Yield Chasing Never Ends Well – Even in Equities

Most people associate the term “Yield-Chasing” with actions taken by bond investors going further out on the risk or duration curve to grab higher levels of current income. In our Fed-distorted markets, the yield-chasing phenomenon was transposed into the equity markets as well – and that’s why relative valuations for the most mundane, boring stocks shot up to such absurdly high levels.

Most people associate the term “Yield-Chasing” with actions taken by bond investors going further out on the risk or duration curve to grab higher levels of current income. In our Fed-distorted markets, the yield-chasing phenomenon was transposed into the equity markets as well – and that’s why relative valuations for the most mundane, boring stocks shot up to such absurdly high levels.

The combination of bond market refugees looking for bond-like equities along with the influx of flows into so-called “minimum-volatility” funds and ETFs led to an overvaluation in the high-dividend equity space, an excess that the market spent the majority of 2013 working off.

This chase for yield in the stock market led to the same thing that all such chasing always leads to – underperformance.

Here’s Savita Subramanian’s quant strategy team at Bank of America Merrill Lynch with their take and some great illustrative charts:

The inflection point: end of easy money

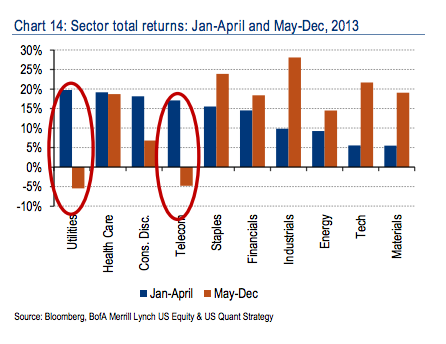

During the first four months of the year, market leadership was decidedly

defensive: Utilities was the best performing sector through April, and four of the

five top performing sectors were defensive (the other was Consumer

Discretionary, the full-year winner). Investors had flocked into high yielding stocks

in areas such as Telecom, Utilities, and Tobacco amid record-low interest rates,

driving up valuations for these sectors.But once the Fed began to talk about tapering in May, leadership changed—

Telecom and Utilities underperformed dramatically, making them 2013’s worst

performing sectors overall. In contrast, Industrials, Tech saw dramatic pick-ups in

their performance from May-December as interest rates ticked up and the global

growth outlook improved (Chart 14). And while the more defensive/domestic

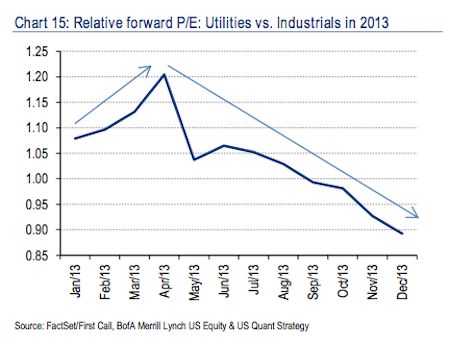

sectors are still generally expensive vs. history, valuation gaps narrowed notably—

see (Chart 15). We expect cyclical sectors—particularly those which are more

globally diversified, such as Tech, Energy and Industrials—to lead the market in

2014, as multiples continue to compress for the more defensive, higher yielding

areas of the market which are more interest rate sensitive and inexpensive.

Josh here – check out this leadership change from before and after the May Taper Tantrum:

And here’s that PE multiple compression, a classic study in valuation mean reversion. Here you’re seeing :

The message is clear. Yield-chasing never ends well, regardless of whether it happens in stocks or bonds. It’s only ever a question of who’s left holding the bag at the inflection point.

Source:

Why they did what they did: 2013

Bank of America Merrill Lynch – Equity and Quant Strategy