Best Buy is down 30% on an earnings warning.

Best Buy is down 30% on an earnings warning.

Holiday sales were down 0.9% with revenue down 2.6% to $11.45Bn, partially saved by a 23.5% rise in on-line sales. We had picked BBY last November at our PSW Las Vegas Live Conference, as one of our top picks but we abandoned ship at $42, waiting for the next sale to buy shares again. Is this, then, an opportunity to bargain hunt or should we wait for the ship to hit bottom. There's a conference call at 8 am, so we'll have more information ahead of the bell.

I already put out an early morning Alert to our Members to short the Futures at Russell 1,170 (/TF), Dow 16,400 (/YM) and, of course, Oil $94.50 (/CL) and we'll stop out if any two of the 3 get back over the line or the Nasdaq (/NQ) gets over 3,600 or the S&P (/ES) gets over 1,840 but these are just follow-on plays to yesterday's aggressive short option positions we sent out as an Alert yesterday afternoon at 12:33.

I already put out an early morning Alert to our Members to short the Futures at Russell 1,170 (/TF), Dow 16,400 (/YM) and, of course, Oil $94.50 (/CL) and we'll stop out if any two of the 3 get back over the line or the Nasdaq (/NQ) gets over 3,600 or the S&P (/ES) gets over 1,840 but these are just follow-on plays to yesterday's aggressive short option positions we sent out as an Alert yesterday afternoon at 12:33.

As you can see from Dave Fry's Dow Chart, 16,500 (on the index, 16,400 in the Futures) has been a tough nut to crack and the REASON the Futures are 100 points below the actual index is BECAUSE sentiment for the FUTURE is lower. Make sense?

That's the real sentiment, from people who actually put their own money on the line to predict the future, not the sentiment of paid pumpers who shuttle from interview to interview so they can drill their talking points into the heads of retail investors, driving them into whatever positions the pumpers are paid to promote that day. The entire financial network is itself just another propoganda machine for their advertisers, who are generally Investment Banksters who make their money churning retail investors in and out of positions. It's a gigantic SCAM – don't take it seriously…

BE THE HOUSE – Not the Gambler! That's our theme for 2014 and we are drilling this point home in our series of weekly Webcasts, as well as our live weekend conferences. If you want to see our first Webcast on this topic with Mike MacDonald – you can see a replay HERE. We have a lot of fun doing short-term trades but it's really just something to do while we wait for our SENSIBLE, CONSERVATIVE long-term positions to bare fruit.

A lot of fruit should be borne by our short position on XRT. We had 20 Jan $90 puts at an average of $3.34 and XRT has been grinding down into expirations, finishing yesterday at $84 and pushing the puts to $6 (up 79%) but the BBY news will be the cherry on top so, if you didn't close those out on the last dip – keep in mind there are just two rules at PSW:

Rule #1: ALWAYS sell into the initial excitement.

Rule #2: When in doubt, sell half.

Following those two rules will keep you out of trouble most of the time! That position was also a good lesson in scaling in as we had CONVICTION that Retail Sales would disappoint (see our PSW Holiday Shopping Survey) so we intially bought 10 short contracts for our virtual Short-Term Portfolio (Members Only) on 11/14 for $4 and then, on 12/24, when those contracts fell to $2.68, we doubled down to average 20 at $3.34. That's Scaling In – the main topic of our Strategy Section! See how useful our site can be….

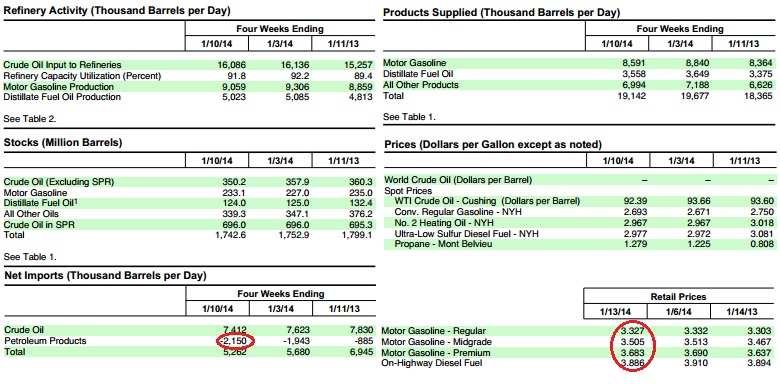

Speaking of scams – it's time to WRITE TO YOUR CONGRESSMAN again, as the NYMEX crooks are back in action! Yesterday, the Energy Information Agency reported a draw of 7.7M barrels of crude for the week and this apparent boost in demand (also reflected in Tuesday American Petroleum Institute Report) gave the NYMEX thughs all the ammunition they needed to boost the price of oil from $91.50 back to $94.50 – up over 3% in two days! With Americans consuming 19M barrels a day, a $3 increase costs us $20.8 BILLION per year.

And why is oil up 3% in two days? Not because of US demand, our demand is DOWN 10% from last year and production of oil in this country has never been higher. So, why would the price of oil be higher? BECAUSE THESE FITHY CROOKS ARE SHIPPING 2,150,000 BARRELS PER DAY (15.1Mb/week) OUT OF THE COUNTRY! That's right, you have been conned into "Drill Baby Drill" and building pipelines so THEY can send YOUR oil OUT of YOUR country and charge you MORE for the ARTIFICIALLY lower supply.

And why is oil up 3% in two days? Not because of US demand, our demand is DOWN 10% from last year and production of oil in this country has never been higher. So, why would the price of oil be higher? BECAUSE THESE FITHY CROOKS ARE SHIPPING 2,150,000 BARRELS PER DAY (15.1Mb/week) OUT OF THE COUNTRY! That's right, you have been conned into "Drill Baby Drill" and building pipelines so THEY can send YOUR oil OUT of YOUR country and charge you MORE for the ARTIFICIALLY lower supply.

Do you see why you need to write to your Congressman? They are not making us energy independent by sending 15M barrels of petroleum OUT of the country, are they? Of course, if you're Congressman is a House Republican, he's actually the guy that did this to you so, good luck – but at least you can vent. Venting is healthy…

FILTHY, LYING, BASTARDS – Clear enough?

They are taking YOUR (America's) oil, they are sending it OUT of the country and then they are telling you there is SHORT SUPPLY locally and driving up prices, despite our own efforts to cut back consumption by 10%. This is costing you MORE than the extension of Unemployment Benefits would cost, 5 TIMES MORE than the amount they have already cut from Food Stamps this year. If this doesn't piss you off enough to do something – I don't know what will.

As I noted earlier, our Members see through this BS and we shorted oil (/CL) at $94.50 and already this morning it's dipping to $94 and we're making $500 per contract on our Futures trades – that's enough to pay for plenty of extra gas for our Range Rovers – this is why rich people don't give a crap about rising energy prices – we can profit from it. Congress doesn't care either because, after all, they are just a bunch of rich folks passing laws to help their rich contributors get richer – enjoy your Corporate Kleptoctracy folks…