China is still closed.

China is still closed.

Mainland China (the Shanghai) will be closed all week for the Lunar New Year (horse) and the Hang Seng is closed today, so we don't know what the tone will be when the sleeping giant awakens and reacts to our ugly closing out in January.

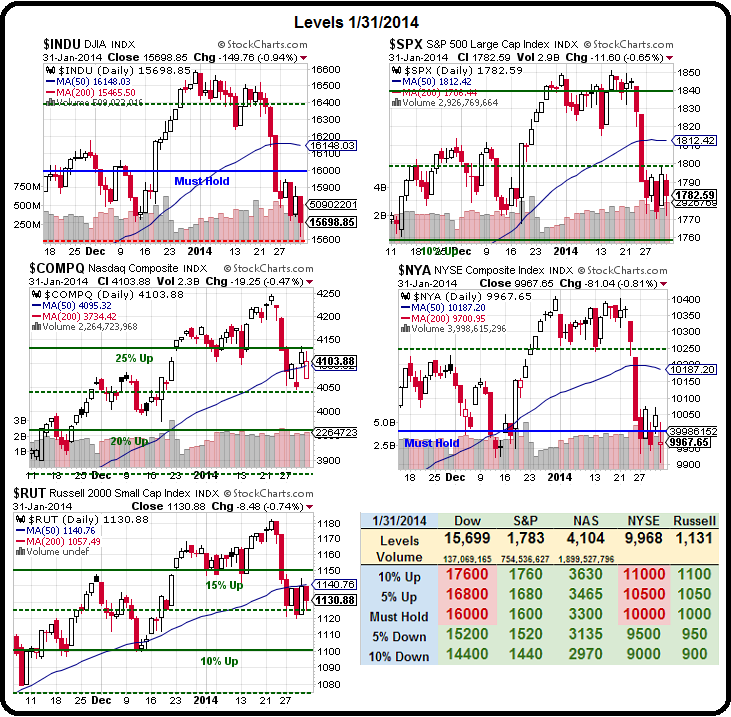

As you can see from our Big Chart, we have a classic "vomiting cobra" pattern, where the "spitting cobra" doubles over in pain and drops to the previous floor – all very scientific – like any TA pattern…

At the moment (7:50 am) our Futures are doing what they usually do in the morning – rising on very low volume. We went long in Member Chat already (6:44) because you don't have to show us the same move 10 times in a row before we finally get it. Already we picked up a nice move off the bottom with our /NKD longs up 50 points already ($250 per contract) and the Dow (/YM) up 70 points ($350 per contract), which is enough money to pay for our Egg McMuffins – so we're very happy.

At the moment (7:50 am) our Futures are doing what they usually do in the morning – rising on very low volume. We went long in Member Chat already (6:44) because you don't have to show us the same move 10 times in a row before we finally get it. Already we picked up a nice move off the bottom with our /NKD longs up 50 points already ($250 per contract) and the Dow (/YM) up 70 points ($350 per contract), which is enough money to pay for our Egg McMuffins – so we're very happy.

Now, as long as the S&P Futures (/ES) hold 1,780, we can enjoy the ride up but, if the RUT is rejected at 1,130 (/TF) and the Dow fails at 15,700 and the Nasdaq fails 3,525 (/NQ) and the S&P fails its line then the Russell will make an excellent short on the way back down.

As noted by Dave Fry, so far, we're getting a healthy and much-needed distribution with a mild, 4% correction on the S&P to start our year. HOWEVER, the Stock Trader's Almanac states: "…every down January on the S&P 500 since 1938, without exception, has preceded a new or extended bear market, a 10% correction, or a flat year."

As noted by Dave Fry, so far, we're getting a healthy and much-needed distribution with a mild, 4% correction on the S&P to start our year. HOWEVER, the Stock Trader's Almanac states: "…every down January on the S&P 500 since 1938, without exception, has preceded a new or extended bear market, a 10% correction, or a flat year."

A flat year (post-correction) is exactly what I predicted for 2014 so this is fine with us. We love flat markets, they are much easier to make money in since we KNOW how to buy stocks for a 15-20% discount and we KNOW how to BE THE HOUSE – and sell premium to others and collect steady fees in a flat market. It's been a long, long time since we had a flat market – it would be great!

We're HOPING (not a valid investing strategy) we get a flat market but we are WARY because the Nikkei is already down 10% in January and fell another 300 points overnight (2%). While that's exactly why we played them for a bounce – there's a lot worse than the Bird Flu going on in Asia and the Emerging Markets this Winter and it's still being mainly ignored by the MSM.

We're HOPING (not a valid investing strategy) we get a flat market but we are WARY because the Nikkei is already down 10% in January and fell another 300 points overnight (2%). While that's exactly why we played them for a bounce – there's a lot worse than the Bird Flu going on in Asia and the Emerging Markets this Winter and it's still being mainly ignored by the MSM.

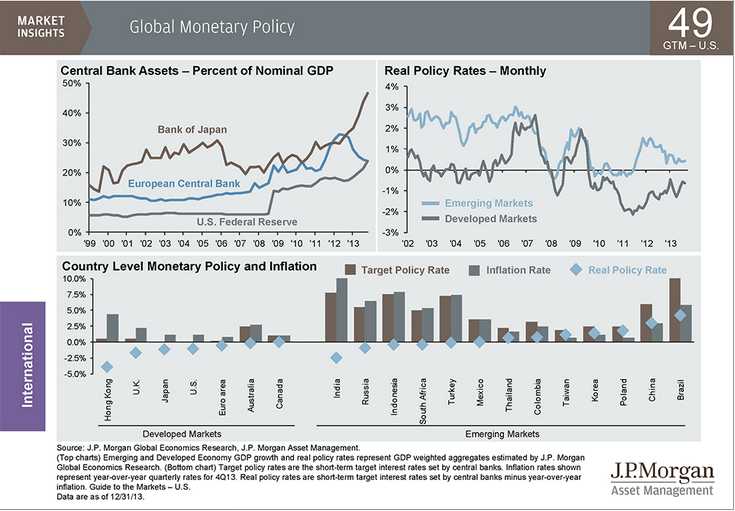

As you can see from this JPM chart (and powerpoint!), Japan, Spain, Italy, Portugal and Greece are all still in BIG TROUBLE, joined by Singapore and the US and Singapore with debts that are more than 100% of their GDP. Of course, the US and Japan, through MASSIVE stimulus programes from their respective Central Banks – APPEAR to be growing their economy but Greece, Portugal and Italy are shrinking their GDP, which of course makes the debt to GDP worse and Spain is not too far behind that 100% line with 2% GDP shrinkage.

Also alarming (slide 49) is the BOJ's assets as a percentage of GDP, now almost 50% of the nation's GDP, vs just over 20% for our own Federal Reserve's $4Tn balance sheet that even they think is getting out of control! Hong Kong, the US, Japan, Russia, India, the EU and the UK are all running NEGATIVE Real Policy Rates – which is to say they are effectively lending at rates that are lower than inflation – effectively subsidizing borrowers with what I like to call – FREE MONEY!

How can we base our economic assumptions and forward projections for endless supplies of FREE MONEY? THAT is why I so strenuously object to paying high forward multiples for stocks becasue, either a correction is coming as the FREE MONEY is withdrawn or inflation is coming, in which case a little gold and silver in your portfolio will likely outperform any silly stocks you may have your eye on.

Meanwhile, it's another meaningless day in the markets – we'll just sit back, watch the show – and enjoy our Egg McMuffins.