Wheeeee – that was fun!

Wheeeee – that was fun!

It was fun because we were short-term bearish and we finally got a bit of a sell-off. During yesterday's live Webcast, in fact, we had just shorted the Russell Futures at 1,060 in PSW Member Chat and, as I was demonstrating the Futures trade on /TF, we were already down to 1,052 and up $800 per contract. We never got a strong bounce and the next leg took us down to 1,138, stopping out at 1,140 for a $2,000 per contract gain on the day – wheeeee! indeed.

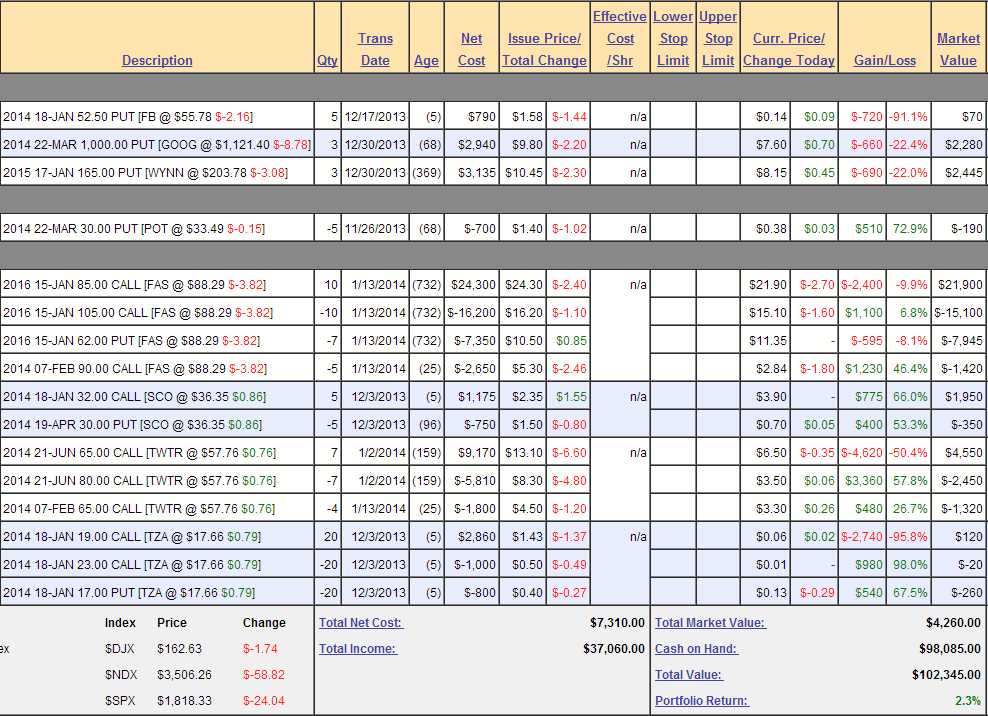

Our very bearish, very aggressive, Short-Term Portfolio positions popped from +18,000 on Friday to +$42,000 but we closed that one and we're going to stick to more conservative trading this year, rather than endure daily $24,000 swings, even when they are in our favor! We already have a more conservatie virtual Short-Term Portfolio in our seminar series and, as planned, that STP popped 2.3% as it was the bearish offset to our Long-Term bullish portfolio, that fell back 0.3% to +0.2%.

We'll be doing a full review in today's Webcast at 1pm, which you can sign up for here.

Meanwhile, the question is, how worried should we be by this little sell-off. Looking at this Dow chart from Zero Hedge that compares the current Dow to the Dow movement just ahead of the great crash of 1929 – it does kind of look like we should be concerned, from a pattern-recognition standpoint at least. Even a bounce today is expected, according to the historical chart, giving us false hopes before the big drop in a week or so.

Meanwhile, the question is, how worried should we be by this little sell-off. Looking at this Dow chart from Zero Hedge that compares the current Dow to the Dow movement just ahead of the great crash of 1929 – it does kind of look like we should be concerned, from a pattern-recognition standpoint at least. Even a bounce today is expected, according to the historical chart, giving us false hopes before the big drop in a week or so.

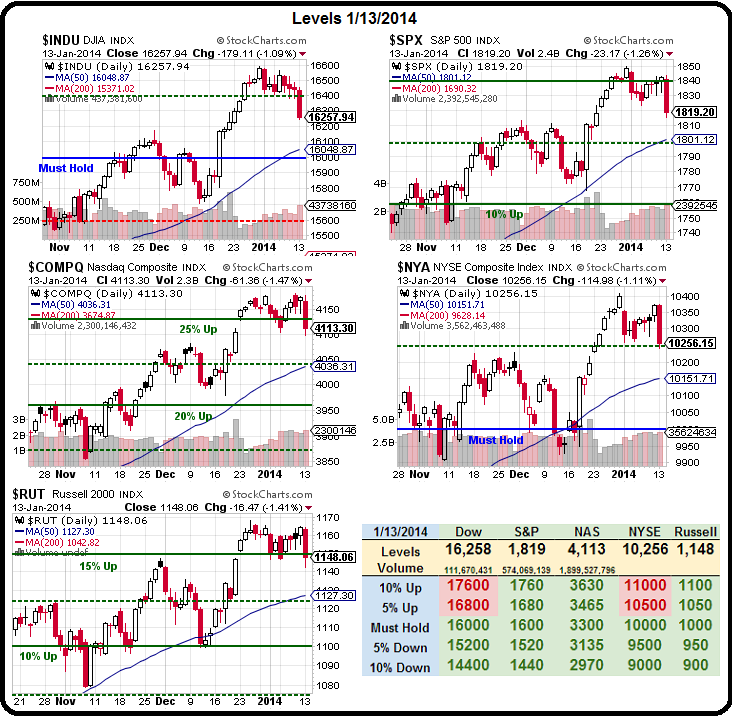

Last Tuesday we predicted how far the indexes would fall using our famous 5% Rule™, and they were the 1.25% and 2.5% drop lines at:

Last Tuesday we predicted how far the indexes would fall using our famous 5% Rule™, and they were the 1.25% and 2.5% drop lines at:

- Dow 16,300 and 16,100

- S&P 1,825 and 1,800

- Nas 4,125 and 4,075

- NYSE 10,275 and 10,150

- Russell 1,155 and 1,140

Not until our indexes get back over 3 of 5 of our 1.25% lines are we going to be making any short-term bullish bets (but we did some long-term bargain hunting already yesterday in Member Chat and in our Webcast). We'd still like to see some earnings reports to give us an idea of which sectors are struggling and today we're already beginning to get some Retail Sales numbers, which are so-so at best.

December sales were only 0.2% above November, but they were dragged down by a huge drop in Auto Sales (watch out for that sector!) but up 4.1% from last December, so not terrible. In factl Auto Sales were 6.2% higher than last year's disastrous December as rich folks really do tie ribbons around cars for Christmas! Online sales were up a very healthy 9.9% but it's still a relatively small part of $500Bn in monthly overall sales.

December sales were only 0.2% above November, but they were dragged down by a huge drop in Auto Sales (watch out for that sector!) but up 4.1% from last December, so not terrible. In factl Auto Sales were 6.2% higher than last year's disastrous December as rich folks really do tie ribbons around cars for Christmas! Online sales were up a very healthy 9.9% but it's still a relatively small part of $500Bn in monthly overall sales.

Department store sales took a 4.7% hit for the year but the big-ticket items were an 8.7% gain in Motor Vehicle Parts to $959Bn, that 10.2% annualized bump in On-Line Spending to $450Bn and a 5.9% increase in Building Supplies to $311Bn – those were our leaders for 2012. Notice how parts sales go up and auto sales go down – that makes sense.

Keep in mind though, that we are up from TERRIBLE comps. People tend to forget that but sales were NEGATIVE in '08 and '09 so imagine the benchmark for 2007 was 100 and we fell to 97 and then 93 on 3% and 4% drops. That means a 2% gain in 2010 takes us to 94 and a 6% gain in 2011 takes us to 99.5 and 4% last year is 103.5 and 4% this year is almost 108 so it's an 8% total increase in sales over 6 years – not all that impressive since consumer spending is 70% of our economy and, of course, not even keeping up with inflation.

Keep in mind though, that we are up from TERRIBLE comps. People tend to forget that but sales were NEGATIVE in '08 and '09 so imagine the benchmark for 2007 was 100 and we fell to 97 and then 93 on 3% and 4% drops. That means a 2% gain in 2010 takes us to 94 and a 6% gain in 2011 takes us to 99.5 and 4% last year is 103.5 and 4% this year is almost 108 so it's an 8% total increase in sales over 6 years – not all that impressive since consumer spending is 70% of our economy and, of course, not even keeping up with inflation.

So, what they don't tell you about retail sales is we're physically selling less stuff. Inflation makes the same stuff cost more money so, if we're not keeping up with inflation in our increases in Retail Sales then, obviously, we are selling less total items – especially when you consider that Auto and Home Repairs are our retail leaders. That means less manufacturing and, of course, less jobs despite the "improving" numbers.

We get Business Inventories at 10 and those are likely up more than the 0.2% expected – a good reason to idle more factories if things don't pick up soon. We're watching and waiting and there will be a live update today at our 1pm (EST) Webcast. We already did a little bargain hunting and there's certainly no hurry, as earnings is bound to give us many more stocks on sale when they disappoint, as LULU did yesterday.