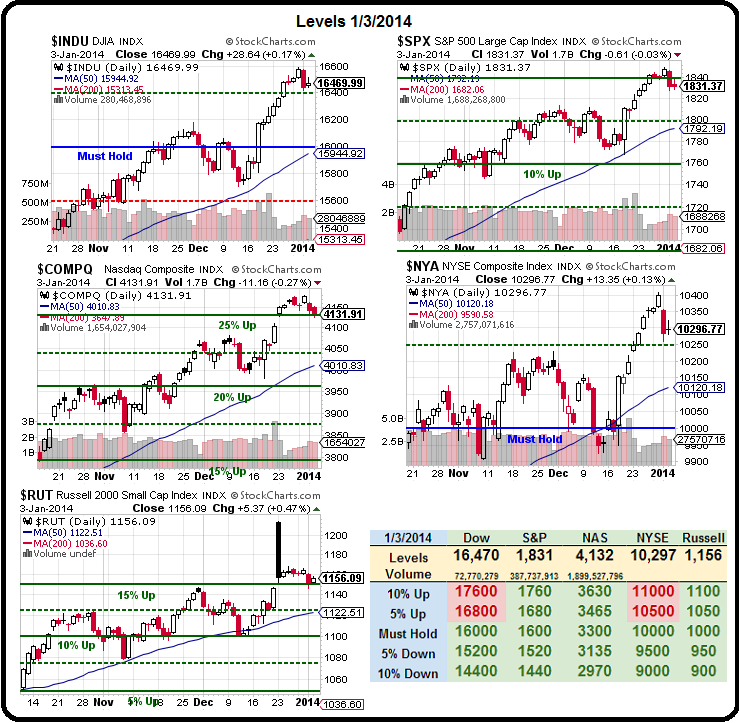

As long as we're holding those levels on the Big Chart, these little dips are just the buying opportunities we expected as more and more Global investors are chased to the "safety" of the US markets. When they do fail, they will likely fail in a spectacular fashion but, until then, we'll play along – with one hand always firmly on the handle of the exit door – just in case reality kicks in at some point.