MADNESS!!!

MADNESS!!!

Was the GDP good news or bad news? Is good news bad news now or everything simply not good enough news to maintain the delusional prices that many stocks are trading at? As I said in yesterday's morning post, I did not like the GDP report very much and almost all of our trade ideas in yesterday's Member Chat Room were for shorting the momentum stocks as they flew back up to their highs – as if the last week never happened.

Dave Fry agrees with my take on the GDP and I will quote his excellent morning take on the subject:

Consumer Metrics Institute summarizes the GDP data as follows:

— The headline unemployment numbers mask a major deformation of the work force — with fewer people choosing to look for work and more being forced to accept multiple part time jobs. People on the street understand the difference between an increasing quantity of part-time work and the quality of full-time jobs.

— Real per capita disposable income was down -0.85% during 2013. And to maintain the prior year's standard of living, the household savings rate plunged 2.3%.

— For many households (and especially the 18-35 demographic) the Affordable Care Act (aka "ObamaCare") will result in increased net monthly outlays for health insurance.

— The per capita numbers continue to mask an ongoing shift in income distribution: although the average per capita income data has grown some 3.3% since October 2008 (per the BEA), the median household income has shrunk some 7% over that same time span (per Sentier Research). The typical member of the electorate lives at the median, and they are not sharing the growth reported by the BEA.

On the surface these were nice numbers, enough to satisfy the Federal Reserve that more of the same lies ahead. Unfortunately, most households would probably prefer something far better than an extension of that "same."

Taken together economic data was a disaster. But equity markets rallied and surely you must wonder why. The truth of the matter is markets were short-term oversold, some earnings news was brighter (Facebook the standout) and it seems the previous meme “bad news is good” has resurfaced with those believing the Fed must still have their backs. Also, we should note as the first month of the year will end tomorrow, there’s some serious window dressing at work from those who must post better numbers.

Earnings aside from Facebook (FB), surely markets are made of more than just one stock, included misses from 3M (MMM) and Exxon (XOM) while others beat like Cardinal Health (CAH), Time Warner (TWC), United Parcel Service (UPS) and Visa (V) which I like to call the company store.

Basically an oversold rally even though economic data Thursday was, well, terrible. Sure, investors liked the less than expected GDP report but beyond that and Facebook (FB) there wasn’t much to cheer about except for some end of month window dressing.

NONETHELESS, we were happy enough with a 1% sell-off in the Futures to go long on the Indexes in early morning Member Chat (7:13) at Dow (/YM) 15,600, S&P (/ES) 1,765 and Russell (/TF) 1,120, because those are nice, bouncy lines and as long as the Dollar (/DX) is under 81.20 and 2 of those 3 are over the line, then we can go long on the laggard. We go long on the Futures to cover the theoretical gains we have on our short option plays. And, of course, we're still short on oil with CONVICTION (see yesterday's note).

NONETHELESS, we were happy enough with a 1% sell-off in the Futures to go long on the Indexes in early morning Member Chat (7:13) at Dow (/YM) 15,600, S&P (/ES) 1,765 and Russell (/TF) 1,120, because those are nice, bouncy lines and as long as the Dollar (/DX) is under 81.20 and 2 of those 3 are over the line, then we can go long on the laggard. We go long on the Futures to cover the theoretical gains we have on our short option plays. And, of course, we're still short on oil with CONVICTION (see yesterday's note).

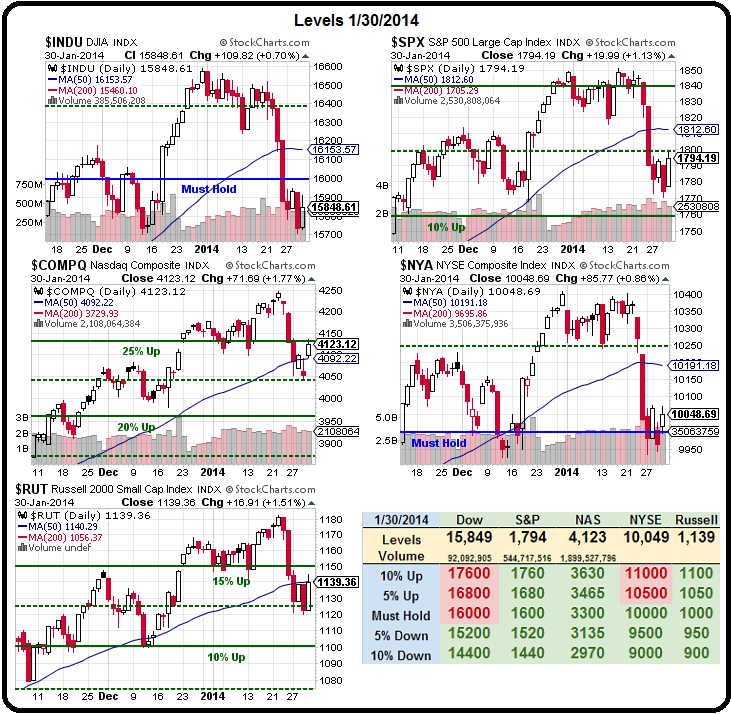

The Big Chart above is an excellent example of what a weak bounce looks like and our targets for the day were Dow 15,880, S&P 1,786, Nasdaq 4,100, NYSE 10,040 and Russell 1,132, so we finished in OK shape.

EXCEPT, it took too long to get there so now we needed our STRONG bounce lines in order to get back to bull betting – those are: Dow 16,060, S&P 1,802, Nasdaq 4,133, NYSE 10,130 and Russell 1,144 and 1,144 was yesterday's HIGH for the Russell, on the button and it was rejected all the way back to below the weak bounce – that was a very bad sign…

The Dow never came close, the S&P topped out at 1,799, Nasdaq touched 4,135 and the NYSE made 10,071 so close but no cigars because they have to HOLD IT for it to count. Even as I write this (7:55) we're failing our bull lines again as emerging markets are moving into full melt-down mode and dragging Europe with them and Asia would be crashing too except CHINA IS CLOSED – so what do you think is going to happen when they come back? As I said yesterday morning, right in the main post:

I'm also not excited by the 48.5 finish to the Architectural Billing Index for December, which indicates a serious lack of planned building activity for 2014 and is a fantastic forward-looking indicator. So we're playing for a bounce but we remain skeptical and will certainly be re-upping some of our bearish bets as we move up to re-test our bounce levels (I don't even see retesting the highs as being likely).

I can only tell you what's going to happen in the future – what you do with that information is entirely up to you... ![]()

Keep in mind it's an end of month window-dressing day so anything can happen – we are still leaning towards playing for another move up off our Futures support and, after that, we're just going to watch our 5% lines.

Have a great weekend,

– Phil