That's it, I'm officially the last bear in America.

That's it, I'm officially the last bear in America.

Well, according to the AAII Bull-Bear Sentiment Survey, anyway. In the entire 23-year history of this survey, there have never been more bulls or less bears and, as you can see from the ratio, it won't be long now before they track me down and shoot me – well, that's what it feels like to be bearish in this market.

I guess the people at Macy's are crazy too, they are closing 5 stores and laying off 2,500 people in the middle of the greatest bull market (sentiment-wise) in history. It won't hurt their stock, of course, which is up 30% from last year (along with the rest of the market) and, in fact, BMO Capital just gave them an upgrade because firing people is what American Corporations are all about these days.

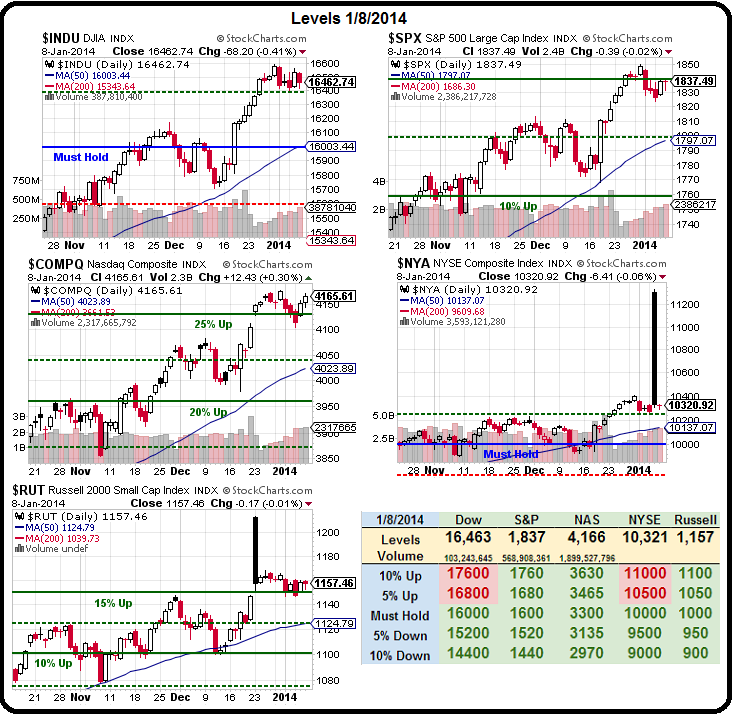

We're still short in our Short-Term Portfolio, and painfully so at the moment but we ARE playing the technicals and we need to see the S&P confirm with a move over 1,840 and then 1,850 to match up with Dow 16,500, Nas 4,175, NYSE 10,400 and Russell 1,070 – as which point we are HAPPY to make more bullish plays.

We're still short in our Short-Term Portfolio, and painfully so at the moment but we ARE playing the technicals and we need to see the S&P confirm with a move over 1,840 and then 1,850 to match up with Dow 16,500, Nas 4,175, NYSE 10,400 and Russell 1,070 – as which point we are HAPPY to make more bullish plays.

Meanwhile, our last set of bullish plays is doing just fine. Aside from our 3 Trade Ideas for 2014, which were all bullish, we had our last 5 Bullish Trade Ideas on December 17th which followed up on November 25th's 5 MORE Trades That Can Make 500% in a Rising Market.

Needless to say (obvious from the chart), all of those trades are doing fabulously, even our ABXs have finally come on strong. The ten trade ideas from those two posts (and you can get trade ideas like this delivered to you daily with a PSW Subscription) were:

- 10 QQQ March $83/88 bull call spread at $2.18 ($2,180), selling 1 AAPL 2015 $450 puts for $32.50 ($3,250) for a net $1,070 credit, now net $1,050 so $2,120 in pocket – up 198%

- DDM April $105/115 bull call spread at $5, selling CAT 2016 $60 puts for $4 for net $1, now $2.55 – up 155%

- 5 DBA 2016 $22/26 bull call spread at $2.20 ($1,100), selling 5 $21 puts for .65 for net $1.75 ($875) and one CAT 2016 $60 put for $400 for a net $175 credit, now net $37 – up 121%

- AAPL 2016 $450/600 bull call spread at $60, selling $400 puts for $35 for net $25, now $37.75 – up 51%

- T 2015 $30/35 bull call spreads at $3.45, selling 2016 $30 puts for $2.85 for net .60, now net $1.77 – up 195%

- ABX 2016 $15 puts for $2.92, now $2.38 – up 18.5%

- CLF 2016 $18 sold for $4.40, now $3.50 – up 20.5%

- IAG 2016 $2.50 sold for .55, now .52 – up 5.5%

- POT 2016 $25 puts sold for $2.70, now $1.65 – up 38.8%

- Buying CIM at $3.03, selling 2015 $2.50 calls for .70 and $3 puts for .45 for net $1.88/2.44, now $2 – up 6% and on track

- Buying HOV 2015 $4/7 bull call spread at $1.30, selling 2016 $4 puts for .80 for net .50, now net $1, up 100% and on track

- Selling NYMT July $7.50 puts for $1.20 for a net $6.30 entry, now $1.30 – down 8.3%

Keep in mind, when we review these trades, there are often still opportunities. For example, the QQQ trade was "only" up 112% at net $200 when we reviewed it on 12/17 and now it's net $1,050 so up 425% on cash in less than a month, even if you did miss the initial credit entry. The DDM trade was only up a pathetic 15% and clearly still playable 3 weeks ago at net $1.15 and that is now more mature at $2.55, up 121% in three weeks.

Keep in mind, when we review these trades, there are often still opportunities. For example, the QQQ trade was "only" up 112% at net $200 when we reviewed it on 12/17 and now it's net $1,050 so up 425% on cash in less than a month, even if you did miss the initial credit entry. The DDM trade was only up a pathetic 15% and clearly still playable 3 weeks ago at net $1.15 and that is now more mature at $2.55, up 121% in three weeks.

When we are making our 500% trades, up 100% is only "on track"!

So our DBA spread is merely "on track" to it's projected 1,528% goal (if all goes well) and AAPL has barely budged, despite it's impressive 51% gain since Thanksgiving. The T spread was down 117% in our December update and now it's up 195% and again, this is why we do these reviews – these are highly leveraged trades and they WILL swing wildly but, if you scale into positions you REALLY want to own long-term – as opposed to BETTING on positions you are going to panic out of when they move against you – they do tend to swing back in your favor over time.

The next 5 positions were our newer plays from 12/17 and, as you can see, from our more recent trades, just because we go "long" with 2016 trade ideas does not mean we can't still make very nice short-term profits. Going long means we have more "wriggle room" to adjust our trades over time but it doesn't preclude us from making some thrilling returns when the stock does go our way.

The next 5 positions were our newer plays from 12/17 and, as you can see, from our more recent trades, just because we go "long" with 2016 trade ideas does not mean we can't still make very nice short-term profits. Going long means we have more "wriggle room" to adjust our trades over time but it doesn't preclude us from making some thrilling returns when the stock does go our way.

And what do these trades have in common? They are all FUNDAMENTAL picks – stocks we would LOVE to own more of if they get cheaper. So, it's almost a no-lose scenario as you either make your leveraged upside returns or you end up owning stocks you REALLY want to buy for a good price.

Aside from these featured picks, we also had another round the next day (and again, how can you not want to SUBSCRIBE?) AND there were dozens of other companies mentioned that we also like for 2014 but didn't make that first cut (in fact, some of these trades were featured in our 11/21 "Be the House" Webcast). ALL of those companies are ones we're going to watch into earnings season, to see if there's an opportunity to do a little bargain hunting if they should stumble and give us a better entry.

Yes, I am still bearish and still looking for a short-term correction but, when our "bearish", cautious short put sales make us returns of 18.5%, 20.5%, 5.5%, 38.8%, 6%, 100% and a sole loss (so far) of 8.3% – IN LESS THAN A MONTH – why should we feel any pressure to be more aggressively bullish than that?

So excuse me for hibernating mainly in CASH just a little while longer – we KNOW how to make money in a bull market – let's just be sure we still have one first!