Head and shoulders (knees and toes).

Head and shoulders (knees and toes).

That's the chart pattern that is now shaping up (if you are into such things) and, in fact, it will be marked by a small bouncy "rally" that ultimately fails before our strong bounce lines and ultimately cracks below the bottom of the old channel.

Like my accurate SuperBowl predictions from 1/3, I can only tell you what's going to happen in the future – how you decide to trade on that information is up to you.

Like yesterday, in our Member Chat Room, I said I thought the best risk/reward play for AAPL was playing them for an earnings miss by picking up the next week $500 puts for $2, which could be $10 if AAPL disappoints. Well, disappoint they did and we'll see if we hit our 400% target gains on that one today.

Long-term, we're still long on AAPL and we will be pressing out long bets on this pullback (see my notes on AAPL earnings and trade ideas in this morning's Member Chat) but we're not in a hurry until we see the indices shape up better than this.

Long-term, we're still long on AAPL and we will be pressing out long bets on this pullback (see my notes on AAPL earnings and trade ideas in this morning's Member Chat) but we're not in a hurry until we see the indices shape up better than this.

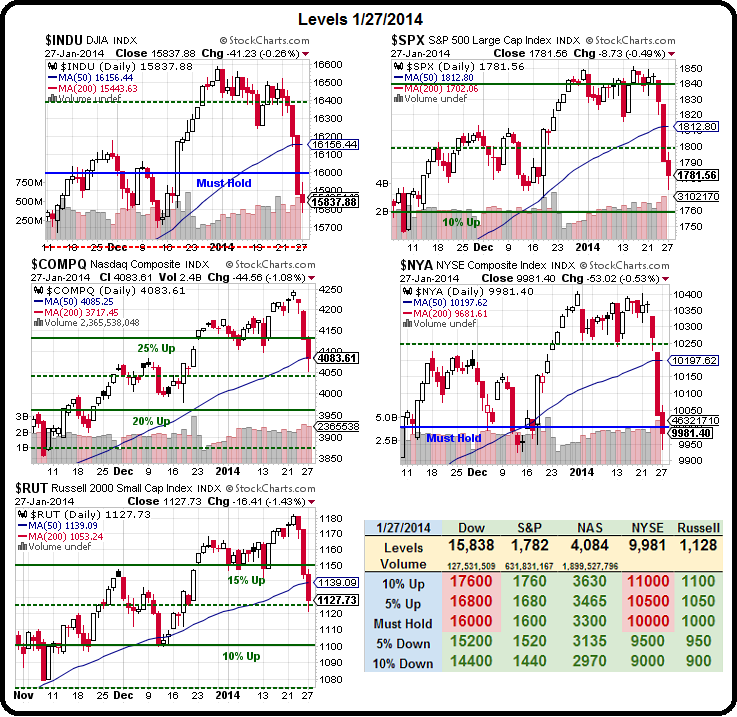

The Nasdaq was only saved by the 50 dma and will open today below it (4,085) while the the rest have plowed through theirs and may be on the way to visit the 200 dmas – 5% below this point and on the way to the 10% correction we expected.

We were not fooled into making any bullish bets yesterday (other than some fun Futures plays on the bounces) because our weak bounce lines were never crossed. Now, as the market gets weaker, we'll have to redraw our bounce lines to accomodate the wider range.

This does not change our 5% Rule's™ ranges at all – these are just the very short-term moves we need to see in order to start pulling back our bearish bets (long in place) and begin to consider some bullish plays:

This does not change our 5% Rule's™ ranges at all – these are just the very short-term moves we need to see in order to start pulling back our bearish bets (long in place) and begin to consider some bullish plays:

- Dow 15,940 (weak) and 16,080 (strong)

- S&P 1,794 (weak) and 1,808 (strong)

- Nasdaq 4,100 (weak) and 4,135 (strong) (includes moring drop not on chart)

- NYSE 10,080 (weak) and 10,160 (strong)

- Russell 1,138 (weak) and 1,146 (strong)

As you can see from Dave Fry's charts, we're not too far from a major breakdown but we've had some pretty good earnings and the Fed will not be likely to taper more tomorrow if the market is falling so we'll find out if these fairly minor pullbacks can hold. We've already made fantastic money to the downside, our Short-Term Portfolio, for example, which was up just $1,400 as of our January 23rd review, finished the day yesterday up $6,770 on against a $1,565 cost basis – up 332% on cash so far this year.

Though we prefered to stay mainly in cash, we did take some fairly aggressive bearish positions in anticipation of this sell-off. We left ourselves "cashy" (see review notes) so that we could take avantage of changing conditions. We'll do an update today in our live Webcast at 1pm (EST) – you can JOIN US HERE.

Though we prefered to stay mainly in cash, we did take some fairly aggressive bearish positions in anticipation of this sell-off. We left ourselves "cashy" (see review notes) so that we could take avantage of changing conditions. We'll do an update today in our live Webcast at 1pm (EST) – you can JOIN US HERE.

These trades were also a counter-balance to our Long-Term Portfolio, which is almost entirely bullish and, despite yesterday's dip, managed to hang on to $2,440 worth of gains against a cash credit of $13,910, returning 117.5% of the cash should we decide to close it out early.

That's why we love our CASH!!! at PSW – there are so many fun ways to play with it!

In the short-term, we're now getting oversold so it's a good time to form those shoulder patterns, though I'd prefer to see a nice blow-off bottom to buy into than us drifting back into our Thanksgiving levels.

In the short-term, we're now getting oversold so it's a good time to form those shoulder patterns, though I'd prefer to see a nice blow-off bottom to buy into than us drifting back into our Thanksgiving levels.

8:30 Update: Our Durable Goods Orders for December were down 4.3%, a huge miss of the +1.6% expected by the Economorons who, for some reason, are still being asked what they think, despite these routine 600% misses of their estimates.

To be fair, ex-Transport, the result was only -1.6% vs +0.7% expects, so our "experts" were only off by 328% on the less volatile number. We had a big miss on New Home Sales yesterday as well (414,000 vs 457,000 expected) and, of course, when you look at the chart on the left, you can see how pathetic that is in the bigger picture.

To be fair, ex-Transport, the result was only -1.6% vs +0.7% expects, so our "experts" were only off by 328% on the less volatile number. We had a big miss on New Home Sales yesterday as well (414,000 vs 457,000 expected) and, of course, when you look at the chart on the left, you can see how pathetic that is in the bigger picture.

As I've been saying all of last year, lack of a housing recovery means less jobs for all the lumberjacks and appliance makers and the tile makers and the hardware people and plumbers and electricians and movers and home builders and realtors and lawyers and bankers, etc. etc. It's a key component of our economy and it's still 50% below the pre-crash average. How can we possibly have a real recovery in this country if Housing looks like this?

We have Obama speaking today and the Fed tomorrow so we'll stay technical and just see what sticks this week. On Friday, one of our Members (Terrapin) asked me what hedge I recommended if the S&P couldn't hold 1,800 (and it didn't) and my trade idea was:

Hedge/Terra – Why didn't you ask me yesterday when TZA was my favorite? In the STP, we had 20 short Feb $16 puts at .55, and they were.60 yesterday but .35 now. I guess you can sell the March $16 puts for .75 and use that to buy the $17/21 bull call spread for 0.93 and then you're in the $4 spread for net 0.18 with 2,100% upside potential and TZA is already at $17.36 and $21 is up 23% or about an 11% drop on the S&P. Of course you could also use any short put on something you really want to buy if it gets cheaper, like CLF 2016 $18 puts at $4.20, which pays for 4.5 of the spreads each.

CLF will be taking off this morning but, as of yesterday's close, those 2016 $18 puts were still $4.50 and the TZA March $17/21 bull call spread was still "just" $1.30 (up 39%) so, if you were willing to sell 10 of the puts for $4,500, you could afford to buy 40 of the spreads ($5,200) for net $700. The potential upside would be $16,000, for a 2,185% return on cash in 52 days at TZA $21 and the worst-case to the downside is you lose $700 and own 1,000 shares of CLF at $18 ($1,800).

Overall, that TZA spread with the more aggressive short puts (now .48) is net .82 and that's up 355% in 2 days and THAT is how we hedge the markets!

Join us for more trade ideas like this one in today's 1pm Webcast.